Write something

💡 Demystifying the Infinite Banking Concept (IBC): A Simple Guide to Building Wealth 💰

Curious about how the Infinite Banking Concept (IBC) works? Let’s break it down into a clear and straightforward process that shows how IBC can help you grow wealth while giving you control over your finances. How IBC Works: A Simple Example 1️⃣ Contributing to the System:Imagine 10 people each contribute $100 into a company (representing an insurance company). These contributions come in the form of policy premiums, paid-up additions (PUAs), or Excellerator Deposit Options (EDOs). The company guarantees their money will grow—for example, at a 7% rate. 2️⃣ Borrowing from the System:One person borrows $50 using their contribution as collateral. They pay 6.5% interest on the loan, meaning they’ll repay $53.25 over time. Once repaid, they now have access to borrow $53.25 if needed, with their money still growing uninterrupted. 3️⃣ Dividends and Growth:The company earns more than expected and distributes the excess revenue to everyone who contributed—these are the policyholders. These “dividends” are credited to your policy and can never decrease or be taken back. Why This Matters: - Continuous Growth: Your money grows even while you borrow against it. - Guaranteed Wealth Building: Dividends and compounding ensure your financial position strengthens over time. - Flexibility and Control: Borrowing and repaying within your policy keeps you in control of your finances, not external lenders. Key Takeaway: The Infinite Banking Concept isn’t complicated when broken down—it’s a self-sustaining financial system that helps you grow wealth, borrow strategically, and build long-term financial security. Ready to simplify your finances and take control of your future? 👉 Learn more: Demystifying the Infinite Banking Concept (IBC): A Clear and Simple Guide 🌐 Visit our website: endurys.ca 🔗 Connect with us: Linktree

1

0

💡 Unlock Your Cash Flow: Funding Your Infinite Banking System 💰

Wondering how to kickstart your Infinite Banking Concept (IBC) journey? Let's explore practical strategies to capitalize your system and take control of your financial future! Two Powerful Strategies: 1. Leverage Your Savings - Transfer existing savings into an IBC policy over time - Keep your money growing, even when you borrow against it - Create a reliable safety net that compounds continuously 1. Debt Recapture - Use policy loans to finance purchases (e.g., car, home renovations) - Redirect payments back into your policy instead of to external lenders - Gradually recapture other debts (credit cards, mortgages) into your system Why This Matters: - Uninterrupted Growth: Your initial capital keeps growing, even as you use it - Increased Cash Flow: Every repayment boosts your available funds - Financial Independence: Build a family banking system that can finance anything Pro Tip: Start small with your existing savings, then scale up by recapturing debts. The key is consistency and commitment to the IBC process. Ready to transform your cash flow and build lasting wealth? 👉 Learn more: How to Find the Cash Flow to Capitalize Your Infinite Banking System (IBC) 🌐 Visit our website: endurys.ca 🔗 Connect with us: Linktree #InfiniteBanking #CashFlowManagement #FinancialFreedom #DebtRecapture What's your biggest financial goal? Share below and let's discuss how IBC could help you achieve it! 👇

1

0

🔍 Debunking Myths: The Truth About Infinite Banking 💡

Heard some confusing advice about the Infinite Banking Concept (IBC)? Let's clear the air and reveal why IBC is more than just interest rates and loans! Common Misconceptions: 1. "IBC loans are bad because of higher interest rates" 2. "IBC loans are treaded like traditional loans" 3. "IBC is just another investment strategy" The Truth About IBC: - It's a Process, Not an Investment: IBC is about creating a financial ecosystem, not chasing returns. - Interest Rates Aren't the Whole Story: When you pay interest to yourself, you're building wealth, not enriching banks. - You're the Banker: Every loan payment grows YOUR financial power, not someone else's. Why IBC Beats Traditional Banking: 1. Control: You decide the terms of your loans. 2. Wealth Building: Interest payments increase your policy's value and borrowing power. 3. Financial Freedom: Break free from conventional banking limitations. Pro Tip: Don't compare IBC to traditional loans or investments. It's a unique system designed to put YOU in control of your financial future. Ready to see beyond the myths and unlock true financial potential? 👉 Learn more: Debunking Myths About Infinite Banking: What You Need to Know 🌐 Visit our website: endurys.ca 🔗 Connect with us: Linktree #InfiniteBanking #FinancialMyths #BeYourOwnBanker #WealthBuilding What's the most surprising thing you've learned about IBC? Share your "aha" moment below! 👇

0

0

🏦 Maximizing Wealth: The Power of Being Your Own Banker 💰

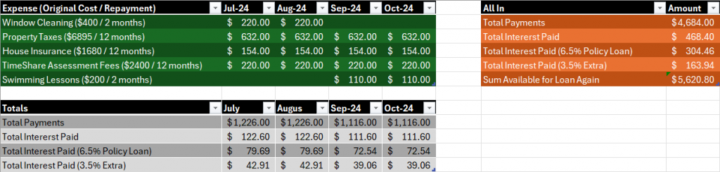

Ever wondered why you're making banks rich instead of yourself? Nelson Nash's Infinite Banking Concept (IBC) offers a simple yet powerful solution. Let's break it down! The Grocery Store Analogy: If you owned a grocery store, would you shop elsewhere? Of course not! The same principle applies to banking: - Traditional Banking: You're shopping at someone else's store. - IBC: You're building and shopping at your own financial store. How IBC Makes You Wealthier: 1. Recapture Interest: Every loan payment goes back into YOUR policy, not a bank's pocket. 2. Grow Your Cash Value: Each repayment boosts your policy's worth and borrowing power. 3. Control Your Financial Destiny: You decide the terms, not a bank. Real-Life Example: Check out the screenshot of my own policy loan repayment schedule: - Green Section: Outstanding loans and repayment schedules - Grey Section: Total amounts and interest calculations - Orange Section: Yearly totals (excluding policy growth) 👉 Key Takeaway: Every payment is a wealth-building opportunity! Ready to stop enriching banks and start building your own financial empire? Learn more: Maximizing Wealth: The Power of Banking with Yourself 🌐 Visit our website: endurys.ca 🔗 Connect with us: Linktree #InfiniteBanking #BeYourOwnBanker #WealthBuilding #FinancialFreedom How much do you think you've paid in interest to banks over your lifetime? Share below and let's discuss how IBC could change that! 👇

1

0

💰 Turn Policy Loans into a Profit-Generating Machine with IBC! 🚀

Ever wondered how to make loans work FOR you instead of against you? The Infinite Banking Concept (IBC) offers a revolutionary approach to borrowing that can transform your financial future. Let's dive in! How IBC Turns Loans into Profits: 1. Recapture Interest: When you repay policy loans, the interest goes back into YOUR policy, not a bank's pocket. 2. Grow Your Cash Value: Each repayment boosts your policy's cash value, increasing future borrowing power. 3. Compound Your Wealth: The cycle of borrowing and repaying creates a compounding effect on your financial growth. Why This Matters: - Be Your Own Banker: Control your financial destiny instead of enriching third-party lenders. - Create Financial Legacy: Build a system of wealth that can benefit generations to come. - Flexibility: Access funds when you need them while still growing your wealth. Pro Tip: Consider paying more than the minimum on your policy loans. This strategy accelerates the growth of your accessible cash value, supercharging your profit-generating machine! Ready to transform your approach to borrowing and build lasting wealth? 👉 Learn more: Transforming Policy Loans into a Profit-Generating Machine 🌐 Visit our website: endurys.ca🔗 Connect with us: Linktree #InfiniteBanking #PolicyLoans #WealthBuilding #FinancialFreedom How could you use policy loans to finance your next big purchase or investment? Share your ideas below! 👇

1

0

1-26 of 26

skool.com/infinite-freedom-society-6919

Join our community of IBC practitioners, sharing strategies, insights, and support to master infinite banking and build lasting wealth together.

Powered by