Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Owned by Tiana

Memberships

AI Launchpad

18k members • Free

AI Automation Society

277.6k members • Free

AI Automation (A-Z)

136.9k members • Free

Content Cartel (FREE)

2.4k members • Free

SystemKit

298 members • $149/m

Free SystemKit

1.6k members • Free

Wealthy Women University

206 members • $2,000/month

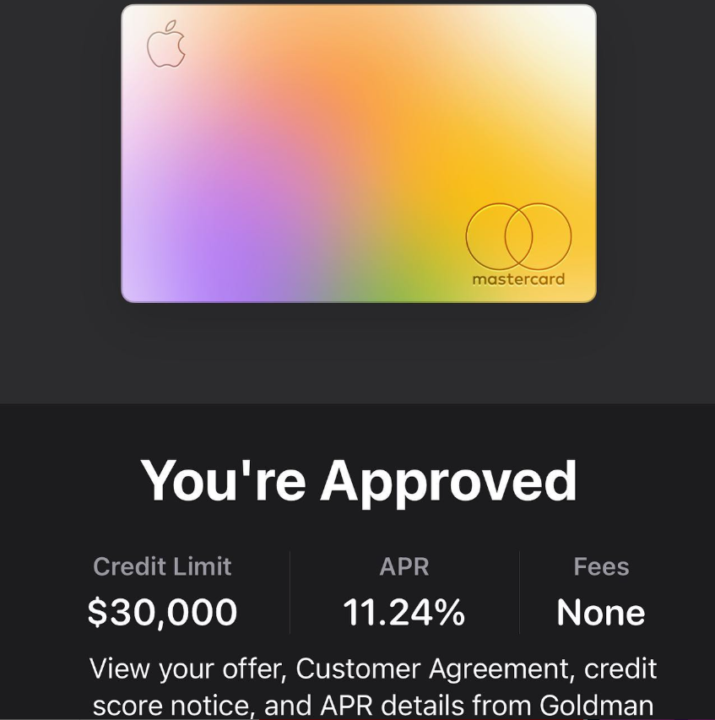

Business Funding Accelerator™

918 members • Free

Money Broker Society

11.4k members • Free

9 contributions to Tailor Made Consulting

🚀 Your $100K Funding Sequence—Broken Down by Bureau

If you’re applying for funding without a plan, you’re leaving approvals on the table. Here’s how to structure your apps by credit bureau to get maximum results: ✅ Start with Experian Apply for Chase and Amex first. These pull from Experian and are known for high-limit business cards. ✅ Then hit TransUnion Next, go for GM Marcus and U.S. Bank. These pull from TransUnion and are easier to get once Experian is tapped. ✅ Finish with Equifax Wrap it up with Key Point and Citizens Bank. Both pull from Equifax and help you complete the sequence without triggering overlapping denials. 💡 Why this works: Each bureau gets hit once, letting you stack approvals without tanking your profile. This is How Our clients are securing $100K+ in funding in a single wave. Need help with the Funding Process $100K fast? Comment “100K” below and I’ll DM you the details to get started. Let’s fund your business the right way.

Business Auto loans w/New LLC

Hi! I was reviewing some of the gems on business lending. I am an OH resident and LLC is only 6 months old...and I'm seeking a couple banks (outside of Navy Fed) that I can pursue a business auto loan with. Most in my area require 2+ years in business...SMH! HELP.....INSIGHT NEEDED.......????? 🤔🤔🤔

0 likes • Feb '25

@Michelle Johnson Hi, yes it is Bank of America. And 🤔 that might be the case. I haven’t ran the play personally yet, but I have a guy I can ask about it. I had my LLC sitting for some years so I should have that criteria’s so not even smthng I can test out. I would say that another option might be getting an aged corp. but that’s if it’s that serious and you don’t mind paying for it. I don’t know about any others from the top of my head, but I’ll look and ask. Lmk if find one. I hear there’s a way to use personal and later transfer it which helps personal by having closed auto loan on it.

Tradelines 101 TRAINING! 📱📱💎

When it comes to CREDIT! .. Tradelines are a Versatile And Power Tool To have Under your tool belt! They can Help you… 1. Boost your Credit Score! 2. Lower the Total credit card Usage On your personal credit! 3. Raise your average age on your Credit Profile! 4. As well as help those who have Children … to Start their Credit Journey on the Right Foot! ✅ Here’s a training Going over EVERYTHING you need to Know About Tradelines! 🔥🔥🔥🙏🏽 https://www.skool.com/ttg/classroom/180e0646?md=389c4bf47e704f8f8926efa8a1ddda3b

Understanding the Difference Between Tradelines and Primary Accounts

Tradelines and primary accounts play very different roles in building your credit profile. Primary accounts are accounts in your name, like credit cards, loans, or utilities. These are critical for building a strong foundation. Aim to have around 10 solid primary accounts to establish a reliable credit history. Tradelines, on the other hand, are accounts you can purchase to temporarily boost your credit score. These are only effective when your credit profile is already structured properly and you’re preparing for funding. Keep in mind, tradelines typically have a 3-month (90-day) impact window, so timing is everything. Focus on building your credit with primary accounts first, and use tradelines strategically when you’re ready for funding.

REMOVE NEGATIVE INFORMATION

How can I remove negative information from my credit file in the next 60 days

1-9 of 9

@tiana-anderson-8894

I ❤️ automations!

I help businesses streamline their processes w/ automation. I provide credit repair, tradelines, biz funding & affiliate options.

Active 6h ago

Joined Jan 6, 2025

Long Beach, CA

Powered by