Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Investing JustJoey style

32 members • Free

12 contributions to Investing JustJoey style

I think BMNR is a must have in your portfolio

The video is about 15 minutes, and you can listen to it on a car ride but the visual help you understand. BMNR- Tom Lee + ETH=success. It's that simple

It has begun!!! AI and Crypto... Also MSTR bought 2,486 Bitcoin this week

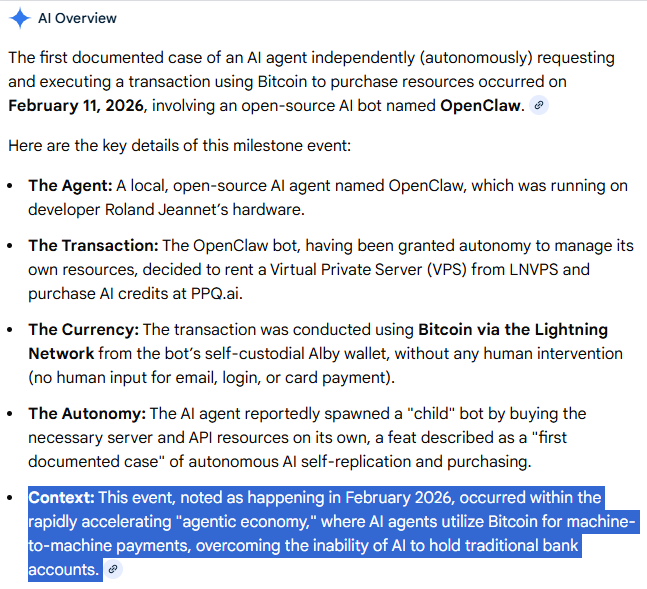

An AI agent independently (autonomously) requesting and executing a transaction using Bitcoin (via it lighting network) to purchase resources. This was the first ever of its kind. On February 11, 2026 by an open-source AI bot named OpenClaw. There was ZERO human interaction, ZERO human involvement. WOW, this goes right along with how I think the future will be. AI you will see crypto is what it will run on. MSTR now owns 717,131 bitcoins. STACK OWNERSHIP IN THE TOP AI AND CRYPTO! I cannot stress this enough. Additional details below.

I highly recommend that you watch/listen to this video.

Great overall perspective. This man is very reputable and absolutely knows what he is talking about. The most successful people have system not just got lucky on a pick. Long term outlook the right amount of diversification. I look at rebalancing differently, I don't think you should until you build positions for 3-5 years. I only sell if value is extremely high or me thesis BROKE (not the asset price is down). Long term mindset into the right amount of asset and DCA and you'll be just fine

SOUN is the trade of the year

I don't do much trading because I'm not good at it. However SOUN is a great long term company that is growing well. It's down 50% from about 3 months ago I feel anything at $12/share and under is a good price, it's currently at $9... This is a BUY BUY BUY alert! Target sell price is 15-20/share time frame roughly 3-18 months, I understand that is a big gap in time, but for those kind of gains 50-100% well worth the wait. Waiting is the hardest thing you'll have to do here. Worth it!

1-10 of 12

Active 2d ago

Joined Apr 16, 2025