Sep '25 (edited) • Tax Tips = Free Social Posts

Tax Tip #1

Tip #1: Don’t Overlook Small Deductions—They Add Up!

Many people miss out on tax savings by forgetting to track small expenses throughout the year.

For example, did you know you can often deduct things like work-related mileage, out-of-pocket charitable donations, or even certain home office expenses?

Quick action:

- Keep a simple log (on your phone or a notebook) of any work or charity-related expenses as they happen.

- Save receipts, even for small amounts—they can really add up at tax time!

Why it matters:

- Every little deduction can help lower your tax bill or boost your refund.

- Good records make filing easier and help if the IRS ever asks for proof.

Stay consistent—review your expenses each month so nothing gets missed when it’s time to file!

5

5 comments

powered by

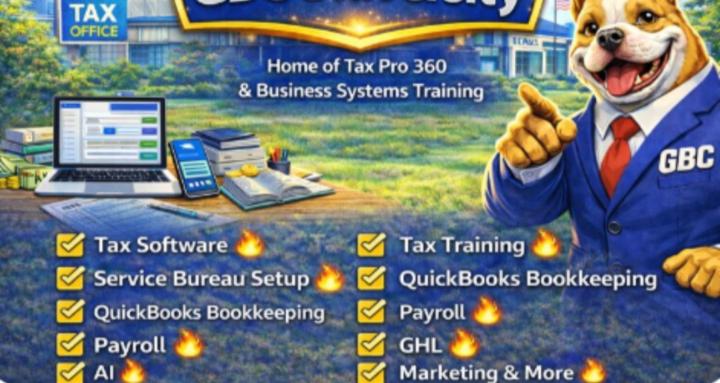

skool.com/gbc-university-6206

PTIN Setup🔥EFIN Setup 🔥 Service Bureau Setup🔥QuickBooks🔥Payroll🔥Go High Level🔥AI🔥Business🔥Course Builder🔥Marketing & More

Suggested communities

Powered by