Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Buy Box Club

92 members • Free

Flip Flop Flipper Real-Estate

4k members • Free

Money Broker Society

10.7k members • Free

Elite Capital Raiser (Free)

1.3k members • Free

7 contributions to Buy Box Club

Agent Contact Info?

where is the highest match of realtor contact information (specifically emails) you are seeing from lead softwares? Not quite sure what happened with Deal Sauce on their "MLS crackdown" requirement but their fix is definitely not working and all the agent info is blank now except for their name which isnt very helpful. What else is getting good results?

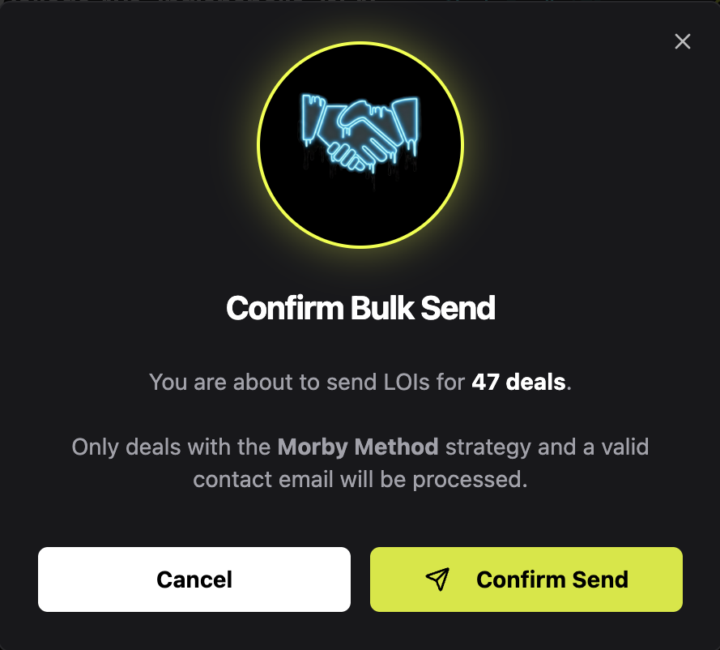

Send LOIs out at Scale

Phase II of III is partially built out now. For Match Pro users you have the ability to not only send LOIs but send them at bulk. Right now you can do this. There is a cost I incur to sending out emails so this is not a free feature. The last part of this phase (ETA early next week) user will have the ability to Upload spreadsheet of deals, have the system automatically underwrite them and then automatically send LOIs for every deal that passed your underwriting standards. Right now this feature is only available for Single Family Morby Methods. Will be integrating more strategies and asset classes with this feature over the next few weeks. By now Single Family Morby Methods is highly tested and highly reliable on the results. Still working through other asset classes / strategies.

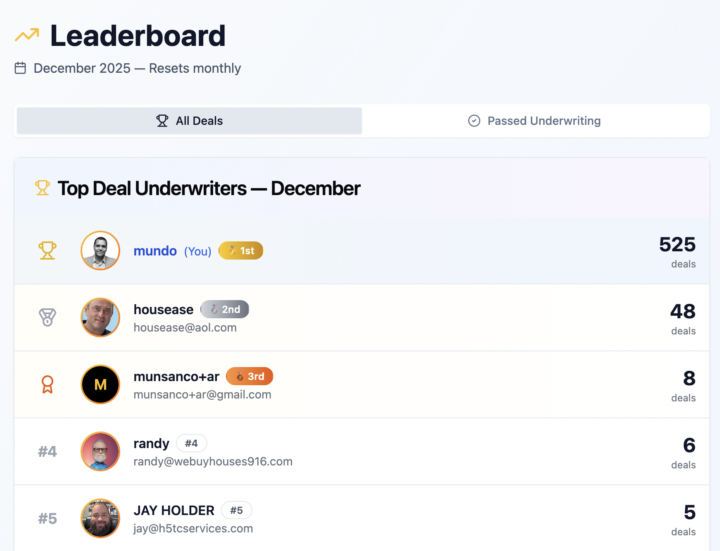

Leaderboard Competitions

This is going to be fun! More to come on this later, but we now have a Leaderboard both Total Deals Underwritten and Good Deals Underwritten. Prizes will be coming soon for Top 3 each month. Well, i guess Top 2, cause looks like people are going to have a hard time beating me 😂

False Alarm

I thought what i saw earlier on the call this morning was a bug. Turns out im just an idiot and it is working. I just didnt put in a City or State when I was entering in the deal. You wont be able to find matches for a deal without that because thats part of how it matches deal with buyers. As always please let me know if you see any issues that need to be fixed

1-7 of 7

@kimberly-koste-4901

I love to meet people and solve problems! Let's collaborate.

Active 22d ago

Joined Dec 8, 2025