Write something

Key Difference: Golden Visa vs. D2 Visa

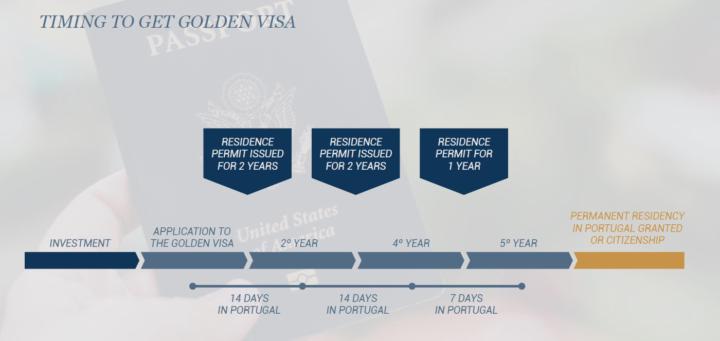

Golden Visa Purpose: Attract large investors into Portugal. Minimum investment required (2024 rules): €500,000+ in funds, companies, or R&D. Or creation of 10 jobs (8 in rural/low-density areas). Cost barrier: Out of reach for most small entrepreneurs or freelancers. Who it suits: Wealthy investors, real estate buyers (though property path is now restricted). D2 Visa (Entrepreneur / Independent Professional Visa) Purpose: Attract small and medium entrepreneurs, freelancers, and independent workers. Investment requirement: No fixed minimum. Instead: Show you have a viable business plan. Deposit sufficient funds in a Portuguese bank account to support yourself and the business (often €5,000–€10,000+ is enough, depending on activity). Legal structures accepted: Sole Trader (ENI) – e.g. a freelancer registering in Portugal. LDA (Limited Company) – if you want liability protection and credibility. Who it suits: Freelancers, digital nomads, entrepreneurs wanting to set up a business in Portugal without needing €500k+. Immigration Benefits of D2 - Residence permit initially valid for 2 years, renewable. - Can lead to permanent residence and citizenship after 5 years. - Family reunification possible. - Access to Schengen area. Tax incentives possible (NHR – Non Habitual Resident regime, though reforms apply after 2024). Steps to Apply for a D2 Visa 1. Prepare a Business Plan (showing feasibility and benefit to Portugal). 2. Open a Portuguese bank account and deposit initial funds (€5k–€10k recommended). 3. Get a NIF (tax number). 4. Register your business (as Sole Trader or LDA). 5. Gather documents: - Proof of accommodation in Portugal. - Proof of funds. - Business registration papers. - Business plan. - Clean criminal record. - Valid health insurance. 6. Apply at Portuguese Consulate in your country of residence. 7. On approval, enter Portugal and schedule SEF appointment (immigration office) for residence permit.

1

0

Starting a Business in Portugal on a Low Budget

A. Sole Trader (ENI – Empresário em Nome Individual) Best for: Freelancers, small service providers, individual entrepreneurs. Advantages: Very cheap to start (can be under €50 if done online). Simple accounting (sometimes no need for certified accountant if turnover < €200,000/year). Lower bureaucracy. Steps: 1. Get a NIF (Número de Identificação Fiscal) Portuguese tax number (needed for any legal activity). 2. Register as ENI at Portal das Finanças (Tax Office) or Empresa na Hora desk. 3. Open a bank account (for business activity, though you can use personal for ENI). 4. Choose a CAE code (business activity classification). 5. Register with Social Security – contributions are mandatory (approx. 21.4% of declared income, with exemptions in first year). 6. Issue invoices with an approved invoicing system (Programa de Faturação or Finance portal). Ongoing costs: No share capital required. Accountant optional (unless VAT registered or above turnover threshold). Social Security contributions after first year. B. LDA (Sociedade por Quotas – Private Limited Company) Best for: Startups, businesses with partners, limited liability, international trade. Advantages: Liability limited to company’s assets. More credibility with banks/partners. Can apply for business visas or residence permits easier. Steps: 1. Get NIF for each shareholder/director. 2. Reserve a company name at RNPC (Registo Nacional de Pessoas Colectivas) OR choose a pre-approved name at Empresa na Hora. 3. Draft articles of association (Estatutos). 4. Deposit share capital (minimum €1 per shareholder, but usually €1,000+ for credibility). 5. Register the company officially at Empresa na Hora or Conservatória do Registo Comercial. 6. Declare start of activity at Portal das Finanças. 7. Register with Social Security. 8. Hire a Certified Accountant (mandatory). Ongoing costs: Certified accountant fees (≈ €100–300/month). Social Security for directors (€200–350/month minimum).

1

0

Portugal Golden Visa Program

GOLDEN VISA INVESTMENT ACTIVITIES The eligible investment options include: - Investment Funds (Venture Capital or Private Equity Funds): A minimum investment of €500,000 into units of investment funds. These funds must be regulated under Portuguese law, and at least 60% of their capital must be invested in Portuguese companies. This has become the most popular route. - Scientific Research Investment: A capital transfer of at least €500,000 to activities of scientific research carried out by public or private scientific research institutions integrated into the national scientific and technological system. - Artistic Production, Cultural Heritage Recovery or Maintenance Investment: A capital transfer of at least €250,000 for investment or support in artistic production, or the recovery or maintenance of national cultural heritage, through public institutions, public foundations, or private foundations that pursue activities in these areas. - Job Creation: Creation of at least 10 new permanent jobs in Portugal. - Investment in Commercial Companies: A capital transfer of €500,000 or more, intended for the incorporation of a commercial company with its head office in Portugal, combined with the creation of 5 permanent jobs; or for reinforcing the share capital of an existing commercial company with its head office in Portugal, combined with the maintenance of at least 10 jobs, or the creation of at least 5 permanent jobs, for a minimum period of 3 years.

1

0

1-3 of 3

powered by

skool.com/global-partner-network-3184

Great real estate deals in Portugal. Invest, buy, holiday & earn referral commissions with Carlo International.

Suggested communities

Powered by