Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Options

STOP trading market direction. Start using options strategies to turn volatility into steady income. We sell premium, and think in probabilities.

Memberships

OptionMasters

8 members • Free

Option4All

60 members • Free

Imperium Academy™

49.4k members • Free

Risk Management

9 members • Free

Skoolers

190.8k members • Free

University Of Traders

83 members • Free

PainlessTrader

373 members • $12/year

AI Stock Investing

682 members • Free

HYROS Ads Hall Of Justice

4.7k members • Free

1 contribution to OptionMasters

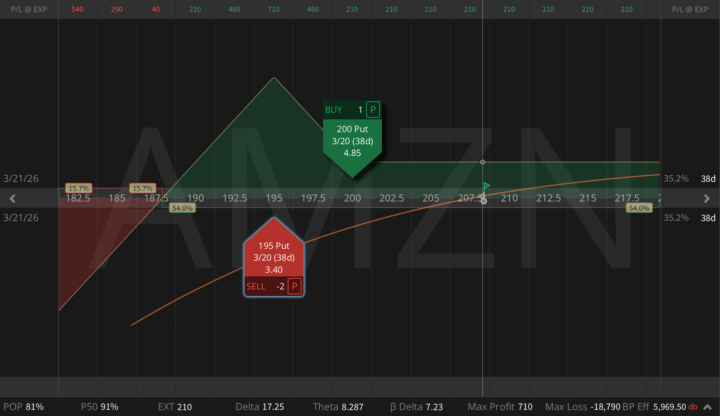

Amazon After Earnings: When Ratio Risk Beats Naked Risk

Hey! I wanted to share my first options trade idea here for your review. Last week we skipped trading AMZN earnings. Options were pricing 7.5%, reality was -14%, so short gamma was not the place to be. In my personal view it was only a repricing of capex and FCF timing, nothing more. AWS re-accelerated, ads keep growing >20%, NA retail margins are improving, but the market suddenly realized buybacks and FCF are pushed out by heavy AI capex. Post-earnings, the setup changed. The shock is out, downside skew is still rich, and fundamental downside convexity is much lower than before the print. That's why ratio risk now beats naked risk, so today I'm expressing this via a March put ratio:

1-1 of 1