Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Owned by Guillermo

Level up your writing career by mastering the essential skills of a T-shaped writer in a supportive community.

Memberships

Unboring Ads & Funnels

974 members • Free

Skoolers

181.9k members • Free

Momentum Society

1.6k members • Free

INNER SANCTUM

108 members • Free

Copy Blocks Academy

203 members • Free

Predictable Profits Mastermind

820 members • Free

PCM Mastermind

92 members • Free

PCM Bootcamp

127 members • Free

Agency Owners

18k members • Free

9 contributions to TGE

Ask Ruben Anything (Submit Questions Here)

Hey friends, going to post the question submission for Monday recorded video, a bit early. Go ahead and ask away.

Ask Ruben Anything (Submit Questions Here)

Hey friends, go ahead and ask me your trading questions: It can be about anything trading related.

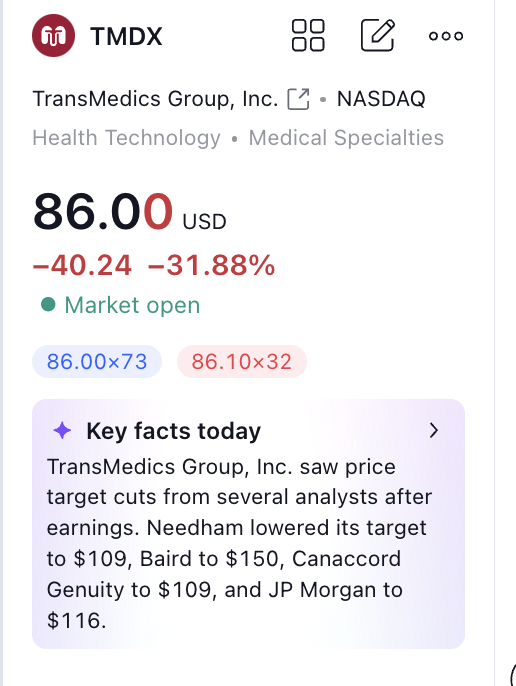

A Real-World Earnings Lesson: TMDX

I want to share a real-world example from a recent trade of mine that might help you navigate similar scenarios in your trading journey. I went into this earnings season with some long positions on TMDX, expecting it to hit its historical pattern of meeting or exceeding EPS. The forward guidance remained strong, but here’s where the market can throw curveballs: despite stable guidance, the company missed revenue and EPS targets — hitting 0.12 EPS when 0.28 was expected. As a result, the stock price took a sharp 30% dive, and my position lost significant value. Naturally, it felt unexpected. But a closer look at historical performance showed it actually made sense; the stock’s price pulled back to a level previously seen when it last reported similarly low EPS, essentially rebalancing itself. Key Takeaways 1. Historical Context Matters: It’s essential to understand how past earnings can set benchmarks for stock behavior. TMDX dropped to align with its previous low EPS cycle, proving that the market often “remembers” certain thresholds. 2. EPS and PE Ratios Are Key Signals: Earnings per share and PE ratios can reveal more than initial guidance suggests. Learning to read these metrics helps clarify when a price movement may or may not be justified. 3. Not Every Drop is a Buy Opportunity: Just because the stock dropped doesn’t mean it’s time to jump back in. Sometimes, it’s best to let the dust settle and observe if earnings improve next quarter before re-entering. Action Steps - Research Historical Performance: Before committing to a position around earnings, take time to examine how the stock responded to past reports with similar earnings misses. - Avoid Knee-Jerk Reactions: When a position takes a loss, review the fundamentals before deciding on your next move. Sometimes the market pullback is actually a healthy reset. - Plan Ahead: Consider re-evaluating your position closer to the next earnings report. If EPS returns to a reasonable level, it may indicate recovery potential.

2 likes • Oct '24

thank you for sharing. Very refreshing to see someone post about trades that don't pan out and giving the lesson from it (unlike the gurus I see who only post win after win, trying to make it look like they have a 100% win rate). Super valuable too, since now I can hopefully avoid this kind of mistake by taking the same action steps!

You can only pick 2 indicators

Friends, out of all the ones you use… Pick 2. Post them in the comments Tell us why too!

1-9 of 9

@guillermo-rubio

Work: Copywriting

Fun: Music production & Songwriting

Active 4h ago

Joined Oct 17, 2024

Powered by