Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

The Health Collective

90 members • Free

Amy's Health Nest

282 members • Free

4 contributions to LetsGetFunded FREE

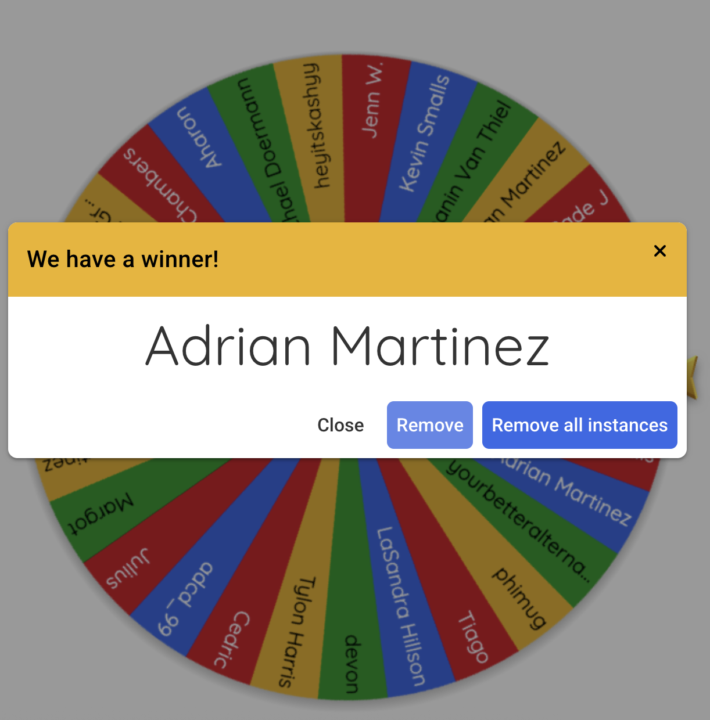

🎉 Wheel Winner! 🎉

Shoutout to Adrian Martinez, who just joined the Inner Circle and already scored $200 on the Wheel 💸 We're still dropping some real value here. Join us while we're at it! 🔥 🔗 https://us06web.zoom.us/j/86005656909

$200,000 APPROVAL NON DOC

It’s insane. I just got approved for $200,000 without providing a tax return. Funders and clients come to me SO FREQUENTLY lately “ oh the banks aren’t lending.” That information is incorrect. I gotta be real guys if you aren’t in the INNER CIRCLE you are missing out. Free credit repair Calls EVERY SINGLE DAY My $1.5 MILLION DOLLAR ROADMAP I have now gotten 1.5 million dollars of funding without providing a tax return… Let me say that louder for the people in the back. I HAVE NOW GOTTEN 1.5 MILLION DOLLARS OF FUNDINT WITHOUT PROVIDING A DOCUMENT I am now in Columbia with a free flight (points), free Hotel (points) Stop living your life on hard mode. Join here or forever hold your peace. Side bar our price is going up very soon. You lock in the price now you’re locked in for life. Skool.com/100k Your trusted leader Evan

📈 Consistency > Perfection

Even if you’ve got some old negatives sitting on your file, lenders are looking for one thing above all: steady improvement. They don’t just want to see that the negatives are aging. They want to see you’re moving in the right direction: ✅ Payments made on time ✅ Utilization under control ✅ Responsible credit activity That’s what builds trust and gets you lender-ready. ➡️ If you’re serious about fixing your profile, join our Community Onboarding at 1PM ET today 🔗 https://skool.letsgetfunded.com/fskool-group-onboarding-book ➡️ Already serious about the next step? 🔗 LGF Pro – www.skool.com/lgf – Done-for-you credit repair to fast-track results 🔗 Inner Circle – www.skool.com/100k – Done-for-you credit repair PLUS daily calls to grow and scale your business

🔥Locked in💰The Funding Bundle Approach — How to Stack Cards, LOCs, and Vendor Credit Into One Big Approval Window

Most people think funding is one-and-done. Apply for a card, wait for approval, move on. But real capital builders know the game isn’t single plays — it’s bundling approvals. A funding bundle is when you sequence multiple approvals in the same 30–45 day window so that each approval strengthens the next. Done right, this creates a snowball effect — stacking $20K here, $50K there, until you’ve got six figures in new credit lines. Here’s how the Funding Bundle Approach works: 🧱 Step 1: Start With Vendor Tradelines (Low-Risk Foundation) Before you go for banks, build the “reporting trail” with vendors that post to the business bureaus. Examples: - Uline (Experian & D&B) - Summa Office Supplies (Equifax) - Shirtsy (D&B & Equifax) Why it works: Lenders see activity. Even $50–$100 orders show you’re a real business. This step is like laying bricks before building walls. 💳 Step 2: Stack Business Credit Cards (Strategic Timing) Within the same 2-week period, target 2–3 cards that pull from different bureaus. Example play: - Amex (Experian, soft pulls after first card) - Navy Federal Biz Card (TransUnion) - Truist Biz Cash Card (Equifax) Now, you’ve got approvals across all three bureaus with minimal inquiry overlap. 💡 Pro Tip: Keep utilization under 10% from day one. Reported low usage boosts your fundability profile instantly. 🏦 Step 3: Add a Business Line of Credit (LOC) Once your new cards report (typically 30 days), your business profile looks stronger. Now’s the time to approach banks for an LOC. Requirements usually include: - 3 months of business bank statements - EIN docs + LLC paperwork - Proof of deposits (regular inflows, not random Zelle cash apps) Banks like to see stability. Even $3K–$5K monthly deposits can unlock $20K–$50K LOC approvals when paired with a clean personal file. 📊 Step 4: Leverage Merchant Accounts for Extra Weight Don’t sleep on merchant processors. A Stripe or Square account with steady deposits is gold to lenders. It proves cash flow — even if you’re just moving controlled money.

1-4 of 4

@tyanne-evans-7528

Educator & entrepreneur helping women save, build wealth, and thrive through practical resources, faith, and community support.

Active 4h ago

Joined Aug 20, 2025

Powered by