Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Memberships

AdvisorTechBook LIVE 🎙️

134 members • $99/month

RIA Operators

1.1k members • Free

7 contributions to AdvisorTechBook LIVE 🎙️

Ep 36. Making RIA data easy to research with RIA Pulse

with @Jayce Nall of https://riapulse.com/ Including like the attached list of fastest-growing firms using Altruist!

📰 RIA Pulse - Falcon Preview

@Jayce Nall is building cool stuff for RIAs... v2 of RIApulse.com is coming soon.

Building websites is incredibly easy now

There is absolutely no reason to pay someone like $MG to do it anymore. I have no affiliation with these guys: http://www.10web.io/

1 like • Dec '25

Great tool to get up and running. I have not used it, but skimming the site I do like that it still uses a developer-friendly CMS (Wordpress) on the back end so you can hire on webdev help when it makes sense. A lot of ai site/app builders don't do this and leave you with unmaintainable spaghetti that needs to be rebuilt later.

Looking for a Compliance Pro

Hey folks, I thought this may be a good place to ask for an expert opinion. I'm building an open platform for browsing ADV data to replace the IAPD and am having a hard time sorting out why my custodian numbers differ so wildly from other independent reports. They don't show their work, but I'm happy showing mine in pursuit of truth. Does anybody here work in compliance and understand the nuances of the regulatory filings?

1 like • Nov '25

@Trevor Hicks Specifically I was referring to this: https://advizorpro.com/post/ria-custodian-trends-report-2025 My tool, RIA Pulse is using ADV Schedule D 5k3 data to provide custodian data. Advizorpro's report cites ADV filings as their source but their counts are far higher than what I see in those 5k3 filings for the same period. My first thought was maybe they're trying to extrapolate the number of individual accounts by looking at each firm's total aum and total number of accounts relative to the amount reported for each custodian in the 5k3 but it's unclear to me.

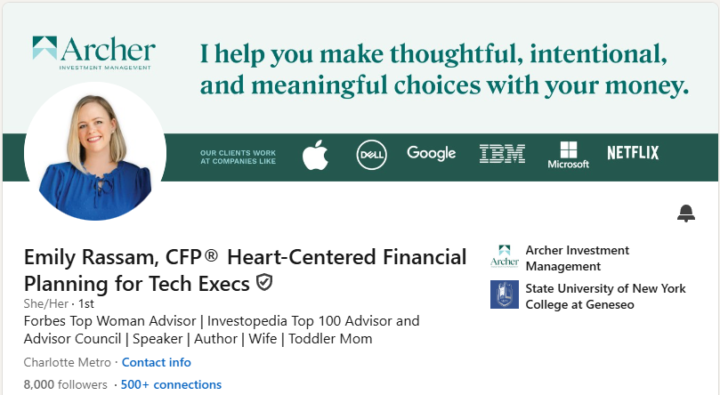

Emily Rassam - Archer Investment Management - $360mil

Today I'm pleased to share Emily's tech stack just as she crosses 8,000 followers on LinkedIn (see screenshot!) @Emily Rassam is here, so feel free to chat with her about any of these tools. https://www.linkedin.com/in/emilyjcasey/ https://archerim.com/ The REAL Tech Stack: Schwab - Custodian Wealthbox - CRM Jump - AI Notetaker Orion / GeoWealth - Portfolio Management Fynancial - Client Portal RightCapital - Financial Planning Monarch Money - Budgeting Sharefile - Document Uploads Orion / RightPay - Fee Billing MessageWatcher - Communications Archiving Nitrogen - Risk Tolerance / IPS generation Calendly - Scheduling

2 likes • Nov '25

@Emily Rassam We surface data from the SEC. The advisor count comes from the Form ADV filing field for "Staff Performing Advisory Functions" Perhaps you could help me better understand this distinction between what is filed with the SEC and what the firm considers an advisor. In any case, @Joe Moss - your suggested feature of firms being able to "claim" their profile and provide supplemental/clarifying information is certainly moving up the priority list :)

1-7 of 7

@jayce-nall-7046

Creator of RIApulse.com //

Technology Consultant //

Software Development

Active 1d ago

Joined Oct 17, 2025

Chicago

Powered by