Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

LEARNin Local Academy

52 members • $5/month

4 contributions to LEARNin Local Academy

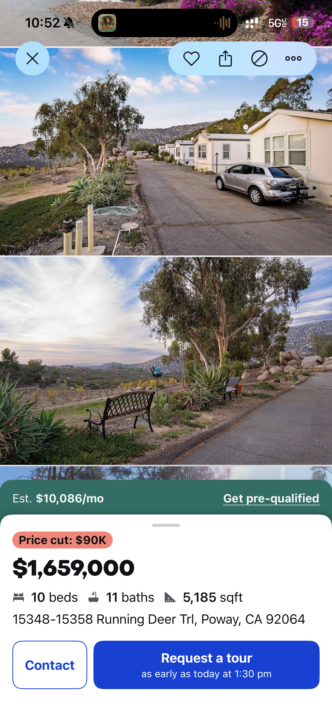

10 unit in Poway, STR Manufactured Homes

Happy Weekend All 🤓 @Martin Magana As usual, great work hosting and holding down the fort we call the DEALs segment! My brother 👊🏽! @Anastasiia Buiadzhy @Nicole Turner ! It was an Amazing LIVE yesterday! Your dynamic duo-made me do a quick Zillow search for a Poway property! 😁 I’m interested in this property with the intention of creating a short/mid term rental. 🤔 Summary: 6 Spectacular Units on 2.49 Acres. Additional 4.36 Acres RRA. Lot 278-200-31-00, is also available for additional price of $150,000 on a Package Deal! Land/Lot MLS#250037625, available and is marketed separately. Owner requires selling both locations with a simultaneous close of escrow. Legal 5-2BR,2BA 920sq.ft. Modern Manufactured Homes built in 2004 and frame/stucco Office Bldg with 1.5BA approx. 585sq.ft. "Value Add", Incredible Ocean and Mountain Views. Area of Large... @Roger Lee do you have an STR Operator in this area that can give me INSIGHT? 😀 @Harry Dennis @Casey Clayton Me and @Rafael Davis only fund stick built property at RevCap so would love your input as well in regards to financing.💰 @Patrick Ono @Angel Garduno can you provide INSIGHTs on how much insurance would be for this MF manufactured property? We don't fund these so I have no idea. @Adib Mahdi @Carver Tripp @Jon Hayes do you do work in Poway? In the event that I’d want to build, I need an expert!🔨 @Tristan Bushkov @Samuel Shayegi @Aleksandar Johnson I’ll be free to discuss this deal all weekend so hit up the celly anytime! 📞

Major Homebuilders ‘Weigh Plans’ for a Million Entry-Level ‘Trump Homes’

Happy Tuesday All! First and foremost, I'll be the last one on this platform to talk politics and specifically "divisive" politics! 😠. Anyhow, you will likely have heard about TRUMP HOMES and this article a perfect article to reference this coming Friday! If you are going to be on the show this Friday, RATHER THAN POLITICS I would focus more of your attention on the last part of the article that questions whether a "rent-to-own" pathway would actually benefit many first-time homebuyers. ""The reason this hasn't been done before at a large scale is that rent-to-own just isn't a very favorable proposition to buyers," he says. Rent-to-own makes sense only in specific circumstances where the buyer is unable to get a mortgage now, but will be in the future, and is willing to commit to a specific home upfront, says Berner. The rent-to-own buyer is also gambling that the home's value won't decline over the lease period. "It's a small subset of the buyer population that experiences all these conditions," he says. "Building more homes is great for buyers, and a large-scale building boom will make homes more affordable. Just build them. Sell them or rent them out as builders normally would." @Nicole Turner @Aris Anagnos @Noemi Flores @Jean Anagnos @Christopher Astillero @Erica Traulsen @Michelle Adams @Adib Mahdi @Martin Magana @Alley Perkins would love to hear thoughts! Check out the article at https://www.realtor.com/news/real-estate-news/trump-homes-lennar-taylor-morrison-plan/ Make it a great day, Coach RU @Ruben Austria

February 13, 2026 LEARNin San Diego LIVE featuring Anastasiia Buiadzhy of the North Inland Region

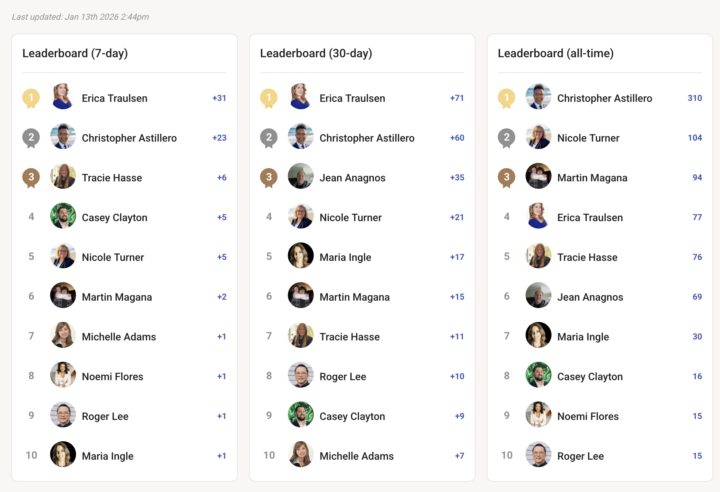

Hello Everyone! @Anastasiia Buiadzhy of the North Inland region of San Diego County will be featured 😀 For the February 13th, 2026 LIVE production the following SMEs (aka 9 LIVEs) will have production control over that LIVE show according to the attached screenshot of the 30 day Leaderboard: - @Erica Traulsen - @Christopher Astillero - @Jean Anagnos - @Nicole Turner - @Maria Ingle - @Martin Magana - @Tracie Hasse - @Roger Lee - @Casey Clayton More details to come in the next 30 days about this LIVE production! The "LIFEline" thread on LinkedIN for the LIVE will be at https://www.linkedin.com/messaging/thread/2-NDU4MDA0NzctODU4YS00Njc1LTkxYjEtYmI0YmU1MDZhM2NiXzEwMA==/ THANK YOU all for your contributions and participation! Let's make it happen! Coach RU @Ruben Austria @Emerson Pacete @Kelcey Coyne @Reina Espejo 😃

1 like • 2d

@Martin Magana Just an overview at 5% down Conventional loan Principal & Interest: $3,418 Mortgage Insurance: $100 HOA: $648 Property Taxes (1.25% est.):$651 Homeowners Insurance (est.):$90 Total Estimated Monthly Housing Payment: $4,907 / month Estimated Cash to Close - Down Payment: $31,250 - Estimated Closing Costs (approx.): $8,500–$10,000 - Total Estimated Cash Needed: ~$40,000–$42,000

LEARNin Local LIVE October 10, 2025

Happy Friday! Article has been settled for the October 10, 2025 LIVE!! https://www.sandiegouniontribune.com/2025/10/02/bidding-wars-are-in-the-rear-view-san-diego-home-prices-fall-in-u-s-rankings/ 1) Host @Christopher Astillero 2) INSIGHTs Host ? @Harry Dennis 3) DEALs Host @Carver Tripp 4) EVENTs Host @Tracie Hasse 5) SME Guest 1 @Noemi Flores 6) SME Guest 2 @Corie Aguinaldo 7) SME Guest 3 @Aris Anagnos 8) Deal Facilitator @Martin Magana 9) Events Facilitator ? 10) LIVE Evaluator on YouTube ? 11) LIVE Evaluator on LinkedIN ? 12) LIVE Evaluator on Facebook ? EVENT LINKS YouTube: https://www.youtube.com/watch?v=rrkQs09Ij_Q Facebook: https://www.facebook.com/events/1336361081435891 LinkedIN: https://www.linkedin.com/events/7381775577898221569/ STUDIO LINK Studio Link (for guests and hosts): https://streamyard.com/zk7jm54853 SLIDES https://docs.google.com/presentation/d/1UcUA0G4_-9gdnFy3abBzXSsPjLxHyUpSLM1pVDnzyUw/edit?slide=id.g37260f2bf8f_1_4#slide=id.g37260f2bf8f_1_4

1 like • Oct '25

For Traditional Financing Owner occupied 6.25% Conventional - 3,5,10 % down, 20% down no MI Investment finaincing Conventional 25% down Fix and Flip 90%-91% LTC / down payment 75% ARV 100% of rehab budget Borrower typically has experience. They should have a good idea of what they are doing 8-9%

1-4 of 4

Active 21h ago

Joined Oct 9, 2025

Powered by