🩺 Can I write off my car? Ask the Tax Doctor | Dr. Geno

📘 Short Answer: Yes — but you need a plan.

There are several IRS-approved methods to deduct vehicle expenses, and once you choose a method, there are rules you must follow going forward.

📘 The Main Methods Explained

🚗 Mileage Method

✔️ Easy and quick

✔️ No commitment to one specific vehicle

✔️ No depreciation recapture issues later

✔️ Clean when you sell or trade the vehicle

❗ Requires good mileage logs

🧾 Actual Expenses / Depreciation

Deduction is spread over multiple years

Includes gas, insurance, repairs, depreciation

Requires strong documentation

Business-use percentage matters every year

💥 Section 179 + Bonus Depreciation

Can create huge write-offs upfront

Great for high-profit years

⚠️ Leaves minimal deductions in future years

⚠️ Can trigger recapture if business use drops or the vehicle is sold

Best used strategically, not emotionally

🩺 Dr. Geno’s Take:

The question isn’t “Can I write it off?” The real question is which method fits your income, profits, and long-term plan.

What helps one year can hurt the next if it’s not planned correctly.

This is tax strategy, not just tax prep.

📞 Call or Text: (813) 462-2758 📅 Schedule a FREE video consultation: 👉 www.GenoBradley.com

Ask the Tax Doctor. Go with a Pro. GBC Tax Pros.

4

0 comments

powered by

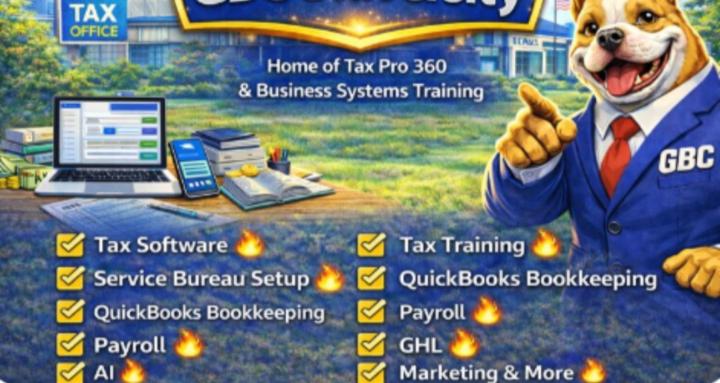

skool.com/gbc-university-6206

PTIN Setup🔥EFIN Setup 🔥 Service Bureau Setup🔥QuickBooks🔥Payroll🔥Go High Level🔥AI🔥Business🔥Course Builder🔥Marketing & More

Suggested communities

Powered by