Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

fundusi

3.3k members • $1/month

23 contributions to fundusi

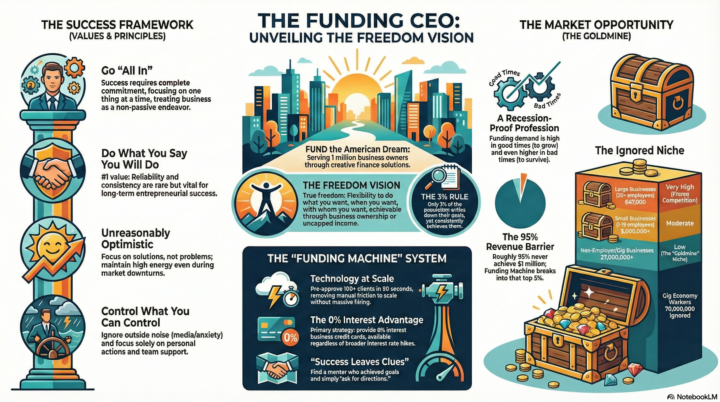

From Bankrupt to 8 Figure Funding CEO

- Awesome case study from Brian Stark - from new to Funding to Funding Expert - Ty's incredible journey working a full time job to building a funding empire - Francois changes lives including his families!

1 like • 26d

OK, LAST DECEMBER I INTRODUCED 7 FIGURES TO A NEIGHBOR. HE LEFT A MESSAGE HERE. MR. FOWLER. LAST WEEK, I TOLD 3 PEOPLE, THEY ARE EXCITED AND WANTS TO JOIN 7 FUNDING. SINCE I AM BRINGING THEM IN, HOW DOES THAT WORK FOR ME? I RECRUITED THEM, ARE THEY STILL MY RECRUITS? INQURING MINDS WANT TO KNOW. ROFL.

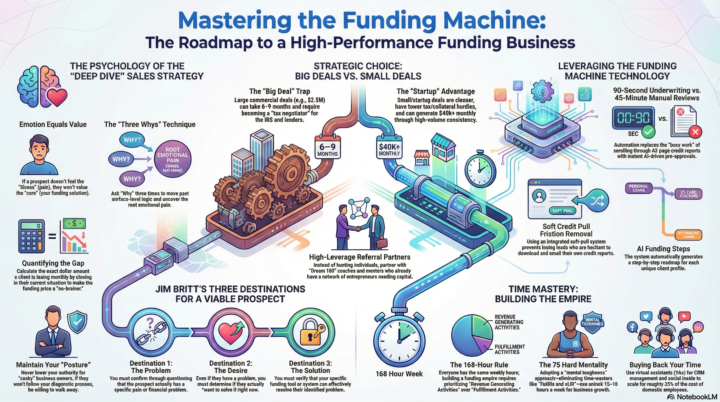

He made 30k on 1 Deal

- Nate shares his crazy story from $13/hr to $6k a week! - Small Deals or Big Deals? - Tony Robbins First Coach shares 3 keys to Sales Success

1 like • 26d

THE CLASS LESSONS GOT ME MORE EXCITED THAN I WAS BEFORE. I'D ADVISE EVERYONE TO AT LEAST LOOK AT THE VIDEOS, WEEKLY BECAUSE THEY WILL KEEP YOU EXCITED AND MOTIVATED. AND THE MORE I VIEW THEM, THE MORE I RECEIVE A DIFFERENT KNOWLEDGE, AND THAT LIGHT COMES ON BRIGHTER AND I SEE THINGS MUCH CLEARER IT'LL GET THAT MOTOR IN YOUR BRAIN RUNNING LOL. IT'LL KEEP THAT THINK MACHINE CHARGED AND YOU EXCITED ABOUT THE NEW JOURNEY THAT YOU'LL ABOUT TO UNDERTAKE!

PERSONAL LOAN

HEY GUYS, I NEED A PERSONAL LOAN. THIS LOAN WILL HELP ME WITH THEPOINTS NEEDED FOR THE MULTI-DWELLING UNIT I SHALL BUILD FOR THE HOMELESS, VETERANS, DISABLED AND LOW-INCOME. I NEED YOUR HELP ASAP. IS THERE ANYONE WHO CAN HELP ME. I AM ON A MISSION AND TIME IS OF THE ESSENCE. IS THERE ANY REASON, YOU CAN'T OR WON'T HELP ME HELP THOSE "UNSEEN" SOULS? PLEASE HELP. ALSO, I HAVE A GOFUND ME. ONE MONTH AND NOT ONE SOUL HAS PAID, BUT ME! LOL. I KNOW TIME IS ROUGH BUT IF YOU GIVE FROM YOUR HEART, GOD WILL GIVE FROM HIS ABUNDANCE. YOU ARE SOWING INTO FERTILE GROWN AND YOUR RETURN SHALL BE GREATER THAN ANYTHING THAT YOU THOUGHT POSSIBLE, I WILL LITERALLY BLOW YOUR MIND. SO GIVE AND IT SHALL BE GIVEN BACK UNTO YOU, PRESSED DOWN, RUNNING OVER, SHALL GOD GIVE BACK TO YOUR BOSSOM!

NEW HERE

I am new here. I AM A CONTENT CREATOR, WEB DESIGNER AND INTERACTIVE MEDIA DEGREE 3.98 DEGREE IN MERCHANDISING 3.89 AND HAVE A REAL ESTATE INVESTMENT BUSINESS, ALSO AN AWARD-WINNING PUBLISHED AUTHOR, I STARTED A PUBLISHING BUSINESS 3 YEARS AGO, I AM AN ENTREPRENEURER. LOVE MEETING PEOPLE AND HELPING OTHERS. I AM LOOKING FOR INVESTORS FOR A PROJECT THAT GOD LAID UPON MY HEART TO DO A FEW YEARS BACK. FINALLY HAVE THE CHANCE TO DO IT, BUT I CAN'T DO ALL BY MYSELF. I BELIEVE GOD SENT ME HERE. I FEEL THE FULFILLMENT. I AM OPEN. I HAVE A CALLING TO HELP THOSE LESS FORTUNATE, OUR VETERANS. DISABLED, AND HOMELESS. IF ANYONE FEEL IN THEIR HEART TO REACH OUT, PLEASE DO SO. IT'S MUCH NEEDED. WE NEED HOPE IN THE USA, WHY NOT PROVIDE IT FOR OTHERS? BTW, LOL. I'M NOT YELLING. THE CAPS MEANS "EXCITEMENT! 😀

1 like • 29d

TY AND LOL IT'S VERTHA NOT BERTHA AS IN VONNIE NOT BONNIE. MY NAME STARTS WITH A V LIKE YOURS, HAHAHA. THANK YOU FOR REACHING OUT LOL. My business is in flipping houses, but my desire is to build homes for the homeless (unhoused) displaced, veterans, disabled and very low income. Nice homes, I don't do the ghetto thing, meaning homes that's below standard. I wouldn't live in one and I won't let my residents live in subpar conditions.

Push the Wheel or Reinvent the Wheel?

Team, If you ever doubt the power of "pushing the wheel" instead of reinventing it, watch this clip from Scott Dias. He hit rock bottom (financially) at the worst possible time. He didn't claw his way out by inventing a new gadget or starting an agency. He did it by leveraging the Funding Machine. The takeaway: The system works if you work it. Who else here is doing "1/3 the work" compared to their old job? Let me know in the comments. 👇

1-10 of 23

@vertha-higdon-9301

entrepreneur, award winning published author. DEGREE IN SCIENCE AND ART.

Active 23d ago

Joined Oct 8, 2025

Powered by