Write something

Credit Scores and Scoring Models

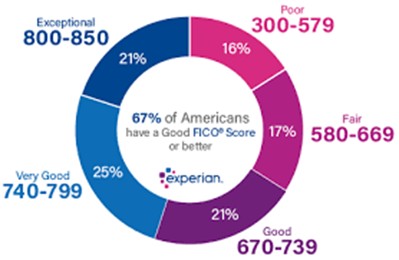

A credit score is a number that is used to predict how likely you are to pay back a loan on time. Companies use credit scores to make lending decisions. Credit scores are also used to help decide the interest rate and credit limit you receive on a loan or credit card. Do you have access to your personal credit scores? Are you seeing FICO scores or Vantage Scores? Or worst, a third-party consumer credit scoring model. Do you even know? If you don’t know make sure you find out. You need to know what you are looking at. Most of us have heard of a FICO score. FICO stands for Fair, Isaac, and Company. A FICO® score is a particular brand of credit score. FICO was a pioneer in developing a method for calculating credit scores based on information collected by credit reporting agencies. The FICO score is used by 90% of all lenders. Another scoring model gaining in popularity is VantageScore. Credit bureaus Experian, TransUnion and Equifax created the algorithm to produce VantageScore in 2006 to compete against the better-known FICO score. VantageScore has begun to get lenders’ attention, and it is widely offered to consumers for free. Currently, less than 10% of lenders use VantageScore. No matter what scoring model you are using, be sure to know what you are looking at and be sure to monitor your credit score and credit file. Learn how that particular model comes up with a score. This way, you’ll be able to work on improving the “heavily weighted” areas to improve your scores. Most all credit scoring models weigh making payments on-time and consistently the most heavily weighted component. What is the next most heavily weighted component in your scoring model.

0

0

Credit Card Line Increase Technique

To make it easier for the credit card issuer to raise your current credit limits, use this technique. Start using your targeted credit card (or cards) and run it up near the limit (75%). Buy all your life necessities and monthly obligations on your credit card when possible. All the stuff you were going to pay with cash, debit card, or check anyway. Pay the card off at the end of the month. Better yet, make two payments if you can each month 2-weeks apart. This helps with reporting lower usage when calculating your credit score. Do this for 2-3 months before asking for a credit line increase. This also is a great way to earn additional points or cash-back on things you were going to pay by cash, debit card, or check anyway. Make it easy for the credit card issuer to say YES to your request for a credit line increase

0

0

🚨 TransUnion Data Breach = YOUR Move 🚨

Millions of files just got compromised. That’s bad for them — but if you know what to do, it’s leverage for YOU. 🔒 Step 1: Freeze your credit. Lock it down. 👀 Step 2: Watch for anything new or negative that shows up. ⚖️ Step 3: If you find ANY inaccuracies — wrong balances, outdated negatives, accounts that aren’t yours — DISPUTE IMMEDIATELY under the FCRA. 💥 This puts TransUnion in a defensive position — and when they can’t verify with 100% accuracy, they must DELETE. ⏳ Don’t wait. Dispute NOW, while the bureau is weakened. They’ll often delete questionable accounts faster rather than risk liability. 🔥 Knowledge is power — but timing is EVERYTHING.

0

0

Credit Score Enhancement Tips

Here are a few ideas..............................nothing new. Just reminders. 1. The fastest way to raise your credit score is paying down your credit card balances. As soon as you reduce your balance-to-limit ratio, your score instantly increases. If your balance is over 30% of the allowed limit, your score gets docked. If your balance is over 50% of the allowed limit, your score gets docked even more. If your balance is near the limit or maxed out, then you get penalized with a major decrease to your credit score. The optimal percentage to gain the most points is a balance-to-limit ratio of less than 10% according to FICO. Keep in mind the balance-to-limit applies to each credit card and applies to the sum of all cards. If your score is 640 or above you may be able to get a personal loan to pay down the utilization. 2. If you do not have the money to pay down your balances, call the credit card company and ask them to raise your credit limit. This accomplishes the same thing by lowering your credit utilization ratio. If you have been paying on time, they will usually agree, hoping you will spend more and owe them more in interest payments. You can do this every 6-12 month (and you should). 3. If you cannot pay down your balance or get a credit line increase, you might be able to redistribute some of the high balance cards to other existing cards with lower utilization. Be sure and stay under 30% on each card if possible. Keep the higher balances on the lowest interest rate cards. 4. If you have true business credit cards that do not report to personal credit bureaus, you can do balance transfers to these business credit cards. This will remove that amount off your personal credit and increase your scores dramatically. 5. Another unique way to increase your score is to report your Cell Phone, Rent, and Utility payments to the credit bureaus via a company called Level Credit (Now Self). Very few consumers know of this service. Utilize bills you are already paying. Build your credit without taking on more debt. https://www.levelcredit.com/how-it-works The cost is a onetime fee of $49.95 plus $6.95 per month. They will report to all three credit bureaus. Add up to 2 years of past payments. Build your credit fast! Rent Reporters is another way to report your rent and gain a valuable tradeline.

0

0

Keep Your Utilization Low for Maximum Leverage

Credit utilization makes up (30%) of your FICO score, and it’s one of the easiest factors to control. Here’s how lenders view it: 📌 <30%: Meets basic low risk standard 📌 <10%: Strong credit management. 📌 1–9%: Ideal. Borrowers here tend to have the highest approval odds. Note: Many banks offer soft-pull credit limit increases every 6 months. A higher limit lowers your credit utilization without paying off extra debt. If you have been using a credit line and paying it on time, request a credit line increase when you can (every 6-12 months). This is how you take $10K cards and turn them into $35K cards over time. Get the credit when you can even if you don't need it now! If you don't use the credit line the bank has provided you there is no reason for them to increase your credit line. Can you apply for a credit line increase this week?

1

0

1-7 of 7

skool.com/fast-track-capital-academy-1577

Designed for serious entrepreneurs who want capital now. Real strategies & real cash funding. 1-on-1 sessions with a 20-Year Credit & Funding Expert.

Powered by