Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

What is this?

Less

More

Memberships

InvestCEO with Kyle Henris

38.2k members • Free

Peakvest Society

12.3k members • Free

12 contributions to InvestCEO with Kyle Henris

Times for Paper Trading

So I’ve never heard any trader elaborate on this and it may seem like a silly question but someone asked me. So, is the best time to paper trade the same as the times when the live market is open? My answer was yes. Just made sense to me. Anyone have a different POV?

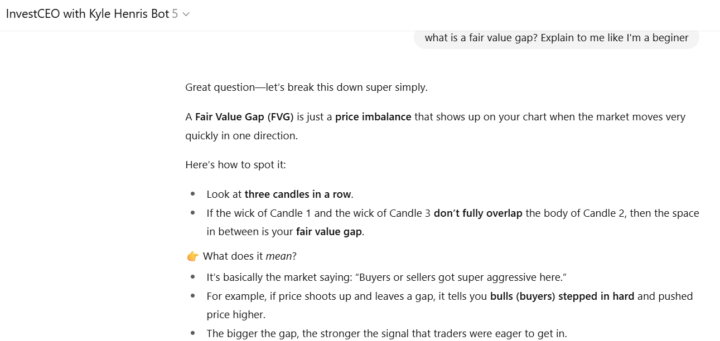

AI craziness...Day 2 🤯

For those that stuck around for Q&A tonight...crazy how my InvestCEO AI bot described this concept in basically the same way I did when the same question was asked to me...

Day 1 is in the books! 📗

💡What was your biggest light bulb moment from tonight?

Happy birthday Coach 🎉

Please wish a very happy birthday to our very own @Matt Wedan!! Appreciate ya coach 💪

InvestCEO Custom AI

💎 Here’s another gem straight from the InvestCEO AI. Reminder this is free for you to use right now! …. “Great question — passing a prop firm challenge is one of the fastest ways to access large trading capital without risking a big chunk of your own savings. Kyle covers this in detail, and the best approach is to treat it like a business, not a gamble. Here’s the step-by-step strategy: ⸻ 🔑 1. Complete practice before attempting a challenge • Don’t jump straight into a challenge. Go through the practice phase first (paper trading or demo) so you already know your numbers. • Only attempt a challenge once you’re consistently profitable in practice ⸻ 🔑 2. Choose the right account size for your goals Kyle recommends starting with just one account (not multiple accounts or trade copiers) until you’ve proven consistency. • $50k account → $1–2k/mo target • $100k account → $2–4k/mo • $150k account → $3–6k/mo • $250k account → $5–10k/mo 👉 The bigger the account, the less aggressive you need to be. A small account forces you to take oversized risks. ⸻ 🔑 3. Treat it like you’re managing someone else’s money Kyle says: think like a fund manager. Your primary goal is to protect capital, not rush to hit profit targets. • Be conservative. • Respect drawdown rules. • Take fewer, higher-quality trades. • Follow your stop-loss plan strictly. This mindset drastically increases your odds of passing. ⸻ 🔑 4. Use Kyle’s Superman Trading Model for edge This 3-step framework gives you repeatable probabilities: 1. Long-term plan area → identify direction (long vs short). 2. Short-term shift → time your entry. 3. High profit factor → risk 1 to make 2+. When you stick to this, you can win even with less than 50% accuracy, because your winners are bigger than your losers. ⸻ 🔑 5. Leverage automation (when ready) Kyle has automated day trading software that can help you pass challenges by removing emotions and scaling multiple accounts. Many traders fail challenges because of impatience or revenge trading, not because the strategy is bad. Automation solves that.

1-10 of 12

@kamika-beshay-7967

Hi I’m Kamika. I am new to trading and I look forward to learning here and chatting with some of you here as well. Let’s get these bags.

Active 2d ago

Joined Jul 8, 2025

Los Angeles

Powered by