Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

AI Cyber Value Creators

7.8k members • Free

Builders by Buildy.ai

2.7k members • Free

NN

New Name Coming Soon

8 members • Free

REI Connector Formula (FREE)

69 members • Free

High Vibe Tribe

79k members • Free

Surplus Funds Collective(Free)

494 members • Free

Poster Print on Demand

2.8k members • Free

Capital Connectors

2.7k members • $500/month

Wholesaling Real Estate

62.6k members • Free

6 contributions to LetsGetFunded Starter (Free)

🚨 We’re LIVE!

Join us now for Scaling Your Business: How Business Owners Are Getting Up to $100K at 0% Interest Learn how to access funding fast! No docs, no investors, just results. Tap in here: https://us06web.zoom.us/j/86005656909

🎉 Wheel Winner Alert!

Congrats to Jason for winning $150 from today’s live call! We’re still in the Q&A, so if you haven’t joined yet, there’s still time to tap in, learn how to access $100K at 0%, and win a generational knowledge to gain wealth! Tap in here: https://us06web.zoom.us/j/86005656909

Business Line of Credit versus Business Credit Cards

I speak to many business owners and most everyone wants a traditional business line of credit. They prefer a BLOC over a BCC. I’d like to point out an advantage credit cards have over traditional lines of credit. Business credit cards are easier to obtain. They often come with 0% interest rates from 6-18 months. And they provide points or cash back which doesn’t exist with a traditional line of credit. A credit card offering points is often a great choice for those that travel frequently or want to. Many of these branded cards allow you to enjoy luxury experiences at a discount. They are great for those that want to benefit from “higher tiers” of rewards with use. A credit card offering cash back is often a great choice if you don’t travel a lot, you like simplicity, and you want an easy effort way to lower your cost of doing business (ROI). After all, you are spending money on business items and expenses you pay for anyway. Cash back credit cards allow you to lower the cost of doing business. Both credit cards and traditional lines of credit are examples of unsecured lines of credit. Meaning no collateral is needed. You can obtain larger traditional lines of credit if you have collateral but you don’t need to go that route. I prefer unsecured credit lines. Points and cash back business credit cards are a great advantage over traditional lines of credit. And there are techniques you can implement to keep your 0% rate for an extended period of time. Better yet, why not obtain both!

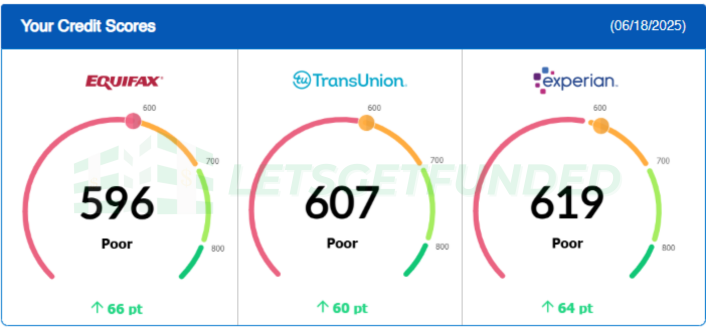

Some Big Wins Lately 🔥

SHARING SOME WINS FOR OUR CLIENTS! ✅ Went from a 510 to 620+ in just a few weeks ✅ Another jumped from 655 to 705 and is now pre-approved for a new car ✅ One more is on track to hit 750+ before the summer’s even over THIS is why we do what we do. No fluff. No credit repair scams. Just real results with a clear, step-by-step game plan that actually works. If you’re working on your credit and want to be around others making real progress.. 👇 Drop a “WIN” below to get more info

Mindset Shift: Bad Credit ≠ Bad Person 🔥

Credit isn’t about who you are—it’s about what you do next. The system is designed to keep you stuck. We’re here to show you how to flip it. 📉 Bad credit is temporary. Mastery is forever. 👉 Drop a “💯” if you’re rewriting your story—and get into Inner Circle Pro if you want the blueprint.

1-6 of 6

@dewell-moore-6564

TymeZoneLLC

Dewell Moore

dewellmoore@gmail.com

(971) 977-5983

Portland Oregon

Subto✌️PNW

Active 7d ago

Joined May 7, 2025

Powered by