Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

Trade Algorithm Elite

258 members • $2,997/y

27 contributions to Trade Algorithm Elite

Performance Update & Exciting Developments Ahead...

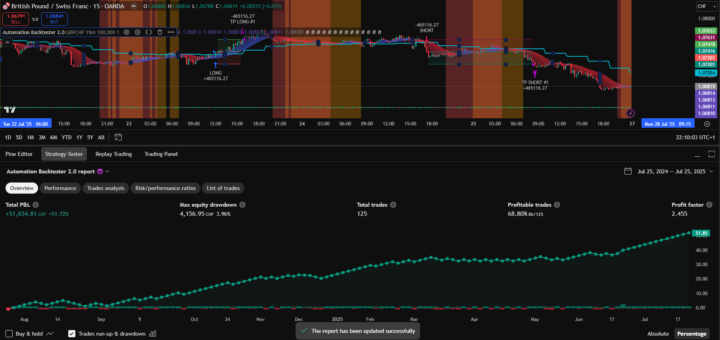

Hello everyone, I want to share an announcement regarding recent trading performance, current market conditions, and the steps we’re taking moving forward. Over the years, our setups have delivered strong results across a variety of market conditions, and many members have achieved consistent payouts & profits along the way. That’s the big picture we always come back to. We’re currently in a market phase where several setups are experiencing drawdowns at the same time. While these periods are part of the natural market cycle, we know they can feel challenging when you’re in them. Our strategies are designed and tested to handle phases like this, and past performance shows they have consistently recovered and gone on to deliver strong results over time. These periods can last weeks or sometimes longer, but they are temporary, and our focus is always on navigating them effectively. To give you the full picture, we’ve attached the past year’s performance results, and you can also view them anytime in our Automation Backtester on TradingView. If you don’t yet have access, please contact @Mr. Sivaa and he’ll get you set up. As part of our current risk management, we’ve temporarily paused trading on USDJPY. This is a strategic decision based on recent behavior in that pair and is aimed at reducing unnecessary exposure while we concentrate on the highest-probability opportunities. If you’re trading through Duplikium, remember that one of the biggest advantages you have is full control. You can adjust your risk settings, rebalance allocations, or connect/disconnect from hosts as needed. Lowering your risk per strategy can help smooth performance when multiple systems are in drawdown, and if you’d like guidance on adjustments, our team is here to help. Looking ahead, there’s a lot to be excited about. We’re currently testing the automation of another one of our indicators/ algorithms. Early results have shown faster entries, more accuracy, and strong adaptability to tighter drawdown limits. Once released, this will give you an additional edge and a completely new automated strategy to work with. We’ll keep you updated as we get closer to launch.

1 like • Aug '25

@Thomas C OK thank you, I'd been using others from the tester that had been performing well. Will these three be held for a while now so we can bed in with systems? Just checking them now and there are some brilliant figures on the three that can backtest, so hope you don't mind the question. I'm just keen to get some consistency with the integration systems.

My first challenge did not go well.I am on my second challenge,but still demo account.I hope ,that I will be finish better than first one

If I should add something else to my scheme,please let me know. Thank you. So update like after 2 days,but I started very late on 4/8/23 I did 13 Trades all wins,so far win ratio is 100% and already have my 100% account + What I lost in 2days,I have it back 🚨Update Tuesday,Still second today today of my challenge I did 17 trades,all wins today. Update of second day.25 TARDES, 24 wins ,1 lost.profit today £1221.52 ,account growth 122.15% .. 3rd.day is starting now ✅️.

Automation Backtester 2.0 is Now Live!

Our Automation backtester on TradingView has been updated with our newest and most advanced automation strategies. With the backtester, you can: - Instantly view when trades are triggered on TradingView - Evaluate long term and live performance of our current strategies - Run backtests using % risk per trade across the setups We recommend viewing the last 365 days of performance, as market behavior evolves and these strategies are specifically optimized for today’s conditions. The 2.0 upgrade introduces cutting-edge sideways and choppy market detection filters, built to - Improve strategy win rates - Reduce losses in uncertain market conditions - Deliver more reliable performance over time To activate the update, simply refresh the tool on your chart in TradingView. Have a great weekend, everyone.

Swing trading strategy

1 years data Profit factor 5.8% Drawdown 3.93% Profitable trade 55.71% Profit 156.82% Profit per month 156.82/12=13.0683

[ANNOUNCEMENT] Week Round-Up & Clarity On Trade Quantity

Hi everyone, Hope you're all having a strong finish to the week! I’m very pleased with how things are performing so far; the commodities system is up nearly 3% this week on the host account (results attached). The Forex system was trading slowly this week, as 2 of the strategies spent most of the time in a "no trade" condition. This is by design, showing our new updates working perfectly, and keeping us out of a market that is not right to trade in. Next week, I believe the Forex system will be more active. Of course, not every week will look like this (such is the nature of trading), but it’s great to see the team’s hard work delivering results. A huge thank you again for the belief and trust you continue to show in the system; it genuinely drives us to keep improving every single day. Quick clarification on multiple open positions (no issue): There’s been a bit of confusion around why you may see multiple trades open at once. To clarify: Some of our strategies use multiple Take-Profit (TP) levels. When this happens, the system will split the position into separate trades, all with the same stop loss (SL), but different TPs. So, for example, if a strategy is risking 1% total and has 3 TP levels, you might see three trades open, each with 0.33% risk. Note: Some strategies will deliberately weigh the risk more heavily toward certain targets. This is completely intentional and part of the strategy design. Here’s how many positions you can expect to see per strategy, when trades are opened: - GOLD 15M 1:1 – 1 Position - GOLD 10M SPLIT TP – 3 Positions - SILVER 5M SPLIT TP – 2 Positions - USDJPY 15M – 3 Positions - GBPCHF 15M – 1 Position - EURUSD 15M – 1 Position Please make a note of the above for future reference. You’ll also notice that in some strategies, the risk isn’t always split evenly between the TPs — again, this is by design. Any questions, just drop them below so everyone can benefit from the answers. Have a super weekend.

![[ANNOUNCEMENT] Week Round-Up & Clarity On Trade Quantity](https://assets.skool.com/f/8ae76f406cd243ed90e88210f42d259c/8286301bab1349ae81091f6f143b9ea275d0d2fc033d4f5382474335cbdbc3a5-md.png)

1-10 of 27

Active 12h ago

Joined Mar 25, 2025

Powered by