Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

InvestCEO with Kyle Henris

38.5k members • Free

13 contributions to InvestCEO with Kyle Henris

Apex and their rules

I read this on reddit today. I found it useful and thought some of you might find it useful. It builds off of what Kyle has taught and there's some good insights in here. I'm sharing to share, not because I agree with everything per se. Apex's system is designed to prey on poor impulse control and undisciplined traders. People complain a lot about their rules, but if you really start to dissect them one by one, you should already be following most of them if you're managing risk properly. For 90% of traders, my comments apply to them, and for the 10% that don't, Apex just may not be the right prop firm for you. There's only one that I somewhat disagree with, but it makes sense from the company's perspective and prevents people from 'gaming the system'. I'm saying this because I used to be like this and have spent $15K on account fees before reaching this payout. 300+ Evals (during sales) and 70 PA accounts. I started trading in groups of 5-10 accounts after my 10th PA account, so I probably only blew around 10 'batches' of accounts starting on account 11 if that makes sense... For the example/info below, I'm assuming a $50K account. $2,500 Trailing Drawdown: If you were trading with personal capital, you should not be risking more than 1% of your account per trade ($500). This would mean that you would theoretically need to have failed 5 consecutive trades to fail this requirement. The alternative scenario is that you had a trade run up for a bit and then it goes all the way back down to break even. To be generous, let's say the trade runs up $500 and then stops you out at break even. This would trigger $500 of your drawdown, but if you repeated this scenario another 10x, your drawdown would remain the same. To fail the account, you would now need 4 consecutive losing trades. 30% negative P&L Rule: Open trades should not exceed a 30% negative drawdown from the account’s profit balance ($750). Going back to my example above, the only way you fail this rule is if you have a single trade result in an open P&L that exceeds -$750. If you cap your risk at $500 a trade, you should never be able to hit this. I also set my daily loss limit on Tradeovate to lock me out at -700 for the day just to be safe. This also helps me from overtrading. 90% of the time I blow up a PA account, it's happened in one day chasing losses. Anecdotally, I haven't blown an account since enabling this...

1 like • Feb 11

@Kyle Henris What I meant was that I usually see a lot of negative regarding apex. I'm not sure if I like apex or not. I seen some people say that when they would make a big trade on friday to try and up their profits, apex would flag them and deny them payouts. Maybe I don't understand them fully. I don't know. Lol Just worries me to put money into a prop firm and to be denied a payout when apex seems to be a biweekly payout.

Zero Day

A journey of a thousand miles begins with a single step and yesterday was my entry point into this career. I'm excited to see how this journey progresses and I look forwarded to getting to know this community. Thank you

Newbie

Looking forward to moving to step 3. Very excited with what’s to come !

Took a break

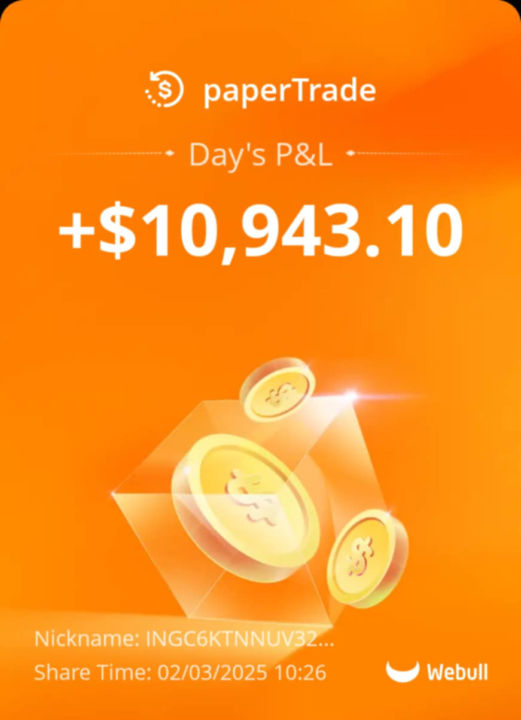

Took a nice long break after blowing a few accounts. Kept on studying for months with people on TikTok and YouTube following support and demand, support & resistance, bos and price action. Well recently I started paper trading again on webull while at work. This was the result on last Monday! Looking forward to getting a few evaluation accounts passed this income tax so I can put me and my family into financial freedom! 😄

MY Favorite way to build wealth 🤑

I mentioned in the poll from yesterday that my favorite way was NOT in the list of choices. Don't get me wrong...I love trading/stock investing, I love building businesses and plan to add real estate to my asset portfolio down the road. I even love crypto and the returns it can generate. All these assets can be great...(unless you lack my favorite...) My FAVORITE way to build wealth is through... ✅Income producing SKILLS Yep. Skills/investing in your knowledge is absolutely the highest return way to build wealth. In fact I would argue a "lack of the right skills" is the biggest reason for the growing wealth gap in America. Most people have skills that would make them successful....in a 1985 world. But today we live in the digital age, and in this age you're either going to make more money than you ever thought possible...or you're going to get left painfully behind. Let's talk through some examples... - Many of you listed real estate as your favorite way to build wealth. I get it, everybody LOVES to talk about how great real estate is. And to be fair, it can be a tremendous asset. But if you don't know what you're doing how much wealth do you think you're going to build with real estate? (Spoilers...probably none. Most likely scenario is you lose money). The people that make money with real estate either create a business out of it, or have enough capital to find and negotiate the best deals. Both of these things require skill first. Same thing with trading/stock investing. If you don't truly have the skill, you'll lose money. If you do, it can be the greatest asset in the world. It's the SKILL that is the separator...not the asset. Now compare this to my current situation: - I've learned to trade - I've learned the ins and outs of stock investing - I've learned all about insurance - I understand how to build an online business - I know how to sell - I know how to market If everything went to 💩 tomorrow I have at least half a dozen ways to quickly start making 5-figs a month again.

1-10 of 13

@derick-clapper-5525

Hello my fellow traders! My name is Derick and I am a husband and a father. I'm looking to support my family and become successful!

Active 294d ago

Joined May 29, 2024

Powered by