Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Owned by Rondre

My goal is to inspire others to move with faith, focus, and integrity in life and in the markets and music. KD-TRADES - Mindset. Structure. Execution.

Memberships

Paid Ad Secrets

18k members • Free

Skoolers

179.5k members • Free

10 contributions to KDTRADES

Cadillac Love – KD-TRADES Studios

“Cadillac Love” rides with the confidence of an all-black Escalade gliding through the night smooth R&B textures blended with grounded rap storytelling. It’s a record about elevation: pushing through the struggle, trusting God through every setback, and turning pain into purpose. Deep 808s, soulful melodies, and luxury-grit lyricism make this track a soundtrack for anyone climbing toward greatness with faith in the tank and destiny in the trunk. A story of resilience. A testament to growth. That’s Cadillac Love. #KDTRADESStudios #KDTrades #CadillacLove #NewMusic #RNB #RapSoul #MotivationalMusic #FaithAndGrind #AllBlackEscalade #StudioVibes #MusicWithPurpose #RiseAndGrind #IndependentArtist #LuxuryVibes

1

0

KD-TRADES CHART ANALYSIS SUMMARY

Title: “We Follow the Banks @ KD-Trades” Framework: Institutional Market Structure + Volume Profile (POC Retests) Market: US30 (Dow Jones Futures) Breakdown • POC (Point of Control): The price level where the highest trading volume occurred it acts as a magnet for institutional orders. • Retest Strategy: • Wait for price to break structure and return to the POC zone. • Enter on confirmation (retest and hold). • Target next liquidity pool or Fibonacci extension level. • Institutional Context: Each “Buy on the Retest of POC” aligns with a break of structure + liquidity sweep, reflecting how banks accumulate positions in phases. • Results on Chart: • 1,197 pts + 1,012 pts + 1,225 pts • 3,434 total points captured this week INSTAGRAM (Reel or Carousel) Hook Options 1. “Smart money doesn’t chase it waits for the retest.” 2. “3,434 points this week. All from one principle: Follow the POC.” 3. “Want to trade like the banks? Here’s how institutional levels work.” Caption POC = Point of Control the volume level where big money positions itself. Each time price returns to this level, we look for confirmation to re-enter with the banks. No guessing. No indicators. Just structure + volume + patience. Steps: Identify POC (highest volume level). Wait for break of structure. Buy/Sell the retest. Target liquidity or Fibonacci extensions. This week alone: 3,434 points captured following this playbook. Learn the full method inside Mastering Market Structure & Price Action by KD-Trades.

2

0

Master the Volume Profile — Trade Like the Institutions Do

Ever wondered how the pros know exactly where the market is likely to reverse or explode? The secret isn’t guesswork it’s Volume Profiling. The KD-Trades Volume Profile Manual breaks down: How to identify smart money accumulation & distribution zones How to read POC (Point of Control) and High/Low Volume Nodes for precision entries How to combine price action + volume data for next-level accuracy Real examples of institutional footprints within market structure This isn’t another indicator cheat sheet it’s a blueprint to see the market like a professional desk trader. Ready to learn how to use the Volume Profile indicator the right way? Drop “VOLUME MANUAL” And I'll send the file and where to get it for $49.

2

0

KD-TRADES Mastering Course Strategy

Mindset-Structure-Execution KD-TRADES Mastering Course Strategy A step-by-step blueprint designed to help traders think, plan, and execute like institutions. Inside, we break down proven market structure and price action methods into simple, repeatable strategies you can apply in real time. This course goes beyond signals it teaches discipline, mindset, and execution, giving you the clarity to spot high-probability setups, manage risk like a pro, and build consistent growth. Mindset. Structure. Execution. That’s the KD-TRADES way.

2

0

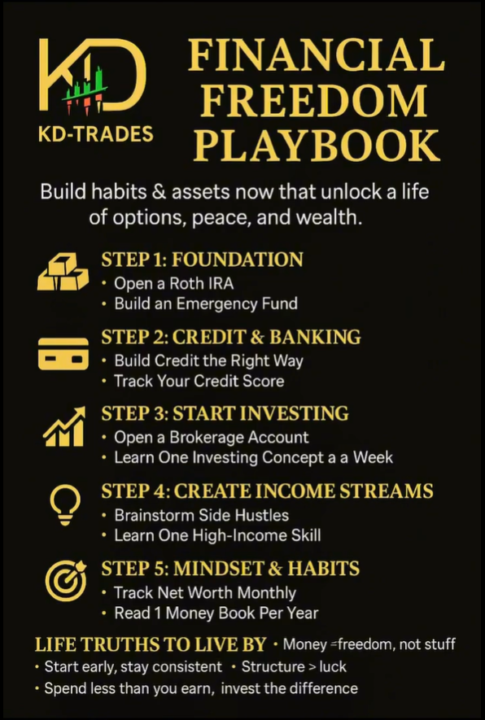

Financial Freedom Playbook

Freedom doesn’t come from chasing trades. It comes from building a system. The KD-TRADES Financial Freedom Playbook is designed to help you: Turn trading profits into long-term wealth Create a structured roadmap beyond the charts Build financial independence with discipline + clarity. This isn’t just about winning trades. It’s about designing a life where money works for you.

2

0

1-10 of 10

@rondre-maberry-maberry-7663

My goal is to inspire others to move with faith, focus, and integrity in life and in the markets and music. KD-TRADES - Mindset. Structure. Execution.

Active 6d ago

Joined Nov 5, 2025

Atlanta Ga

Powered by