Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

18 contributions to Buy Box Club

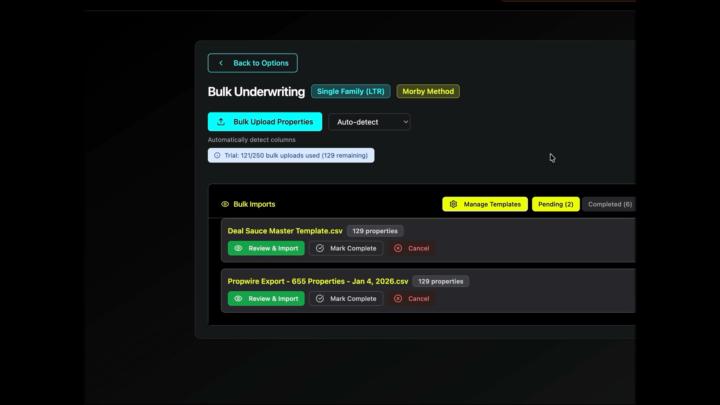

New Bulk Underwriting Experience

Redesigned the bulk underwriting experience, providing more direct user feedback of what data is missing. Remember, if poor is uploaded, expect poor data to be your ouput. For Founders Club, I will be doing a breakdown later this month on each data platform and the quality of data that is provided with pro's and con's of each. For data sources that dont have rental estimates, you can now override this with your own estimates if you would like to ensure they move forward to the next stage of underwriting.

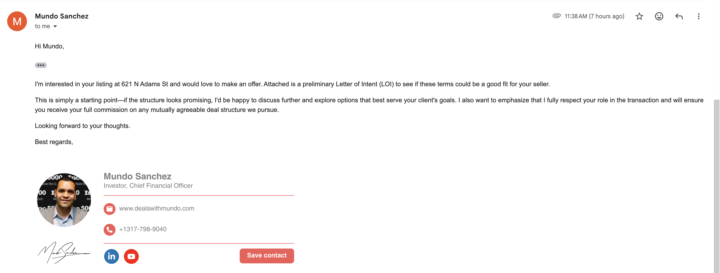

Custom LOI Email & Document Signatures

LOI Template - Now for LOIs being sent out of Buy Box Club, you can customize your signature on the LOI to include either an image that contains your signature or you can hand draw it yourself in the software. Additionally you can toggle whether or not you want your name and phone number displayed and can customize it for each type of Asset Class / Strategy Buy Box. So if you end up wanting to have different signatures for Multi Family vs. Single Family you can do that now Email - Along with customizing the email body content, you can now add your own signature to the email. I am using blinq and it has a blinq capability where you can copy and paste your blinq signature into the template. This is huge because its going make LOIs being sent out to people seem a lot less spammy and appear as if you sent it yourself from your own email manually.

Training Calls to Learn the Software & Underwriting

Check the calendar for weekly support calls to help you out with anything you need. I will keep this calendar updated each week This week: Wednesday 6pm EST Friday 2pm EST

Founders Club Access

Quick update on Founders Club. To keep the group focused and high-quality, Founders Club is intentionally capped at 100 members. Soon Founders Club will be moved to invite-only and I will be removing this from the website today. After Friday, new members will only be added by invitation only and may come at an additional cost of $500 per month. Right now its free, included in your Buy Box Club subscription. Founders Club is a private group inside Buy Box Club built for members who want to grow faster through: - A monthly private Mastermind call - Annual in-person Mastermind Event - Morby Method Underwriting Masterclass ($1,000 value) - Real deal breakdowns and live discussions - Priority visibility and access to resources inside the network - Early access to new features as they’re released - Special Discounts to High Value Services to Help you Grow your Business ⚡ Upcoming Mastermind: Our next Founders Club Mastermind call is January 7th at 6:00 PM EST. On this call, we’ll be joined by my attorney (either on this session or the following month) to walk through legal risks that come from bad underwriting — including where investors and operators commonly expose themselves without realizing it. The goal is simple: to keep the group highly filtered and centered around people actively growing their business. You don't need to be expert-level to be in this group, just have the right mindset focused on growth and development. Nothing about the program itself is changing — this shift is about quality, focus, and long-term value for everyone inside. Until Friday, Founders Club remains open for direct enrollment (again - right now its free included in Buy Box Club membership). After that, access will be invite-only and may come at a cost of $500 per month. If Founders Club feels aligned with where you’re heading, this is the final opportunity to join through open access.

0 likes • Jan 6

Thank you for the update Mundo! My calendar has the Founders Club Mastermind call today at 6 pm ET. Did this change or did I add it to my calendar incorrectly? Unfortunately I cannot attend on the 7th as I will be at the Creative Nations Tour in Detroit. I will be watching the replay. I feel privileged to be learning from you. Thank you for all you do! I am not creating BuyBoxes yet, but I am looking forward to learning more about how the LendingBoxes work.

Buy Box Setup Training at 1pm EST Today

If you need help getting this setup - will be going through step by step and it will be recorded: https://us02web.zoom.us/j/9280318709

1-10 of 18

@sara-larson-8882

Legacy investing — turning small beginnings into multiplicity through creative finance and strategic capital. Funding dreams, one deal at a time.

Active 5h ago

Joined Nov 8, 2025