Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

Patience Pays Portfolio

5 members • Free

1 contribution to Patience Pays Portfolio

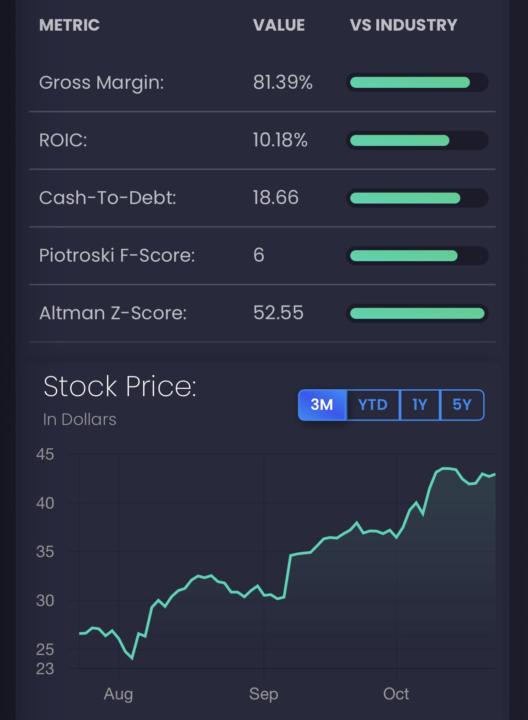

Let’s take a look and explain some of these metrics for Palantir $PLTR

Looking at the data in the image, here’s a quick breakdown of the key metrics: 1. Gross Margin: 81.39% This is extremely healthy, showing the company has a strong ability to convert revenue into actual profit. Well above industry standards, it indicates good pricing power and cost management. 2. ROIC (Return on Invested Capital): 10.18% This is solid but not extraordinary. A ROIC above 10% is generally considered good, meaning the company is efficiently generating profit from its capital. Compared to the industry, it’s competitive but not top-tier. 3. Cash-to-Debt Ratio: 18.66 A very high ratio, showing the company has ample cash on hand to cover its debt obligations. This is a positive sign of financial stability and reduces risk from leverage. 4. Piotroski F-Score: 6 The Piotroski F-Score ranges from 0 to 9, with 9 being the best score. A score of 6 indicates a fairly healthy financial situation, suggesting positive business fundamentals, though there may still be some room for improvement. 5. Altman Z-Score: 52.55 This is an exceptionally high Z-Score, indicating the company is far from bankruptcy risk. Anything above 3 is generally considered safe, and this score is well beyond that threshold. Stock Price Trend The stock price has seen a steady climb over the last three months, rising from around $25 to nearly $45. This reflects strong investor confidence and potentially good recent performance or market positioning. Overall, the company looks to be in a very solid financial position with good profitability, excellent cash management, and a low risk of financial distress. The stock’s recent price trend suggests positive momentum in the market. The more interesting question now is, can the momentum continue?! Imho, long term - no doubt about it. Short term is going to be hard to continue on with a 250 PE. We will see

1-1 of 1