Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Memberships

Elite Signals

788 members • Free

Trade Algorithm Elite

266 members • $2,997/y

33 contributions to Trade Algorithm Elite

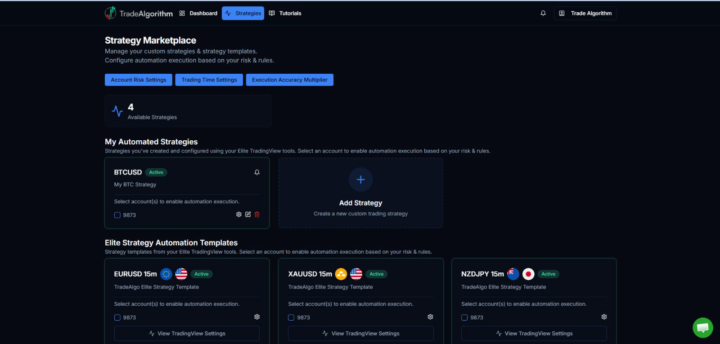

🚨 Big Platform update

We’re just days away from launching the new Elite platform that we’ve been developing intensively over the past several months. Here’s what it gives you: ⚡ Automate your own setups – connect your Elite tool configurations to our platform and have them run based on your rules, your risk settings, your decisions. 📊 View strategy settings – full visibility into current strategy templates, so you can understand, optimize, and develop your own approach over time and share with the community. 🎓 Education built in – a clean interface with video guides throughout, covering how everything works and how to configure it for yourself. This is the foundation we’ll be building on going forward – more broker connections, more automation options, more tools for you to configure as the platform grows. First launch: MT4 & MT5 automation 🔌 We know many of you have been waiting a long time for this release, and we truly appreciate the patience from the community while we’ve been building it properly behind the scenes. Our goal was to make sure the foundation is solid and worth the wait – and we’re excited to finally start rolling it out. We’ll be selecting a small group of members to get integrated first before we open it wider. If you want to be among the first, drop a comment below and we’ll reach out with the details very soon.

TradersConnect Update

Hi all, I hope you’re having a great week. As many of you have seen, TradersConnect is halting operations with MetaTrader starting today. This came out of the blue and, based on our estimates, will affect around 50% of you. As frustrating as this is, especially after looking forward to a clean stretch of trading, it’s not a major issue for us. We already have integration with Duplikium (the same platform we use for Futures), and it works for both MT4 and MT5. I’ll provide a revised version of the setup guide shortly. The process is exactly the same as the Futures setup—just choose MetaTrader instead of Tradovate when prompted. You can find the Futures setup guide right next to the standard CFD setup guide, inside the Automation course page inside the classroom. Summary: You can follow the Futures setup guide (found on the Automation Course page), just select MetaTrader instead of Tradovate. If you have any questions about this, feel free to comment below or message us directly via your private chat. Best regards, Euan P.S. I’m aware a few of you still have pending messages or requests, please bear with us. Our top priority is getting everyone fully back up and running.

New Updates & Strategies - LIVE

Hi everyone, The updated automation systems are now live inside the course. You’ll see two new pages: one for Commodities and one for Forex. This video covers exactly what to do with the new information and what the updates are. HERE: https://www.loom.com/share/92f1ed17396b4c53983dc1bef4041f0c?sid=be964a3d-ce8d-4206-bdb6-6fe6b4e189b2 Each system has: - Login & password info - Symbol mappings - Risk settings - Full performance breakdowns for the last few months - Details on each strategy and the updates we’ve made The setup process is exactly the same as before — just use the new credentials. If you’re on Duplikium, remember you might need to map the symbols manually (GC/MGC etc). If you're on a prop firm or just starting out, I recommend running at 50–75% risk for the first week. Any questions, just drop them below or message me directly on WhatsApp. – Euan P.S. The Automation backtester will have some lag time with updates. Please allow a further 1 week - 10 days for the backtester to show.

[UPDATE] Yesterday’s Trades, and new Strategies!

Hey everyone, Let’s address the obvious upfront: Yesterday, we took 3 almost-full losses, resulting in a net-2.8 % drawdown. For many of our long-term clients, this isn’t too unfamiliar territory. But for newer members, here’s some context that may help... What happened: The system performed exactly as it was designed to, all three trades fell within our maximum allowed risk for a single day. A day like this is statistically rare, but it’s always been accounted for in our planning. While a -2.8% drawdown isn’t large by industry standards, for our system, which is highly refined and typically avoids heavy days, this was an outlier. Our perspective: We feel this with you. As a team, we have significant capital live, both personal and prop-funded, so every loss affects us too. The key difference is: we’ve traded this system for over 6 years, and many of our earliest clients have been here through similar periods. That context makes it easier to zoom out and stay grounded. We’re not just a tech provider, we're a team, and a community. And we’re in this together. What we’re doing: Let’s be clear, we’re never okay with a day like yesterday. But reactive changes based on emotion or hindsight are not the answer. We’re constantly testing new filters, rules, and upgrades, but we never roll anything out without hard data showing real performance improvement. Most tweaks that feel right in the moment actually reduce edge long-term. That said, we’re currently testing several promising updates: • Volatility-based (ATR) stop losses across all strategies - some are already • Minimum market volume thresholds • Directional alignment with broader market trend • Minimum time between trades • Session-based filtering All of these look great in theory, but unless they actually improve performance over hundreds of trades, they won’t be implemented. You can rest easy knowing we will never overfit the strategy to avoid one bad day at the cost of long-term consistency.

![[UPDATE] Yesterday’s Trades, and new Strategies!](https://assets.skool.com/f/8ae76f406cd243ed90e88210f42d259c/ece1b1cf057b4e3c9b694f9e723d85abbb8de21ea22d4992b43d093567c0875f-md.png)

7 likes • May '25

Profit always gets wasted without a trailing stop, asked many times. Just sit and watch those Gold trades. Once price breaches the entry price after being in profit, it always hits stop loss. We need to reduce these unnecessary losses with a trailing stop. Can we have transparency by the team starting a long term live account which we can follow to check alignment with our trades.

5 likes • May '25

@George McCullough Agreed. More trades happen during consolidation than pure up or downtrends. It gets caught on the wrong side and then revenge trades. After 2 losses in one day, no further trades should happen. Preservation of capital is key. I must say that it is stressful as I am now constantly checking the trades counter to what was said. We were advised to check weekly at best.

Results Template

Hi everyone, I've just knocked this up in preparation for testing the Automation strategies but you can use it for the manual strats too. Just fill in the blanks and add more rows as necessary! There isn't a "Totals" row because I intended it for info gathering. Once you've got the numbers you can choose which strategies to combine as a portfolio. Then you add a Totals row (as per Euan's Prop Firm Guide session) Hope it's useful for someone?! 😎

1-10 of 33

Active 1d ago

Joined Dec 19, 2024

Powered by