Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Owned by Allyson

Don’t throw away your shot. Real tax clarity from a CPA who gets creators and knows what the IRS actually cares about.

Duct tape won’t fix your books. Get funder-ready systems and real support from the CPA nonprofit execs call “The Oracle."

Memberships

Sexy After Sixty Weight Loss

12 members • Free

ProveWorth.com Community Proof

332 members • Free

Skool Kit 🧰

209 members • Free

💞 Skool Connection Summit ⭐

424 members • Free

🇺🇸 Skool IRL: North Carolina

47 members • Free

Actual Tax Law

10.8k members • Free

Business Builders Club

2.1k members • Free

“Your Best Course” Build Lab

78 members • $12/year

Like A CEO

145 members • Free

47 contributions to The Skool Hub

⏳ Mid-January Check-In on Taxes

We’re already past the halfway mark of January. If you’re thinking, “I’ll deal with this later,” this is your gentle nudge not to. Waiting until spring, or worse, April, is when things get heavy. Why now still matters 🧠 You still remember what happened in 2025 📂 Your accounts are open and easy to review ⏱️ You have time to make adjustments without pressure That window closes fast once deadlines start stacking. What usually goes wrong Most people wait for forms to arrive. By then, you’re reacting instead of deciding. Right now is better for: • quick cleanups • catching gaps early • setting simple routines before things get busy Small effort now saves real stress later. 🌱 What changes when you don’t wait 😌 February feels manageable 🔍 Numbers actually make sense 📅 April isn’t a fire drill It’s the difference between staying ahead and scrambling. What we do inside Skool of Tax ✔ clear guidance ✔ practical steps you can finish ✔ calm support from a CPA who’s done this a lot No urgency talk. No scare tactics. Just help you’d want before things speed up. ⭐ This isn’t about being “early.” It’s about not being late. And January is already moving. 🎯 Skool of Tax Taxes done with you, not to you...

⏰YEAR-END IS HERE. CURTAIN UP ON 2026.🪶🔥 This is the moment that matters. Allysons community❤️

If you earned money online in 2025, your tax story is already being written. The good news? You still have time to clean it up and start 2026 the right way. 🎭Why join Skool of Tax right now? 📋Get 2025 buttoned up before it locks Income sorted. Deductions tracked. No scrambling when tax forms arrive. 📊Fix small issues before they become big ones Wrong setup, messy accounts, missing systems. Easier now than in April. ⚖️Start 2026 clean and confident Correct entity. Clear categories. Simple processes you can actually keep up with. 💰Know your numbers going into January What you earned. What you owe. What you should set aside. No guessing. 🧠Guidance beats last-minute panic Real support, plain language, and step-by-step direction. From a CPA with 40 years of experience helping small businesses to succeed. Not Google rabbit holes. 🎶Hamilton energy. CPA calm. We move fast 🏃 We get it done 🪶 And we do it right 🔥 ✨This is the overlap season. Wrap up 2025 with intention. Step into 2026 prepared, organized, and confident. 🎤The next act starts now. Join Skool of Tax and make sure this year ends strong and the next one starts even stronger. 🪶🔥Not throwing away your shot. Skool of tax https://www.skool.com/ustax/about Taxes done with you, not to you…

24 HOUR PINNED POSTS ARE LIVE AGAIN!!😱🚀

Get your community pinned at the top of The Skool Hub! All you do is go into the classroom section, scroll down to the 24 hour pinned post and purchase! That simple! All instructions are inside once you buy!⭐️ One member gained over 100+ new members from one 24 hour pinned post!😱 Good luck guys! I love you all, LETS GO🔥 When one of us wins, we all win!💪

Did You Say I Need to Do Something by the End of January??

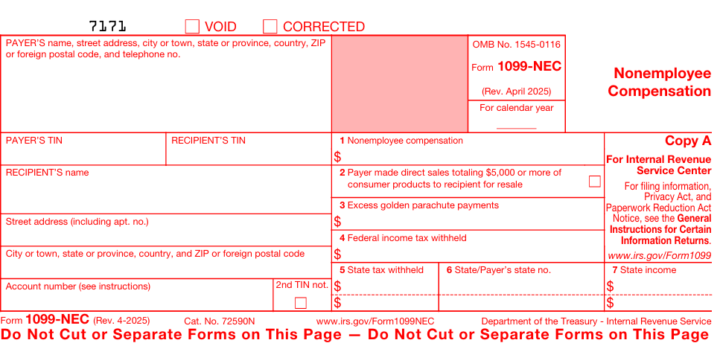

If you are US based, and a business (very likely are if you have been a Skool community owner in 2025) there are a few deadlines that are normally due the last day of January each year but were pushed to 🌟February 2, 2026🌟 this year due to 1/31 being a Saturday. See the attached for details on your reporting requirements to avoid penalties. ✅ Quick recap of attachment: - 1099-NEC: payments over $600 to contractors (those you paid during 2025) - W-2/W-3: employee wages - Deadline this year: February 2, 2026🌟 - Forms must be postmarked, not received - Don’t forget state and local filings For walkthroughs, examples, and tools, head to Skool of Tax

📸 SELFIE SUNDAY 📸

Here we go again! Post your selfies in the comments guys🥳 one selfie will win a 24 hour pinned post at the top of The Skool Hub!🚀🔥

1-10 of 47

@sawtellecpa

Your Journey, Your Choice—Guiding Nonprofit Leaders and For Profit Entrepreneurs to Financial Clarity. Led by an Experienced CPA and Nonprofit Exec.

Active 1m ago

Joined Nov 10, 2025

North Carolina, USA

Powered by