Pinned

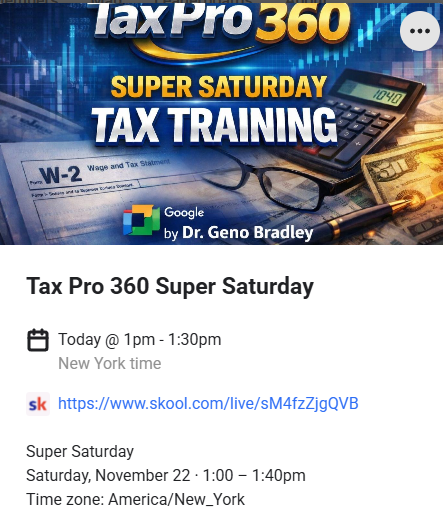

⁉️Super Saturday video call is different this week!

Video Call is inside of Skool. Just login to skool and click on the link to join. We are not going to be on Google Meet................ ⁉️Skool has it's on live video feature⁉️ We are doing everything in skool. If you need me............ message me here in skool chat

Pinned

GBC Marketing 360

Don't buy marketing systems off the street. Buy from me and get A. Cheaper Price B. Help setting up for free 1. Go High Level 360 Quick Start Only $47/month (CRM+Marketing+10 more tools) 2. Content Creator 360 one-time payment of $67 (Quicker Easer Setup)

4

0

Pinned

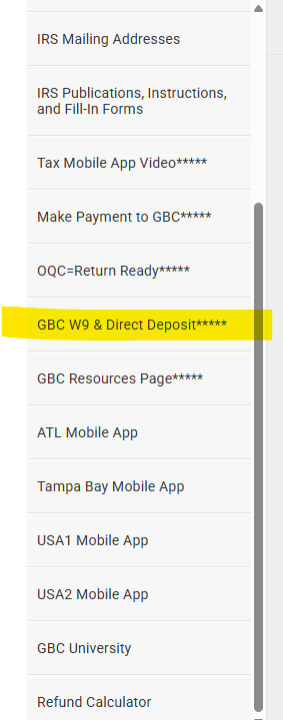

Links + Tax Software Quick Reference = Same as Resource Page

🔗 Tax Software https://gbctaxpros.cloudtaxoffice.com 🔗 GBC Resources Page https://gbcfinancial.com/gbc-resources

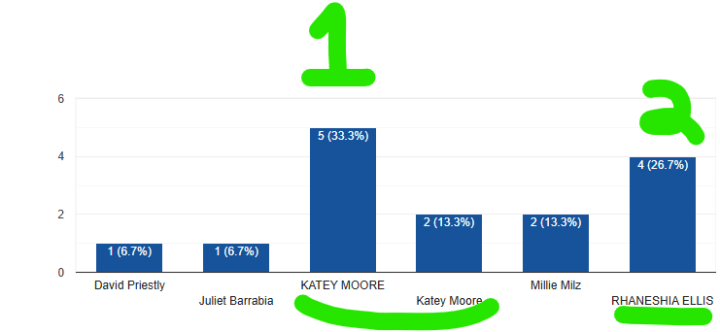

#1 Performer = Late to Class = Katey Express🤣

@Kathleen Moore is Number 1 @Rhaneshia Ellis is Number 2

1-30 of 226

powered by

skool.com/gbc-university-6206

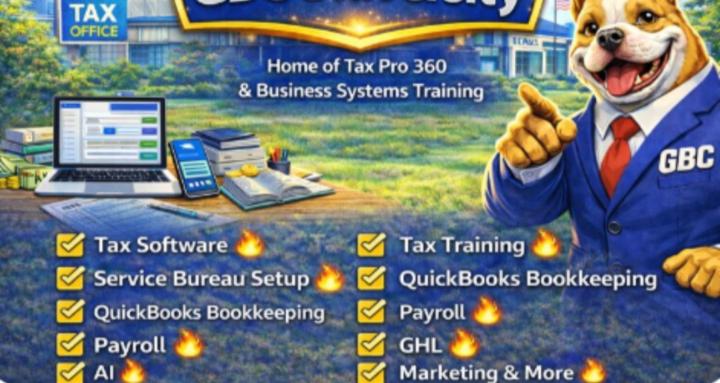

Tax Business Setup🔥Service Bureau Setup🔥QuickBooks Bookkeeping🔥Payroll🔥GHL🔥AI🔥Business Administration🔥Course Builder🔥Marketing & More

Suggested communities

Powered by