Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Owned by Whitney

The Grant Queen👑 I help you win grants and credit for your business. I successfully obtained 5 million for my clients. YOU'RE NEXT!

Memberships

Limitless Potential

149 members • $100/m

7 Figure Digital Inner Circle

75 members • $3,500/m

Skoolers

177.5k members • Free

477 contributions to The Bossy Collective

Are You Ready For Them?

There’s a smarter, stronger, more intentional version of you waiting on the other side of consistency.

🚨 Credit Confusion Alert: Secured Cards vs. Prepaid Cards

A lot of people think secured credit cards and prepaid debit cards are the same thing, but they work very differently, especially when it comes to building credit. Prepaid Debit Cards - You load your own money onto the card - You spend until the money runs out - No borrowing involved - Not reported to credit bureaus - Does nothing for your credit score Think of this like cash with a card. Secured Credit Cards - You put down a deposit, but you’re still borrowing money - You must pay the balance back every month - Reported to Experian, Equifax, and TransUnion - Builds or repairs your credit Think of this as credit training wheels. If your goal is to build or rebuild credit, a prepaid card won’t help. A secured credit card is one of the safest and fastest ways to prove you can manage credit, as long as you: - Pay on time - Keep balances low - Avoid carrying interest Use it correctly, and it opens the door to better cards, higher limits, and more financial opportunities. Drop a 💳 in the comments if this finally made it click.

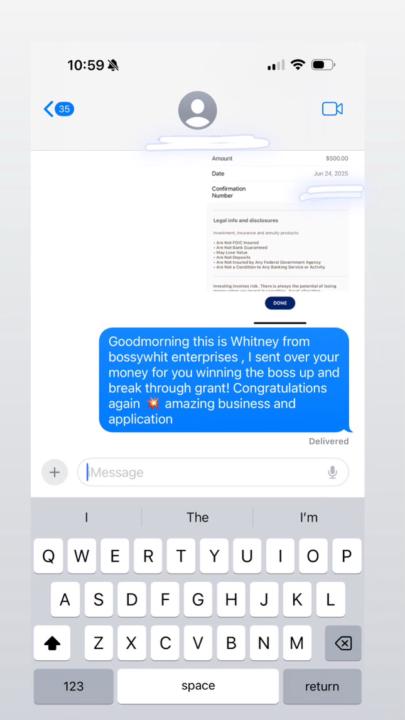

Grant WINNER

EVERYONE congratulate @Dolla Mitchell on winning the bossup and breakthrough grant and today is payout dayyyy! Your appllication was an A+ and I love your drive behind your business. Did you know that this grant is ONLY open to people in this skool community? we have 77 members. Will you be next months winner???

Black Friday Offer is HERE

You’re getting 3 live business classes packed with me dropping JEWELS: Community will access the classes for FREE 📅 Class Dates: January 6, 2026 • January 20, 2026 • February 3, 2026 Here’s what you’re about to learn: ✨ How to secure $100K+ in business funding ✨ How to write and WIN grants ✨ How to go viral and grow your brand ✨ How to build Content, Credit, and Grants the RIGHT way ✨ How to finally walk away from that 9–5 🔥 Drop a “READY” in the comments Community will access the classes for FREE

1-10 of 477

@whitney-cumbo-6851

Hi I’m Whit, The Grant Queen. I own 3 storefronts and I'm a mastermind at grants, credit, and content. Im always egar to learn !

Active 7h ago

Joined May 2, 2025

Chicago, IL