Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

InvestCEO with Kyle Henris

40.5k members • Free

InvestCEO Boardroom

937 members • $2,500/y

1017 contributions to InvestCEO with Kyle Henris

Have I done big money part 1 correctly?

I've just taken a random time slot for daily charts, and tried to place in all the concepts from part 1 so I could practically understand what I was doing. SET ONE FROM NOVEMBER 2024 Image 1: the daily chart with all the action that is happening labelled Image 2: the same section but in hourly form. Image 3: I focused on a select part of the daily in the hourly to set demand and supply blocks to trade with. I focused on where the first daily discount area was in the daily SET TWO FROM JANUARY MODERN TIME 2026 Image 4: DAILY analysis from January Image 5: Hourly analysis from January modern time Image 6: Setting my notification for bullish trade Image 7: Setting my notification for bearish trade Did I label and do everything correctly as stated in the BIG MONEY PLAYBOOK PART 1?

3 likes • 1d

Looking good @Jonathan Ferrier as evidence of work you are putting in and learning the concepts 💪👌 Apart from that one thing that comes to mind is that the market is dynamite and subject to change without warning. You can have the logic for a perfect environment and ideal conditions that trigger your short and long trades. But. Risk on or off changes, and what looked like a great place to take a long position fails. In one day price can continue to go through zones as price seeks to rebalance in a new norm. You can take long positions during a bearish rebalancing or major pullback day, and loose ten in a row easily. I've heard Kyle refer to it as standing in front of a fast moving train. There is common sense to stop taking bullish trade after bullish trade on a heavy bearish day. It is much easier to see in hindsight. But risk management rules can be a life raft during these treacherous trends to keep us for trying every single zone every single day. Examples can be a fixed number of daily losses/chances/tries or a fixed daily $ loss limit. It doesn't matter to me how great a demand zone looks, if world war 3 breaks out I'm going to be very cautious taking a long position, unless it is on gold. The moral of the story is something like don't let a bad day ruin your story. Because loosing a trades or hitting a set number of daily losses according to your plan is not a bad day. A bad day is breaking your common sense rules because you think the market is going to turn around now. Just wait till the next day if the market is not doing what you are expecting. Like in baseball, it's better to wait for the pitch you are best at hitting than to keep swinging at the pitches you have a hard time with to start. Patience and discipline can be more powerful than skill. Common sense can be better than all the logic we've put into our little charts. Keep up the good work!

Skool

I have downloaded the app for trading view. is there an app for Skool?

New to group looking for help

Hey everyone excited to join this community. I just finished going through step 5 and was starting to get acclimated to trading view. As I stated playing with he long and short position features I noticed that the create limit order function box I get is different than what Kyle has. I have a Mac so that could be a reason but either way as you will see in the screen shot the limit order it creates does not match what is set up with the long position. Also it seems like when I update the unit size the stop value also does not increase as it should. Any help welcome as I am just trying to learn how to use trading view. I also noticed I can not get multiple views like the market and plan structure on 1 split screen nor get the 1 day, 1 hour, quick toggle button up on the left hand corner. Thanks for the help.

2 likes • 2d

Tradingview version has entered the 3rd major update. Not sure what version it was at when the video you saw was recorded. Regardless it is the way that it is at the moment and we will adapt. It may be easier to change the quantity not in the order window but right on the position tool. It has caused a lot of frustration for folks in the past week. Also the free version and subsequent subscription levels each have their limitations. Share a screenshot.

0 likes • 1d

@Guillermo Vidal well one thing is for sure, it is not recommended to paper trade with delayed data because it will not be accurate. Unfortunately that doesn't have anything to do with the updates to the order menu. We are all in this together. I just cancel and try again. Eventually it works but in your screenshot as well as my own experience it is not showing the exits on the chart. Close the order menu and try again. Try adjusting the unit quantity directly on the chart instead of the order window. It took me a couple of tires just now to get it to work. Hopefully an update will come soon.

Did i set these limit orders correctly?

I had 4 wins and 4 losses I think for Jan 2025. But not sure whether I set the boxes in the correct width and depth? Jedi approach only

DOJI in 15Min. TF

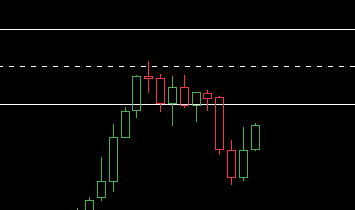

Wow, thought candles is just a "candle" till I saw this doji stays in my supply area from 1H tf. I took the trade and hold it, as you can see the trade is a success. Please share your thoughts, specially for those people who has experience in trading candles.

1-10 of 1,017

@mark-clarno-1860

Make time for mindset everyday!!!

.

Save $15 on a new user Tradingview account!

https://www.tradingview.com/black-friday/?share_your_love=markclarno

Active 3h ago

Joined Apr 1, 2024

California

Powered by