Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Daniel

We empower people to achieve financial freedom through credit repair, funding solutions, and investments in AI-driven wealth-building assets.

Memberships

Coach Capital

2k members • Free

Money Broker Society

9.6k members • Free

Specialty Coffee Community

2.7k members • Free

Daily Coffee Club

29 members • Free

EspressBros Coffee Community

85 members • Free

LetsGetFunded Inner Circle

1.1k members • $97/m

Turn Cars Into Cash Fast

258 members • Free

Funders Academy

106 members • $99/month

Scaling School

1k members • Free

18 contributions to Financial Freedom Formula

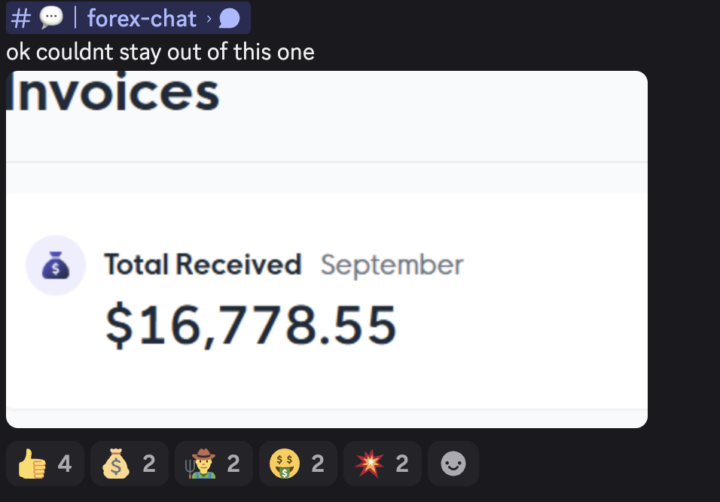

Another Month, Another Win for the Community

Some September Payouts For Our Colleagues Are In: $16,778.55 $11,266.50 $30,000.00 That’s around $60,000+ in verified payouts this month from just Forex Bots + Automated Trading. Hands Free, Just Results! We’re not talking luck. We’re talking systems that work. Every day, our members are getting paid while building wealth through automated income strategies. Ready to be next? DM “FUND” or visit https://financialfreeformula.com to get access.

🚨 NEW: Done-For-You (DFY) Funding Is LIVE! 🚨

Tired of the paperwork, hassle, and delays? We’ll do the work. You get the money. We’re now offering DFY Funding for F3 members. That means we handle the entire funding process for you — no more guessing, no more grinding. ✅ You stay cash-flow positive ✅ You get access to capital ✅ You focus on execution and growth How it works: - You pay nothing upfront - We charge just 10% on the backend — after you get funded - You tell us what vertical you’re using the funds in, and we’ll handle the rest Already have an idea? Great. If not, we’ll even point you to DFY and automated investment strategies that are working right now. 🧠 Less thinking. 💰 More funding. 🚀 Let’s go. ⏳ Drop “DFY” below or DM me before spots are gone. First come, first funded. *** Limited to USA residents at this time.

💸 Would you ever borrow to invest? Why or why not?

Curious how others here would handle this.

1 like • Sep '25

Borrowing is a lever. It amplifies outcomes — good decisions can accelerate growth, while poor ones can collapse quickly. That’s why it’s critical to fully understand the investment model before taking on debt. Used wisely, leverage is one of the most powerful tools of the wealthy. Real estate is a strong vehicle for this because it’s tangible, relatively stable, and carries attractive tax advantages. A mortgage is still borrowing to invest, but if you’re using cash for the down payment, the real question is: where is that cash coming from? Ideally, your cash should be directed toward assets, while lifestyle expenses are supported by passive income streams. As a rule of thumb, if you’re allocating more than 1–2% of your net worth into a single asset, you should strongly consider using other people’s money (OPM) to protect liquidity and maximize scalability.

1-10 of 18