Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

What is this?

Less

More

Memberships

Energy Data Scientist

170 members • Free

4 contributions to Energy Data Scientist

Option Contracts for Crude Oil

A new video has been added to the online course 5.20 in the Classroom. This video explains what an option chain is. An option is a contract that gives its owner the right to buy or sell an asset (it is called 'underlying asset') such as WTI crude oil (in this example) at a fixed price (called 'strike price') by a certain date when the option expires. The underlying asset is WTI Crude in this case . WTI stands for West Texas Intermediate. It is the main crude oil benchmark in the United States. When you hear "oil prices" in American news, they're usually referring to WTI. Crude oil is unrefined petroleum extracted from the ground. Its spot price is $78.5/barrel. The spot price changes every second. An option chain is a set of options having the same underlying asset. In this case, the chain has a set of 5 call options has the same underlying asset i.e. WTI Crude. So in this video WTI crude oil is trading at $78.50 per barrel. We have five options with different strike prices: $70, $75, $80, $85, and $90. I explain what these numbers mean and how they form an option chain.

What solver do you use for your optimization models?

If you are developing optimisation models, I'm curious what solvers do you prefer for your mathematical optimization models. Whether you're doing linear programming, mixed-integer, or nonlinear optimization.

New Video: Volatility in Option Pricing for Crude Oil

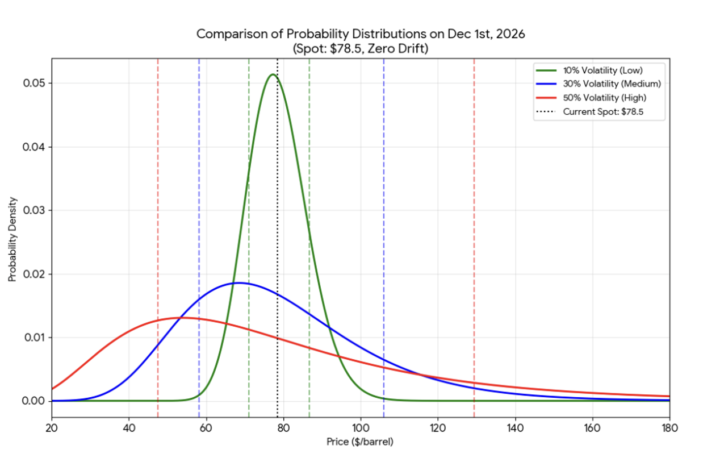

A new video has been uploaded in the Online Course 5.20 in the Classroom. This course focuses on option contracts for crude oil, where the underlying asset is the spot price. An option contract is signed between two parties/ companies . Every option contract applies to an asset . This asset is known as “underlying”. So this course is about option contracts that have the crude oil as their underlying asset. The company that owns the option contract can exercise it until it expires. There is no obligation to exercise it. This is why it is called “option contract”. The company will exercise it only if it makes economic sense ie if it makes a profit. The video focuses on the “volatility” concept of option contracts . The video explains that the spot price of crude oil follows a probability distribution called : lognormal distribution. The attached plot, explained in the video, visualizes this concept. It shows how higher volatility (the red line) creates a much wider range of possible spot price outcomes compared to lower volatility (the green line). So a higher volatility means that in the future , the spot price of crude oil is more uncertain than if the volatility was lower. So volatility is similar to uncertainty . And it is visualized as a probability distribution that is wider. This plot shows the spot price of crude oil one year from today. One year from today this price is uncertain . The spot price of oil follows the log normal distribution . This distribution has a different shape depending on the volatility . Here we look at values for volatility of 10%, 30% and 50%. This is a fundamental plot and analysis for any quantitive finance / energy career . This specific plot has been part of multiple interviews for years . This plot is analyzed in the video using simple language. If you have any questions please contact me. I want this concept to be as clear as possible .

What subscribers get every day

🎯 This community helps you build and maintain expertise at the intersection of economics (energy) and data science. Below is the daily schedule: - Daily: access to all online courses in the Classroom. Available to Premium + VIP subscribers. Also, VIP subscribers get a certificate when they complete a course. - Daily: access to Dr S Giannelos to send your questions (see contact details below). Available to Premium + VIP subscribers. - Daily: access to a real-world energy project. These are tasks for you to solve, designed by Dr S Giannelos based on the online courses you completed. These tasks resemble the requests by clients as part of real - world energy projects. Ideal for consultants. Available to VIP subscribers. - Monday, Wednesday, Friday: A new Energy Industry Report is published. Each focuses on recent trends and economics for energy. Find them in Classroom section 6.2. Available to Premium + VIP subscribers. - Tuesday, Thursday: An Energy Research Report is published. Each report offers a high-level explanation of energy research papers, in beginner-friendly language. Find them in Classroom sections 6.1 and 6.4. Available to Premium and VIP subscribers. Also, VIP subscribers get research reports for entire energy books. - Friday: At least 1 new Job Opportunity is published. Find it in Classroom section 6.3. Available to Premium and VIP subscribers. Also, VIP subscribers can request Dr S Giannelos to send their CV to 1 of his contacts on LinkedIn every month. 👨🏫 About Dr S Giannelos: - PhD in Energy from Imperial College London - Research: 40+ publications, with over 1000 citations. View my profile here - Education: Top-rated educator on Udemy. View my profile here - Writing: Author on Substack. View my profile here Contact info: - Skool: Send me a personal message or reply to my posts. - Email: spyros.giannelos@gmail.com - Personal website: https://www.energydatascientist.com - LinkedIn

1-4 of 4

@nick-anf-6683

Director/ Finance - Energy. Former JP Morgan. MSc in Quantitative Finance.

Active 6d ago

Joined Dec 1, 2025

INTJ

Austria