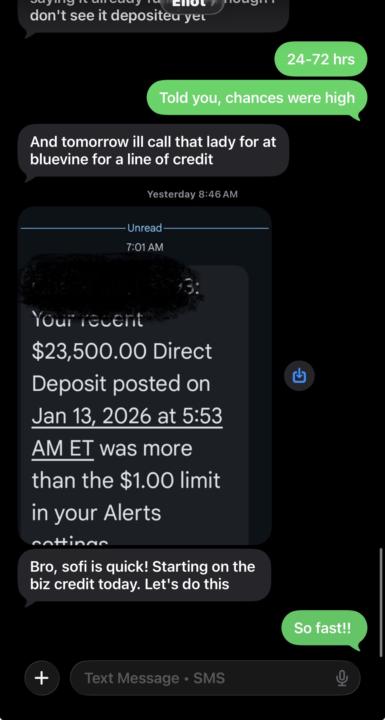

Client Win: 25k Sofi Loan

Client Win: $25 SoFi Approval Locked In Another clean approval to close out the year strong. $25,000 approved with SoFi No fluff. No guessing. Just execution using our Infinite Funding System datapoints. This client had low 600 score we fixed his credit in 3-4 months, got a 15k personal card & now sofi. Now he's positioned himself massive funding ASAP. This is what happens when: - you have the right borrower checklist to follow - you have the right datapoints to use on applications - you have 1on1 support - Funding could be SO MUCH EASIER for you... Comment "SOFI" if you want to get wins like these

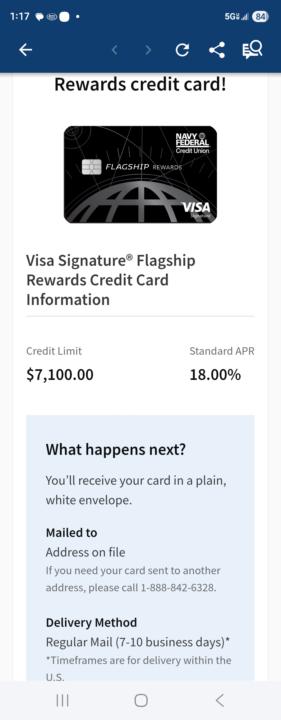

Higher Limits!

I got my first high limit credit card! All baby steps towards my greatest goals!!

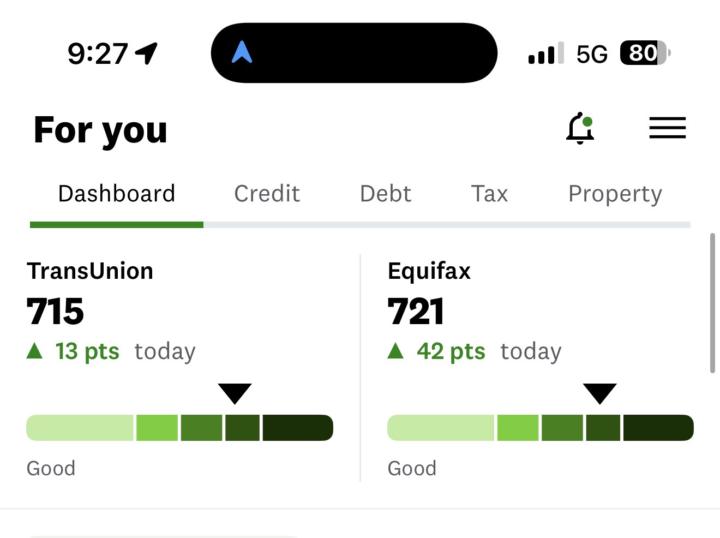

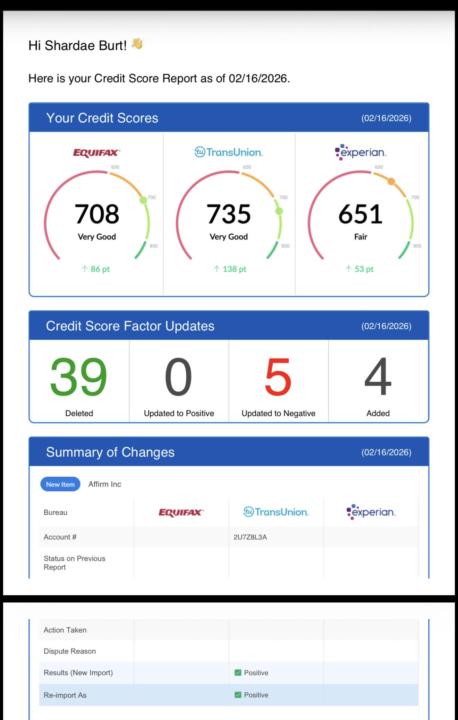

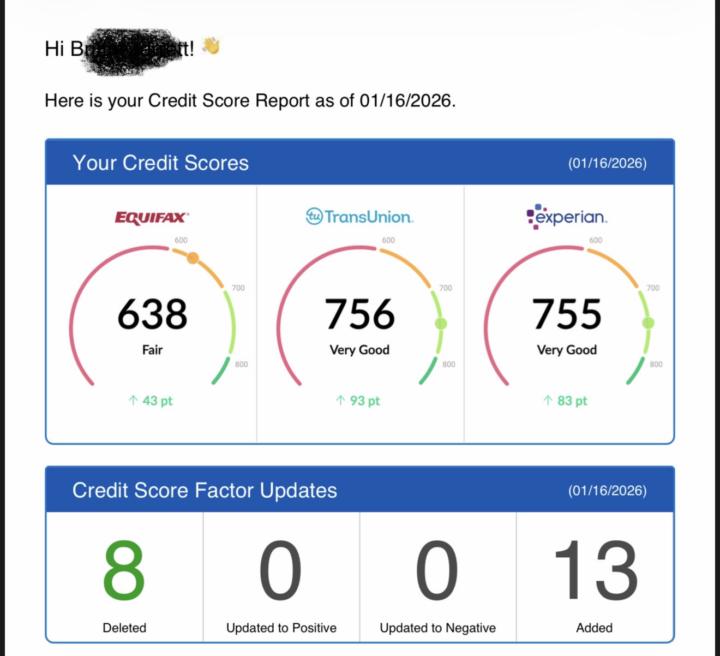

218 Point Credit Boost. Read THAT AGAIN

218-POINT CREDIT BOOST. READ THAT AGAIN. This is what happens when credit repair isn’t random — it’s engineered. 📈 +218 points total • TransUnion: 756 • Experian: 755 • Equifax still lagging — and that’s exactly where the next leverage is This client isn’t “working on credit.” They’re being positioned for $100K+ in funding. Why this matters: - Banks don’t fund effort - Banks fund profiles - And this profile just crossed into approval territory Most people stay stuck because: ❌ They chase hacks ❌ They guess ❌ They don’t understand bureau sequencing This was done with a system, not hope. If you want to know: - how we engineer jumps like this - how TransUnion is used to unlock funding first - how this turns into real capital (not just a score flex) 👇 Comment TITAN and I’ll show you the framework.

1-30 of 43

skool.com/fit-financial-free-7373

Unlock $50k - $300k in Funding. Fix Your Credit. Passive Income Investments. Start a 10k/mo Credit/Funding Biz. One Platform Infinite Possibilites.

Powered by