Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

Peakvest Society

12.5k members • Free

The Vault

25k members • Free

InvestCEO with Kyle Henris

38.7k members • Free

4 contributions to InvestCEO with Kyle Henris

Should I make this a 2026 weekly newsletter?

🚨 The Money Memo (working title) Edition: Week Ending Dec 17, 2025 Vibe: Markets are spicy, but your plan should be boring. ✅ The 60-Second Market Snapshot Stocks (risk-on, but with a weird limp): • SPY (S&P 500 ETF): ~$673.90 • QQQ (Nasdaq 100 ETF): ~$603.75 • DIA (Dow ETF): ~$481.02 • IWM (Small caps): ~$248.56 Crypto (still acting like crypto): • Bitcoin: ~$86,569 • Ethereum: ~$2,845.57 🤓 Kyle’s read: We’re not in “everything is broken” mode… we’re in “stop paying any price for the shiny AI stuff” mode. ⸻ ✅ What Mattered Last Week (and why it moved price) A) AI stocks stopped getting a free pass. Markets have been sliding for multiple sessions largely because big AI names have been taking heat—bubble talk, capex worries, and “how soon is the payoff?” B) Data-center reality check = “show me the money.” Reuters flagged a big snag around an Oracle-linked data center financing situation, which poured gasoline on the “AI spending is getting expensive” narrative. C) Crypto: year-end vibes + macro nerves. BTC has been drifting lower in cautious trade. And markets are eyeing big expirations (“triple witching” + options expiries) as potential volatility fuel. ✅ The Week Ahead: Your “Don’t Get Surprised” Calendar The big one: November CPI drops Thursday, Dec 18 (delayed schedule). Translation: liquidity is thinner into the holidays, so a “normal” inflation print can still create an abnormal move. 🧐 Kyle’s playbook (simple): - If CPI surprises hot → yields up, growth/AI could feel it first. - If CPI surprises cool → risk assets breathe, but watch for “one good print doesn’t fix everything” whiplash. ✅ Setups & Watchlist (how I’m thinking, not what you “must” do) Theme 1: “AI ≠ automatic wins.” This isn’t anti-AI. It’s pro-price. When the crowd gets emotional, I get selective. Theme 2: Small caps = sneaky tell. IWM matters because it hints at risk appetite beyond the megacaps. If small caps can’t hold bids, the “broad rally” story gets weaker.

Poll

181 members have voted

Appex & Tradingview?

OK. So this may seem like a stupid question. Can Tradingview be used with Apex accounts?

8-days!

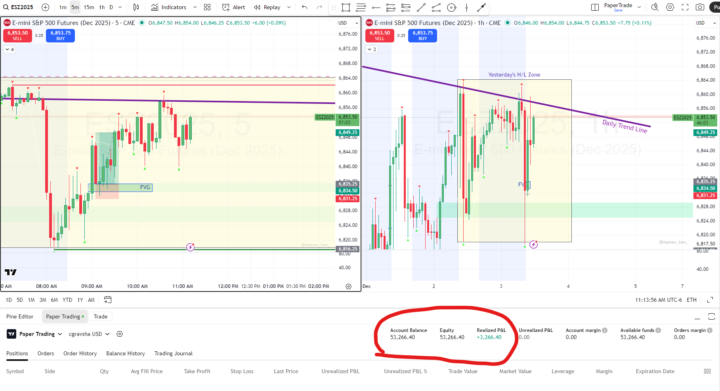

Thanks @Kyle Henris. Studied your content and took my Paper Trading account from $50K to $53k+ in 8 days with a draw down low of ($49,361.50). My risk was $200-$400 and rewards $400-$600 (a few $600+). Traded both ES & MES. Took it slow and steady!!.I am excited to start my Evaluation Acct. I will reset my paper account and keep practicing!!

Reminder 🚨

The 5 Day AI and Day Trading workshop kicks off on Monday! If you haven’t yet, be sure to register your spot here: https://kylehenris.com/workshop The replays will only be available to those that register. We’ll be covering: - How to get ahead through investing - How to make additional income with trading - How to create your own future-proof business plan - How to gain additional capital with the least amount of risk possible - How to take advantage of AI and automation to accelerate your journey to meeting your goals This will be the last workshop I do like this for the foreseeable future, and it’s free for you to attend. Can’t wait to see you all there, Kyle

1-4 of 4

Active 10h ago

Joined Nov 13, 2025

South Alabama

Powered by