Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Owned by Nathan

Memberships

Real Estate Note Investors

569 members • Free

The Trust Trinity System

477 members • Free

9 contributions to Real Estate Note Investors

3 Easy Steps to Get Rich in 2026

Forgive the click-bait subject line... but here are 3 easy things you can do TODAY to make massive progress in the new year: 1. get to level 3 (make some great posts & comments! 20 points (likes) = level 3) 2. watch yesterday's community chat (actionable, boots-on-the-ground reality of note investing) 3. share our affiliate link on your socials or text to your entrepreneur friends 👈 earn 40% for life! We are paying 40% COMMISSIONS FOR LIFE (as long as a member pays us, we split it 40/60). And the best part, you don't have to pitch anything - the basic community is free! Your network joins for free, takes advantage of the value in our Premium (Matchmaker) or VIP (Investor + Matchmaker) membership tiers & you get paid every single month they stay. We help our clients stack passive income with mortgage notes (Step 2 above is your homework to make progress on that front). And since affiliate revenue is another great source of passive income and even faster to get up & running, we activated 40% commissions for you to get some quick wins! 😄

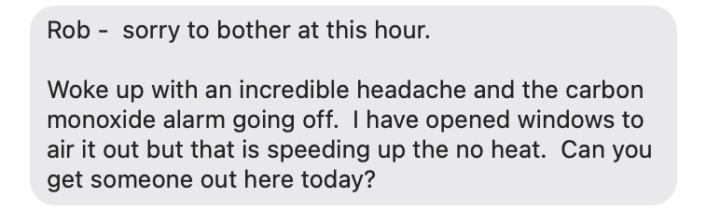

🚒🔥 at my Quadplex

The reason we're all here is because we think mortgage notes are the best way to invest in real estate. Yesterday reinforced this belief for me. Let me set the scene: I'm in an ultrasound appointment with my wife (baby #3 coming in April!) and I get a frantic text from Amber, the tenant living in the 2nd floor apartment of my mixed-use building in a town about an hour away. I had missed her text at 6:43am: "Rob - sorry to bother at this hour... Woke up with an incredible headache and the carbon monoxide alarm going off. I have opened windows to air it out but that is speeding up the no heat. Can you get someone out here today?" Her follow up text sent me into a panic. And after calls to the furnace repair company (that had cleared screwed something up when they tuned up the machine last month) & the utility company to turn off the gas I called my tenant back with the instructions: "evacuate the building" But when the phone went straight to voicemail, text messages left unread - my blood went as cold as the icy wind coming through the windows in her unheated apartment... I feared the worst: she was passed out from carbon monoxide poisoning, unable to escape the apartment. I dialed 911 and an ambulance, fire truck and police were shortly outside the apartment. Tried to call her again, RELIEF - she picks up & is on the way out of the apartment. The firefighters get inside the basement of the building and find the furnace spitting out flames into the surrounding area - lighting cobwebs and anything they touch on fire. "You got really lucky..." was all the fire chief could say over the phone while he caught his breath. The furnace is toast but everyone survived. And my tenant sent me a text memorializing the close call: "The FD said the heater is “a mess and probably should be replaced as the issue has to have been building for a while as the reading in the basement was at 70 ppm and 50 will kill you!” It’s down to 17 in the apt now and had been cleared for me to go back in."

📣 ROUND 2: The Pricing Game! [complete]

📊 RESULTS ARE IN - here are the details & actual metrics for Round 2: Strong engagement and solid reasoning across the board. Most guesses clustered in the 25%–35% of UPB range, reflecting realistic risk pricing given vacancy, back taxes, and package dynamics. Several of you correctly anchored on tax liability + timeline risk as the things most dragging down the value. Actual purchase price: $3,000!! (~10% of the UPB) That comes in below most estimates, reinforcing how cheap you can pick up a small-balance, vacant 1st position loan with negative factors like taxes and long foreclosure timelines (especially as part of a package deal, this trade was a total contract of 10 loans for $79,172.00 sale price - 38% of UPB total) Closest guess (winner): @Dj Olojo with $7,075 (25% of UPB) - correct framework, even if the sale price surprised to the downside. What's ironic about this - DJ was the actual buyer of this NPL back in 2024! Looks like you got a better deal than you remembered 😜 Honorable mentions: - @Iván Terrero 30% of UPB with package logic - @Andrew Bogie - strong equity vs. tax offset analysis - @Nathan Trenery - wisdom-of-the-crowd approach On Today's call, we’ll break down: - Why this asset cleared at $3,000 - Where most investors overestimated value - How buyers think about minimum viable pricing on small-balance seconds - How this compares to pricing if the same asset were performing And for those that missed it - here was the original post: 📣 The Pricing Game — Round 2 🕹️ How to Play 1. Review the deal data below 2. Comment with your best guess for the final sale price 3. Optional: add 1–2 sentences explaining your logic 4. Closest guess wins the round 📂 Today’s Deal: Another REAL Closed Transaction Asset Type: Charged-Off, Non-Performing 1st Mortgage (Senior Lien, NPL)

props to Iván for earning the 🔥!!

Skool has a great feature to reward a "streak" of activity on the platform. When you rack up 30 days of consistently liking/commenting/posting a combined total of 10 times per day - you'll get a little 🔥 emoji next to your name - @Iván Terrero is the first in the group to earn one! I'm working on earning my own because consistency is key in business. I hope to see a lot more 🔥 around here soon! (at the very least, all you have to do is press the 👍 button on at least 10 posts in the community per day - and that activity helps out our group a ton - so get to liking!!)

Tax efficiency with notes

Is there any form of tax advantages with notes? I haven’t seen anything important there is but perhaps it’s just something I’ve missed. Thank you for all feedback in advanced 😄

3 likes • 12d

@Dj Olojo thank you. As a strategy, have you created income streams for your self day to day as well or mostly just keep it all in the retirement accounts? I love the idea of eventually having enough cash flow to leave my job but maybe that’s a poor strategy sacrificing so much growth so early ( I’m 33)

1-9 of 9

Active 9h ago

Joined Oct 19, 2025

Vacaville, Ca

Powered by