No corporate tax on "unrealized" crypto gains.

This is big as if corporations had to pay for the gains that were unrealized. That is a huge deterrent to holding crypto. With this new rule that it's not the case, that could be huge for companies looking to hold crypto.

0

0

Crypto News Roundup September 30, 2025

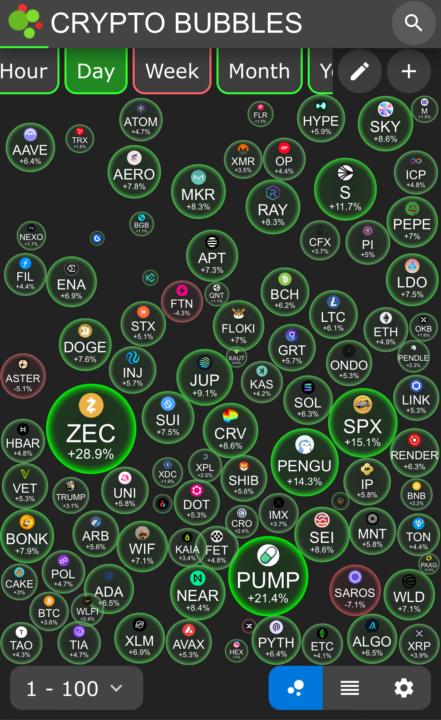

📉 Market & Price Moves - Bitcoin & altcoin dragBitcoin slipped about 1% in 24 hours, with Ethereum down ~2.8%, Solana ~3.9%, and XRP ~2.9%. Many traders see this as a reaction to rising political uncertainty over a possible U.S. government shutdown. Barron'sStill, some altcoins saw gains earlier, with Bitcoin up ~2.4% and Ethereum ~2.8% before the closing pullback. Barron's - Market structure & sentiment 🏛️ Regulation, Policy & Institutional Developments - SEC commissioner open to tokenization engagementHester Peirce (SEC Commissioner) publicly stated willingness to “work with people who want to tokenise,” encouraging dialogue rather than confrontation. Reuters - Visa experiments with stablecoinsVisa announced it is testing a new payment route allowing businesses to fund cross-border transactions using stablecoins (rather than pre-depositing fiat). This move reflects growing institutional confidence in digital assets and the regulatory clarity around stablecoins (e.g. under the GENIUS Act). Reuters - OKX launches stablecoin payments in SingaporeOKX Pay now allows merchants in Singapore (via GrabPay) to accept USDC/USDT. The process involves converting stablecoins to XSGD, then settling in SGD to merchants. This implementation expands real-world use cases for stablecoins in payments. Reuters - China’s offshore yuan stablecoin in KazakhstanChina launched AxCNH, a regulated offshore yuan-pegged stablecoin in Kazakhstan, using Conflux’s blockchain. The move is part of China’s push to expand its digital asset influence in cross-border trade. Reuters - Outgoing NY regulator backs crypto passporting with UKAdrienne Harris (NY Department of Financial Services) voiced support for a crypto “passporting” scheme between the U.S. and UK, allowing regulated firms market access across borders. She made this remark as she announced her resignation. Financial Times - Australia proposes new crypto law under existing licensing regimeThe Australian government tabled draft legislation to extend its Australian Financial Services Licence (AFSL) regime to crypto firms. The rules would impose conduct, governance, and risk standards, with stiff penalties for violations. The Australian - SWIFT & major banks exploring blockchain settlement overhaulSWIFT and leading global banks are collaborating to prototype a blockchain-based ledger for cross-border settlement, aiming to make payments faster, 24/7, and more efficient. Reuters

0

0

1-17 of 17

powered by

skool.com/crypto-mastery-academy-2311

Private club for crypto traders. Let's master trading together.

Suggested communities

Powered by