Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

InvestCEO with Kyle Henris

41.4k members • Free

InvestCEO Boardroom

903 members • $2,500/y

1051 contributions to InvestCEO with Kyle Henris

Trying to practice

Good morning! Still super new, watched all the steps to #5, trying to practice paper trading, but I work and have to use my phone, and my TradingView on my phone doesn’t seem to be in sync with my computer, I even logged out and back in, but time is still off? Any ideas?

GC Declines

Is anyone else unable to trade GC or MGC? My orders have been getting declined for the last few days but im trading everything else no problem.

0 likes • 3d

Here's a search summary.. Yes, there appear to be significant issues with trading Gold (GC) and Micro Gold (MGC) futures, with reports indicating that some brokers have halted trading on these instruments. [1, 2, 3, 4] Based on information from early-to-mid February 2026, here is why your orders are likely being declined: - Trading Halts/Restrictions: Some platforms, such as Apex Trader Funding, reported a halt on GC and MGC across platforms like Rithmic and Tradovate. This restriction affected both simulated and performance accounts, preventing new trades. - Extreme Volatility and Liquidity Problems: The gold market has experienced "very violent price action," with a significant drop in open interest, signaling that liquidity has become an issue. - Major Price Correction: Following a period of record highs, gold underwent a sharp correction, with prices dropping significantly from their peaks. This extreme volatility often causes brokers to tighten risk controls, resulting in rejected orders. - Contract Expiration/Rollover: The February 2026 (GCG26) contracts are nearing their end, with last trade dates set for late February. Liquidity often shifts during these periods, which can cause execution issues for traders using older contracts. [1, 2, 5, 6, 7, 8]

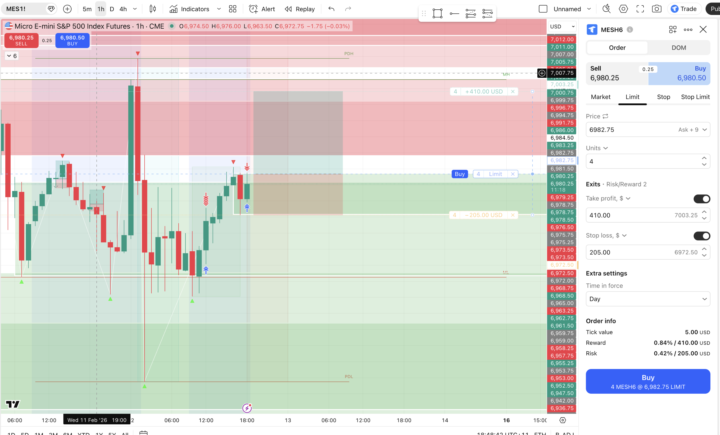

Is it supposed to say "sell limit" on a long limit order?

I did one yesterday on tradovate linked to tradingview and won a trade but i dont think money went through cos it said "sell limit" rather than "take profit"... in papertrading it says "take profit" when i use a limit order but when i use tradovate it is saying "sell limit". Will it still work as a sell limit? Image ONE is what it looks like when i pressed "create limit order" (which is what it looks like when i papertrade after i press buy) Image TWO is what it looks like after i pressed the buy button on tradovate, it turns take profit into sell limit Image THREE are my settings are my settings correct for this to work properly on Tradovate?

Daily Chart

Is it the trend of the daily chart i should be using for market trend, OR what ever the market is doing on any given day?

0 likes • 3d

Great question — and this is where most traders get confused. Let’s simplify it using the Superman model logic 👇 🔵 Short Answer: You use the daily chart (or higher timeframe) to determine the overall market direction…But you execute based on what the market is doing today on the lower timeframe. It’s not either/or. It’s both — in order. 🧠 How This Fits Into the Model Remember the 3 parts of your edge: 1️⃣ Long-Term Plan Area → Higher timeframe (daily / 4H)2️⃣ Short-Term Market Shift → Lower timeframe (15m / 5m)3️⃣ High Profit Factor → Controlled entries & exits 🔹 Step 1: Use the Daily Chart for Bias (Direction) The daily chart answers: - Are we in a bullish environment? - Are we in a bearish environment? - Are we near a major level? This gives you your probability bias. If the daily is clearly bullish and sitting in a long-term demand zone, your job is not to short aggressively that day. That would sabotage your edge. That’s your “where to look” component. 🔹 Step 2: Use Intraday Action for Timing Now zoom into the 15m or 5m chart. That’s where you answer: - Is there a short-term market shift? - Is there structure confirming my direction? - Is there momentum in my favor? This is your “when to enter” component. 🔥 Example Let’s say: - Daily chart is bullish - Price pulls into a daily demand area - On the 5m chart, you see a bullish market shift That’s alignment. If instead: - Daily is bullish - But intraday structure is breaking down aggressively You wait. Patience is part of the art of trading. 🚨 What You Don’t Want To Do ❌ Ignore the daily and just trade random intraday moves❌ Only look at daily and blindly enter without confirmation❌ Flip bias every 20 minutes That’s how traders lose consistency. 🎯 The Professional Way to Think About It Higher timeframe = Context Lower timeframe = Execution Daily tells you what side the big money is likely on. Intraday tells you when they’re stepping back in. That’s how you build edge. https://www.skool.com/investceo-with-kyle-henris-4723/classroom/1a746cdf?md=102e07fa8d42499e8e0a4aa46d86b2f1

Trying to map supply and demand

Ok, not sure if I did this right? Just finished step 3. Kyle said to put screenshot of map in group to get feedback. Maybe someone could tell me what I did right or wrong. Trying to learn , so all you will do is help, wether good or bad! TYIA

1-10 of 1,051

@mark-clarno-1860

Make time for mindset everyday!!!

.

Save $15 on a new user Tradingview account!

https://www.tradingview.com/black-friday/?share_your_love=markclarno

Active 15h ago

Joined Apr 1, 2024

California

Powered by