Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

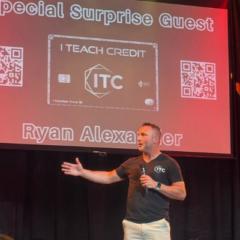

Owned by Ryan

Teaching fastest method to build and manage an 800 Credit Profile with $100K Limits while earning points to travel the world without going into debt.

A friendly mortgage brokerage specializing in educating First Time Home Buyers on the fastest methods to achieve homeownership in PA, NJ, DE, TX, FL.

Memberships

🇺🇸 Skool IRL: New Jersey

104 members • Free

Mikey's Money House

5.9k members • $8/m

AI 7-Figure Coach Collective

4.9k members • Free

Viral Coach

1.2k members • Free

Accelerator

9k members • Free

Skoolers

189.6k members • Free

Synthesizer

37.1k members • Free

Points Travel Buddy

86 members • Free

Credit MasterClass

838 members • Free

30 contributions to Premium Mortgage Corp

How To Lower Your Interest Rate

This is a great article on the 2 most common ways to lower your interest rates on your mortgage: -Better Credit Score -Buying down the rate with Points Buying down the rate can be expensive which is why having a good solid credit score can pay of way more than you realize. Have questions about how to boost your credit score? Put the comments below! https://premiummortgage.myhomehq.biz/single-newsletter/mortgage-points-and-credits-explained

0

0

What Makes The Best Mortgage Lender

If your mortgage company, loan officer or bank tries to pull your credit before asking you about your credit, about your assets or cash saved, about your income and about your expenses, RUN. You want to protect your credit as much as possible, and if your bank or lender do not protect it, you should not work with them. All lenders should ask you about your Credit, Assets, Income and Expenses. This will tell you what you should qualify for and whether or not you should move forward in pulling your credit.

Gov-backed Mortgages: What do we need to know?

Hey everyone, wishing the best of luck on your home buying journey for your family or client. I would love to learn more information on the process of getting approved for a government backed loan such as FHA and USDA loan. Pros/Cons, interest rate range, how does the seller look at this kind of offer, processing length, worth it? etc. Any information would be great!

1 like • Mar '23

Getting approved for Government backed loans is no different, they do however have different guidelines. Conventional you need 620 Credit and 3% down as First Time Home Buyer - 5% if not. FHA you can have a 580 Credit score and put 3.5% down. USDA you need a 640 Credit score and ZERO down, but still have to pay closing costs. The max Debt to income varies per loan as well. Conventional is typically 45% FHA is 50% USDA is only 41% So yes, you can sometimes put less down, but the less skin you have in the game, the tighter the rules in your loan.

Build Credit For Mortgage Approval With A Secured Card

Many people looking to buy a house have absolutely zero credit, and therefore did not qualify. One of the best ways for people to start building credit is by using secure credit cards. Here are three tips you need to know about using secured credit cards to help you build and establish credit to qualify for a mortgage. 1 Make sure you get your money back after the six month period. 2 Do not put more than $500 on the card for your credit limit. 3 Make sure it is a card that gives you some type of cash back or rewards.

2

0

Why Mortgage Payments Go Up

If your mortgage payment goes up over the course of time, more likely than not, it is because of your Taxes and Insurance went up. If your mortgage is fixed, your monthly loan payment won't change. That will stay the same for the life of the loan. Your Taxes and Insurance however are subject to change, and will most likely change every year or every other year as the cost of inflation will always drive taxes and insurance up. If this happens, there isn't much you can do with regards to your taxes, but you can always call your insurance agent and ask them to shop your rate. The best way to do this is to go to an insurance broker and have them shop your insurance rates for you.

1

0

1-10 of 30

@ryan-alexander

I teach people the fastest way to build 800 Credit Profiles with HIGH Credit limits to buy houses, start businesses and travel the world for FREE!

Online now

Joined Feb 23, 2022

Philadelphia

Powered by