Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

Disrupter Academy

1.4k members • Free

The eCom CRO Incubator

698 members • Free

Global Business Growth Club

1.9k members • Free

Data Driven Ads (By Cometly)

649 members • Free

5 contributions to Global Business Growth Club

5472 PART IV?

Quick question: For a single-member foreign-owned LLC filing Form 5472, where should money draws to the owner be reported? I see some using Part IV, while others use Part V/VI with an attached statement. Are both approaches acceptable?

Sales Tax and 3PL

Does using a 3PL constitute physical nexus in a state (e.g. Texas), or can it be considered a remote seller? I want to understand if you have to register for a sales tax permit, even if you are under the economic threshold, but you are considered physical nexus because you have inventory?

0 likes • Mar 5

Thanks What do you think, is it worth registering even if the sales volume is low? Let's say $10,000 in the state? Or wait until we have more volume because they won't cause problems for such small amounts? I think this is of interest to many other people who want to choose where to keep inventory. From what I understand, almost all states consider having inventory, even with an independent 3PL, as a physical nexus. There are states that do not have sales tax like Oregon or Montana, but the location for logistics is not optimal.

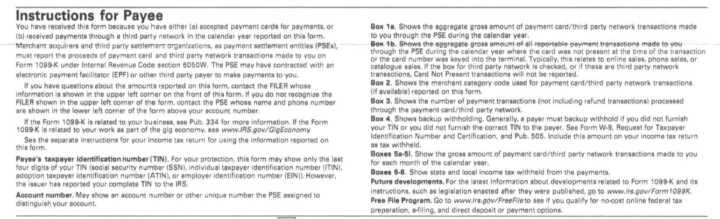

1099-K - Do I care about it?

Apparently I got a physical mail to my company's PO Box from Worldpay, with a 1099K, elaborating the credit card charges I've billed customers with This is the first time I get this. Do I care about it? I mean I have 1065 to file (Multi Member LLC), and I will declare my income there, is it any different than any other income source? This is the "Instructions for Payee" on the letter (screenshot below) Thank you

Shopify Payments, 1099k, W9 W8

I managed to activate Shopify Payments with the simple EIN, as a foreign owner single member LLC. However, after a year they told me that they have to create the 1099K file and asked me to fill out the W9 form. What do you recommend? 1) Try to push to provide the W8BEN form (I do not want to declare with the W9 that I am a US person), and ask them not to send 1099K to the IRS? However, in this case they will probably close the Shopify Payments account that has good fees compare to other processors. 2) Do not worry about the 1099K, simply fill out the 5472 as usual, and fill out the w9, w8? However, is there any need for some precautions for the 5472 form in this case? Should a note be added that specifies not to consider the 1099k? In essence, is it better to avoid if possible that payment processors send 1099k to the IRS? Thanks

intro

Thanks to James for the extremely valuable content he publishes and for this community. I am into ecommerce and I am here to share information to improve our businesses.

1-5 of 5