Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

14 contributions to Global Business Growth Club

Keeping ITIN active / renewal - filing 1040NR nil

Got a question for those who have experience with this: I am a non resident, have an ITIN and am non ETBUS / no US source income / effectively connected US income. This means in my case I will not need to file form 1040NR since nothing to declare. However I would like to keep my ITIN active - best case scenario without needing to extend it approximately every 3 years (which is basically almost the same process as applying for a new ITIN). Several people told me something I had also considered: To file form 1040NR nil with nothing declared. Hence the ITIN would be used and stay active. But I don't have data on this from the real world. Seems the people who have advised doing this only had the one argument that this would keep the ITIN active but what about possible negative effects? Is this safe to do? I don't want to create any problems - e.g. the IRS double checking things on my business / assessing if ETBUS / non ETBUS or anything like that. Are there people here who know if filing 1040NR is common practice and completely harmless? Would be great to know if this is in fact a viable solution to easily keeping an ITIN active for businesses that are not ETBUS.

1 like • Feb 5

nil filing won't work. You could file gambling income, e.g. you won $100 in an online casino (IRS won't ask for proof). You would need to pay around $9 in taxes and declare it on form 1040nr + schedule 1 (line 8b or 8i). Taxes can be paid by credit card with a little fee (https://www.irs.gov/payments/pay-your-taxes-by-debit-or-credit-card) You can mail the 1040s or use a filing service (https://www.olt.com/)

1 like • Feb 12

@Daniel Lim I got the info from a Canadian subreddit, called ITINforCanadians. It's a community of people from Canada who are very into the credit card points game with US credit cards. There was a guide on how to apply and also keep alive the ITIN. The suggested solution for both is filing gambling income and pay some taxes. Also there is an option to create an IRS account (with ID.me). In that account you will be able to see tax transcripts, detailed filing history and also get notifications from the IRS. Basically everything that's available for people with SSN.

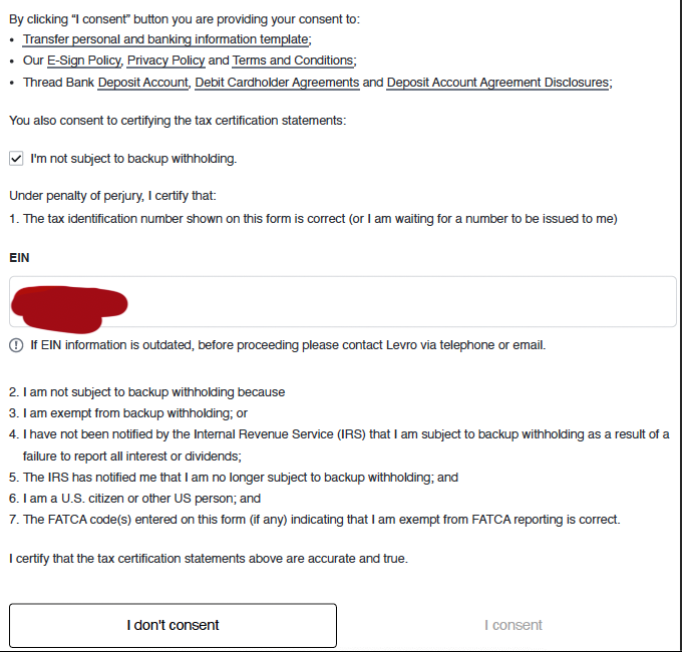

Levro Bank Backup Withholding

Levro has a new partner bank and they invite everyone to transition to them. In the process I am being asked to confirm a tax certification statement. Do I tick the backup withholding box or not? I am a non-US resident with a SMLLC.

New Mexico Digital Advertising Tax

Hi, Last month I was running Amazon Ads with my NM LLC for a physical product on the Amazon.com marketplace. I was expecting to see 4.8% gross receipts tax added to my invoice amount. But to my surprise, Amazon Advertising LLC (Seattle, WA) did't add any tax. My invoice address is clearly NM (Albuquerque) and my credit card on file has the same NM address. Don't get me wrong, I am happy about that. 4.8% in the long run make a huge difference in advertising expenses. Just curious about the tax specifics. Any explanation? Cheers

An LLC on a student F1 visa

Hi everyone, I am an international Egyptian student on an F1 visa. I just started my IT offshore outsourcing services business as an LLC. From my knowledge, technically from an immigration perspective, I should not be working on the US, which is the case. Most of the business operations are done by other people offshore. And from an IRS perspective, I should not pay taxes since it is not a US trader business since the services are performed offshore. Meanwhile, I have a SSN and part-time campus job. I watched a video of James talking how is it a complicated for a foreign LLC owned by a student in the US since it will be a trader business by somehow. Quite did not understand it. How would me being the owner of the LLC a student in the US make it a US trader business ? Correct me if I am wrong, I cant get an ITIN since I already have a SSN. How would it work out separating paying taxes for my part-time student employment and not paying so for my LLC offshore-operated earned income?

Mercury Application Rejection

Hey folks, I had applied for Mercury banking account for my e-commerce startup in USA as a background I am from India and I have incorporated my LLC in the state of Wyoming having a physical address and Florida. I don’t understand why they rejected mine. Can someone help me understand why my application was rejected and if someone had their application rejected before what were the steps you took to rectify it and also if anyone suggest me the precautionary measures, I should be taking while resubmitting the application. Thanks in advance.

1-10 of 14