Write something

Market Pulse — Dec 2, 2025

📈 AlphaEdge Market Pulse — Dec 2, 2025 - Markets bounced back — the S&P 500 rose ~0.2%, the Dow Jones Industrial Average climbed ~0.4%, and the Nasdaq Composite jumped ~0.6% as bond yields stabilized and cryptocurrency (Bitcoin + crypto-linked stocks) regained strength. - Tech and AI-adjacent names led gains. Optimism around a possible interest-rate cut from the Federal Reserve next week continues to support risk-assets. - Big move in industrials: Boeing surged once again on an upbeat 2026 outlook, lifting parts of the Industrials sector and helping broaden the market rally beyond just mega-cap tech strength. 📊 Technical & Sentiment Signals - Market breadth improved a bit — after recent weakness, more sectors and names are participating in the bounce (not just the usual large-cap tech). - Long-term backdrop remains cautiously optimistic: rate-cut expectations and calmer yields help boost risk appetite — but valuation and macro risk remain in the background. - Volatility is still present: crypto’s rebound helped risk sentiment today, but crypto remains highly volatile — so traders should remain alert for erratic moves. 🎯 What to Watch / Strategy Ideas - Watch pullbacks in leaders: If tech or AI-names reopen their gaps or test support, these could be swing entries with tighter risk. - Sector rotation candidates: With industrials and cyclicals showing strength (e.g. Boeing), consider watching for setups in sectors outside tech — especially if rates stay stable. - If you’re cautious: Focus on names with strong fundamentals and liquidity, and avoid over-extended movers with weak charts (especially crypto-linked/risk assets). - Risk control remains essential: Given macro uncertainty (Fed, yields, crypto), keep tight stop-losses or size appropriately on swing trades.

0

0

How we feeling heading into this week?

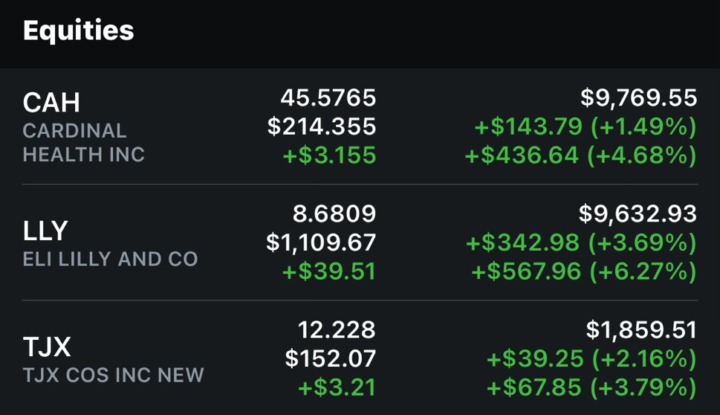

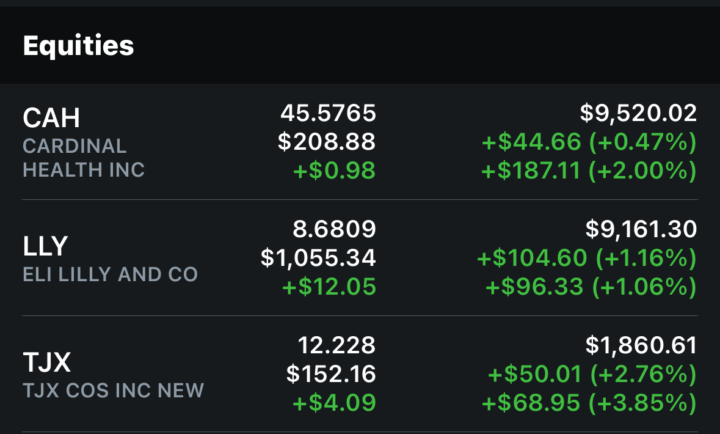

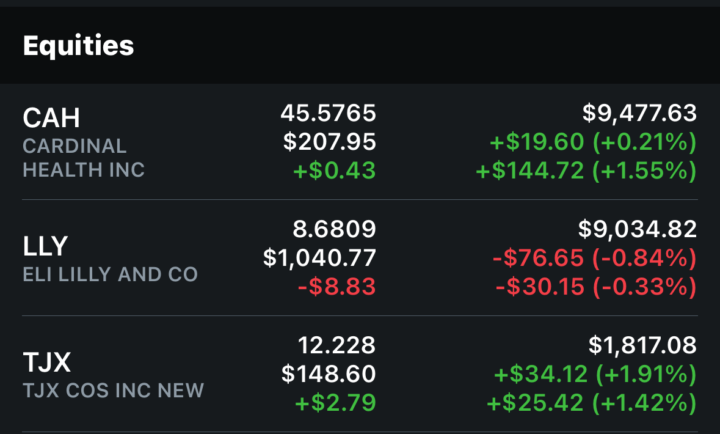

$LLY erased early week gains on Friday. Hoping this was simply overextended profit taking fueled by the low-liquidity, low-volume, post-Thanksgiving session. $CAH and $TJX held relatively flat.

0

0

1-30 of 39

skool.com/alphaedge

AlphaEdge is a community for traders to share insights on stocks, options, technicals & fundamentals — sharpen your edge and trade smarter together 📈

Powered by