Pinned

780 Club & 5/5 on the Amex Run!

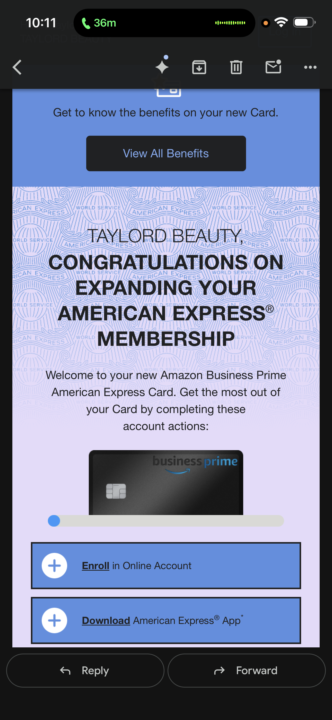

I’ve got to give a massive shoutout to Mr. Win ! Dennell. If you aren’t working with him yet, you’re leaving money and leverage on the table. My personal credit is 780! his guidance on the business side has been a total game-changer. This man is in my ear constantly, pushing me to level up and stay disciplined. Thanks to his strategy, I secured 5 American Express business cards to scale my vision! My newest baby my Amazon AMEX It’s rare to find a mentor this positive and dedicated to your success. Who’s ready to join me and go AMEX for AMEX?

Pinned

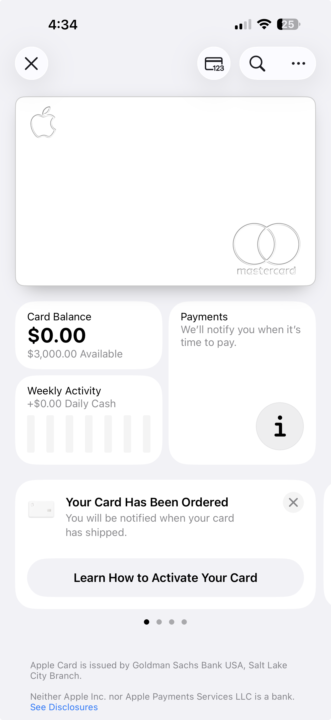

Apple Card play still a go‼️‼️‼️

Pushing play on everything‼️‼️. LET’S WIN FAMILY‼️‼️‼️🏆🏆🏆🏆🏆🏆🏆

Pinned

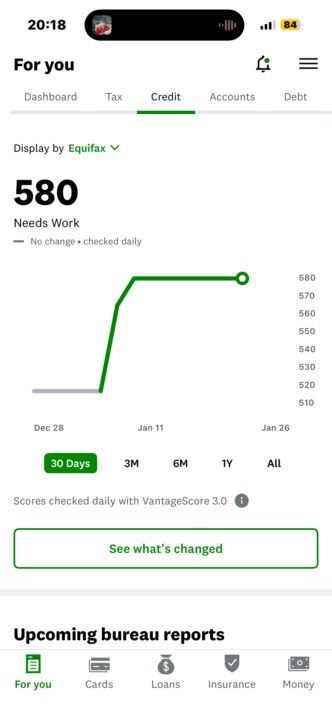

First lil WIN

I startes to put myself first and fix my personal credit. Made some bad decisions in my 20s but this is my first win by adding accounts and credit mix. Appreciate this Skool community for inspiration and big ups to Coach Hines 🤙🏽 #LETSWIN🔐

GO HARD……

Rich Evening 🖤🏦 A note for you all before you all go to sleep tonight…. Imagine if you decide not to do anything different tomorrow….. Your life will change normally as time goes by….. and at some point you may “succeed” or regret time lost….. However….. If you TRY……. Just try something different for once…. Try something that seems difficult or unobtainable…. Try to alter a habit….. Try to sacrifice something…… SOMETHING WILL CHANGE! I promise you one thing…… if you attempt to change something …. CHANGE COMES….. if you do nothing …. THEN NOTHING CHANGES…… #WEWILLWIN

3

0

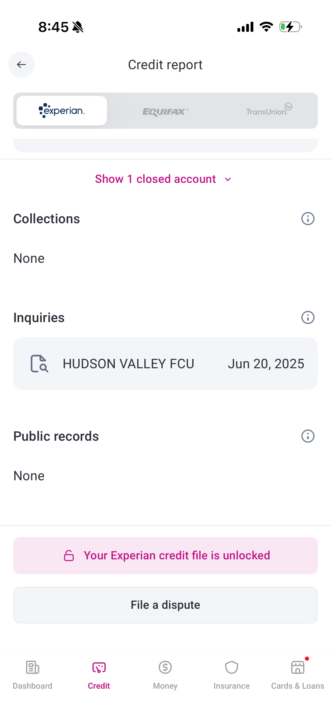

24 Inquiry removal

Hey y’all I did this hack a week ago and today I woke up to 4 deleted hard inquiries from Experian🔥💰

1-30 of 797

skool.com/adversitybeaters

#1 CREDIT & BUSINESS SKOOL

3 PROVEN STEPS TO GET OVER THE 800'S 💎 and $50K IN FUNDING💰

🔥CREDIT TO ASSETS🔥 A HANDHELD EXPERIENCE OF A LIFETIME!!!

Powered by