Pinned

💎💎💎💎Gratitude to Everyone / Vision Is Coming To Fruition

Thanks to you all and your donations every month it’s being used wisely by my family office . The DVWHA is my pride and joy built it out of my likeness of being a living disabled veteran. I have now added key factors to help build the association more using marketing and out the box thinking . Let me show you all I am a mentor that walk the walk and talk the talk ! Any advice on ways to help grow I am always open to it ….. gratitude 🙏🏿 Also the top 3 people on winners chart this month will receive a call from me 1 on 1 💎💎💎💎 to help the mission donate here.. https://dvwha.org/

Pinned

Who Is Norwood “MinisterBeeBetta” Williams Jr?

Equity Consultant! “My role here is simple: I am your equity consultant. I don’t operate as your lawyer, CPA, or paralegal. Instead, I guide you through the private process so you always know what to do, when to do it, and why it matters.” “Think of me as the architect. I design the strategy, show you the blueprint, and walk you through every single step — line by line. I’ll provide templates, checklists, and examples so you can confidently complete each filing, charter, or setup.” “What I don’t do is physically fill out or sign paperwork on your behalf. That keeps me private, keeps you in full control, and protects both of us. You’ll be the one executing each form — but never alone, because I’ll be right there explaining and reviewing.” “The reason my clients invest $15,000k in this program is not for paperwork — it’s for clarity, certainty, and transformation. Anyone can download forms. What matters is knowing how to structure your entities correctly so you keep more income, protect your assets, and build generational wealth privately.” “Here’s how it works: 1. I teach you the principle (why it matters). 2. I walk you through the example (how to do it). 3. You complete your draft (your execution). 4. I review and give feedback (your confirmation).” “This process keeps you in the private, makes you the Beneficiary and Executor of your own estate, and ensures that you—not the system—control your outcome. I am your strategist and guide, so you never walk this path alone.” Service links: https://calendly.com/dvwha-support

Pinned

🔥🔥🔥🔥Each Beneficiary Answer These Questions And Then Inbox to Me

Reprogram Your Mind – Deep Reflection Intake Sheet 1. What results do you want as a Beneficiary? Why now?(Describe the freedom, peace, and control you want to experience over your estate.) 2. Why is reclaiming your estate deeply important to you?(Think about your family, your legacy, and your future generations.) 3. How does living as a “debtor” make you feel right now?(Be honest — frustrated? anxious? controlled?) 4. Where does this affect your life the most?(Work? Relationships? Finances? Confidence? Social life?) 5. What has held you back from stepping into Beneficiary status before today?(Fear? Confusion? Lack of knowledge? Not knowing the process?) 6. If you do nothing, what will life look like in 6 months, 1 year, 5 years?(Write the uncomfortable truth — debt, stress, no plan for your estate.) 7. On a scale of 1–10, how urgent is it for you to reclaim your estate now?(Circle one: 1 2 3 4 5 6 7 8 9 10) 8. Paint a picture — what does your life look like after reclaiming your estate?(Imagine yourself debt-free, operating as Beneficiary, protecting your family’s future.)

🔥🔥🔥🔥Be Sure To Know Difference Between General And Special Appearance 🔥🔥🔥🔥🔥

Be careful videos like this can give masses wrong idea like this stuff is easy it is not ! Especially if you in wrong capacity . Special appearance What that procedure is called When you use the IRS’s own records, procedures, or testimony to challenge the charge in court, you are challenging the validity of the assessment through judicial review of an IRS determination. Depending on posture, it is commonly described as: • Assessment challenge (attacking whether the tax was lawfully assessed) • Challenge to presumption of correctness (forcing IRS to lay a factual foundation) • Evidentiary challenge to the assessment (using IRS records/witnesses against the claim) If done before payment → it is part of a deficiency proceeding. If done after assessment/collection → it occurs in a Collection Due Process (CDP) case or refund suit. What you are doing in plain terms You are turning the IRS into the proof witness: • Demanding the administrative record • Forcing production of assessment certificates (e.g., Form 23C/official transcripts) • Testing whether the IRS followed statutory procedure • Attacking the presumption of correctness when records are incomplete or defective If the IRS cannot establish a proper assessment, the charge collapses. Where this happens (courts) • United States Tax Court – deficiency cases (pre-payment) • United States District Court – refund suits (post-payment) • United States Court of Federal Claims – refund suits (post-payment) Where the rules are found 1. Procedure (how you force the issue) Tax Court Rules of Practice and Procedure • Rule 70–74 – Discovery (documents, interrogatories, depositions) • Rule 91 – Stipulations (what IRS must admit or deny) • Rule 142 – Burden of proof • Rule 143 – Evidence 2. Substantive authority (what IRS must prove) Internal Revenue Code (Title 26) • § 6201–6203 – Assessment authority & method • § 6212–6213 – Deficiency & right to petition • § 6330 – CDP hearings (if lien/levy stage)

😎🔋talk to me nicely 😎🔋

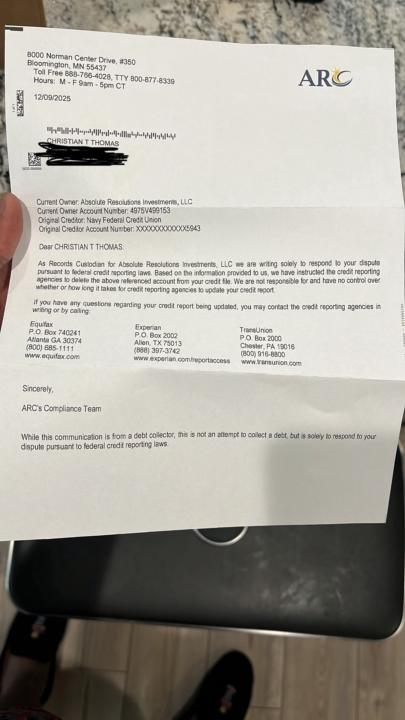

Them letters here in the group work just believe send and wait!

1-30 of 1,101

skool.com/debtfreeordietryingelite

🧠 Where Inner Wealth Meets Asset Protection

Welcome to The Subconscious Estate™ — the space where mindset, law, spirit, and wealth meet.

Powered by