Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

Serving Humanity Community

2.1k members • Free

The Subconscious Estate ™️

79 members • $125/m

Get Funding Ready In 30 Days💰

6.7k members • Free

Kingdom Ecom 🆓

3.3k members • Free

829 contributions to The Subconscious Estate ™️

😎🔋talk to me nicely 😎🔋

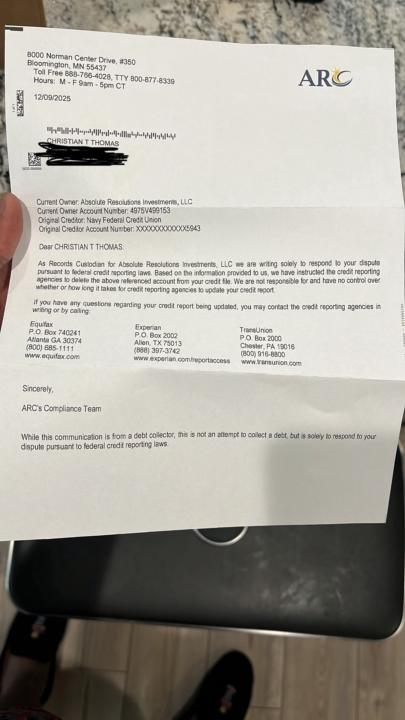

Them letters here in the group work just believe send and wait!

🔥🔥🔥🔥Be Sure To Know Difference Between General And Special Appearance 🔥🔥🔥🔥🔥

Be careful videos like this can give masses wrong idea like this stuff is easy it is not ! Especially if you in wrong capacity . Special appearance What that procedure is called When you use the IRS’s own records, procedures, or testimony to challenge the charge in court, you are challenging the validity of the assessment through judicial review of an IRS determination. Depending on posture, it is commonly described as: • Assessment challenge (attacking whether the tax was lawfully assessed) • Challenge to presumption of correctness (forcing IRS to lay a factual foundation) • Evidentiary challenge to the assessment (using IRS records/witnesses against the claim) If done before payment → it is part of a deficiency proceeding. If done after assessment/collection → it occurs in a Collection Due Process (CDP) case or refund suit. What you are doing in plain terms You are turning the IRS into the proof witness: • Demanding the administrative record • Forcing production of assessment certificates (e.g., Form 23C/official transcripts) • Testing whether the IRS followed statutory procedure • Attacking the presumption of correctness when records are incomplete or defective If the IRS cannot establish a proper assessment, the charge collapses. Where this happens (courts) • United States Tax Court – deficiency cases (pre-payment) • United States District Court – refund suits (post-payment) • United States Court of Federal Claims – refund suits (post-payment) Where the rules are found 1. Procedure (how you force the issue) Tax Court Rules of Practice and Procedure • Rule 70–74 – Discovery (documents, interrogatories, depositions) • Rule 91 – Stipulations (what IRS must admit or deny) • Rule 142 – Burden of proof • Rule 143 – Evidence 2. Substantive authority (what IRS must prove) Internal Revenue Code (Title 26) • § 6201–6203 – Assessment authority & method • § 6212–6213 – Deficiency & right to petition • § 6330 – CDP hearings (if lien/levy stage)

Just my thought correct me if I am wrong....

Ok, so my gut, my head, and my thought process are saying all the same thing in this moment... It seems to me that everyone, including myself, is attempting to evaporate all their past debts, and something keeps eating at me about this. Every time I hear of ways to do this or that concerning past debt, I get thoughts—thoughts of what it would be like if only I could get rid of ALL my bills/debts. Don't get me wrong... I am not saying that there isn't a way, especially when there are those who have said they have done it. However, the more I dig, the more I find that some of the ways people have said they have done and worked on did work, but not for the reasons that they think, and because it seemingly worked, they did not explore why it worked. Their only concern was/is to get rid of past debts, so in actuality they don't care if it was/is right as long as their debt is gone, without realizing the reason why, so when they attempt to do it again, it does not work, so they have to move on to the next thing. I am NOT interested in that; it is a distraction and is keeping me/you from moving in a forward direction. Why do I say that? Hear me out, knowledge is power. If we understood our legal identity and our finances and focused on inner-standing and structure, we would be less likely to be trapped in obligations we get into when we sign on that fatal line. They use scare tactics that if we don't, we won't get what we want. So what do we do? We sign. We need to speak up (express that... we do not have to agree). You have a say. They want something, and you want something; you can come to a meeting of the mind. We did not know this before; now we do. There are things we can do concerning past debt or bills, and that is by speaking up and challenging them, of course, structured properly. The administrative process. That is it!!! This is not going to be overnight; it takes time, ledgering everything, patience, and sending your notices on time. Given the fact that we have to operate always with clean hands and if my old bills/debt magically disappeared, then yes, I could fund my trust faster. I could live a better life altogether.

9

0

ALL 🔥🚫 SMOKE

Yooooooooo, you ready B? @Minister Beryl Princess King . You drive, Sis. I'm gone slang 'dat iron out the back window while we roll down this road. To quote one of my favorite artisans - Bootsy Collins - "You inspire me to poetry." 🫡 Seriously, though, I see you gettin' it in and slide'n through with the help and resources to er'body. Your assistance and journey doesn't go unnoticed. I'm on your heels - in a good way. Have a great day family. As always, I pray you and all that you love enjoy heaven, here on earth. Light&Love... Small. But, know we step'n, Sensei 🤓 @Norwood Williams 🫡 #receipt #ministry

Name Change/Correction Update

I called the court to verify that my fingerprints had arrived and matched up to my file, and they had... Yay! Next, I had to wait for an email, which came five minutes later. Yay!. I responded to the email, which had the e-file of the case and the phone number to call and schedule the hearing. Yay! I called three times; the third was the charm, so I thought, and I got the administrator to the magistrate, where I was informed that I have to wait ten days (the objectionary period) even though I am not objecting to using the magistrate instead of the judge, which will take longer. Tomorrow is the first of the ten-day objectionary time frame which ends on December 29th; the courts are closed until January 5th, 2026, and scheduling is already in March of 2026.😥😢😭I had a moment. What can I do but wait... I'm good; I have plenty to do before then.💯I am on the way! Yay!! On another note, the administrator was really nice; she was clear in her explanation of how things work and how busy they are. She shared that they have a cancellation list, and she added me to it. I had given her the best days for me, and I expressed to her that if she got a cancellation, I would take it and make it work. We even shared a few laughs; prayerfully, she remembers me and things move a lot faster. I emailed her the overview of our call, making sure she had my email.

1-10 of 829

@beryl-king-3975

I am Reclaiming my Estate because I am, I am, I am the BENEFICIARY!!! Mic drop🎤

Active 1h ago

Joined May 12, 2025

Powered by