Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

A Perfect Blend Massage & CE

46 members • Free

The 50+ Club

113 members • Free

2 contributions to A Perfect Blend Massage & CE

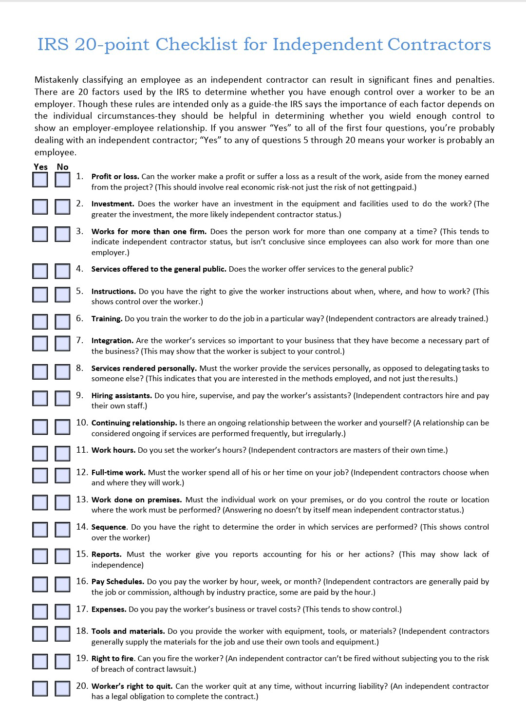

Independent Contractor v. Employee

This is a very hot topic in the spa universe. I have never in my 17 years legitimately been an independent contractor at a spa. I have had independent contractor mobile work but every single spa that I have worked at that has paid me as an independent contractor has been doing so in error. However when you call them out on this, they generally get very upset and mysteriously find a reason to end the working relationship. I have copied and pasted the IRS independent contractor definition as well as posting a picture of the 20 point questionnaire that the IRS uses to determine your status. Pay particularly close attention to #7. For years workers in our industry have been getting taken advantage of. Some spa owners are aware of what they're doing, and some of them are not. The purpose of this is not to persecute anyone. It is simply to bring awareness so that our hard-working hands and heart can be appropriately educated, compensated, and respected. (The following is copied from IRS) "IRS Independent Contractor Are you an Independent contractor (self-employed) or employee? It is critical that business owners correctly determine whether the individuals providing services are employees or independent contractors. Generally, you must withhold and deposit income taxes, Social Security taxes and Medicare taxes from the wages paid to an employee. Additionally, you must also pay the matching employer portion of Social Security and Medicare taxes as well as pay unemployment tax on wages paid to an employee. Generally, you do not have to withhold or pay any taxes on payments to independent contractors. Select the scenario that applies to you: I am an independent contractor or in business for myself. If you are a business owner or contractor who provides services to other businesses, then you are generally considered self-employed. For more information on your tax obligations if you are self-employed (an independent contractor), see our Self-employed individuals tax center.

FSMTA Convention 2026 Altamonte Springs FL

Very excited to announce that I have been selected to present two classes at this year's FSMTA trade show and convention. Join me for High Tolerance, Low Threshold 6ce We will discuss chronic pain and the necessity to come in under the radar to help our clients get back to a normal nervous system baseline. We will discuss opening fascia pain-free techniques slowing down going with breath and tools that can be used to assist in bringing the nervous system into a parasympathetic dominant state. And Get in My Belly an Introduction to Abdominal Massage 6ce In this class we will look at the anatomy of the abdomen, discuss the impact that the abdominal muscles have on the various body systems and get hands-on practice to become comfortable working on this often neglected and delicate area.

1-2 of 2

@schneider-daniel-9407

Defense contractor by day, keeps bad guys up at night Tries to keep the same energy on dates 5’11”if it matters, Swipe right if you can handle NDAs

Active 5d ago

Joined Jan 22, 2026

Indiana