Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

OptionProfits

463 members • Free

TGE

759 members • Free

1287 contributions to TGE

JPM collar confirmed

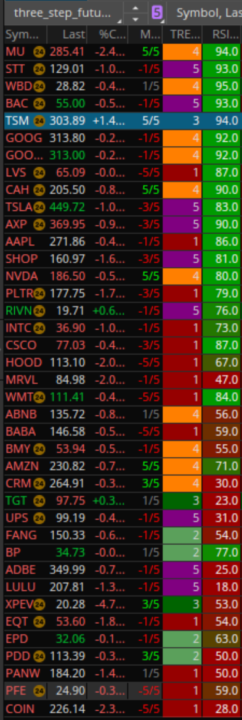

$SPX bookmark this and add these lines to your chart: • Short call: 7195 • Long put: 6515 • Short call: 5495 $JPM collars have been confirmed, and it's a big deal. JPM sells calls (capping upside) and buys puts (protecting downside) to hedge massive equity exposure.

0 likes • 4d

@Zhyara Ashby We can see that JPM has been making higher highs and higher lows and trading firmly in a channel stair stepping in a bullish trend. It did hit 326 today confirming the 325 predictions, but I think it still has some room to go. Ruben's news only solidifies that JPM is taking a positive business action giving investors some confidence that JPM knows what they are doing, even if it is a hedge. I see it next week trading in a range of 322-330 attempting to break out and test that 330 once again.

0 likes • 4d

@Zhyara Ashby I usually do not start my intrday trades before 930 but JPM gave a buy signal at around 845 - taking the trade at the retest and volume confirmation at 940 we saw a nice uptick but it was short lived and a sell signal showed up at 1020 - we stayed out of the trade as the stock traded flat with higher IV meaning that a mean reversion is near. a buy signal did come in when price went up and volatility stayed up at 1230 at 323 and we rode it to end of day to 325 then out in cash at end of day.

My Personal 2026 Market Playbook as an Options Seller and Hedge Fund Manager

Hey! As we start 2026, I want to share a few very personal market views and investment ideas I'm going to actively explore this year. This is not a recommendation and not a directional forecast. It's simply how I currently see market structure, volatility, and opportunity from the perspective of an active options seller and short-volatility hedge fund advisor. 1) Metals: the parabolic move may be behind, but volatility lingers Gold and silver already had their most emotional, parabolic phase. The important nuance is that implied volatility rarely normalizes as fast as price action does, and that lag is where options sellers get paid. So, I'll be very active in GLD, SLV, PALL, and URA, both in my personal portfolio and in our hedge fund. The specific edge I'm watching is post-spike IV that stays sticky after the trend fades, especially when the surface flips into volatility backwardation. That's a perfect setup for short-dated and 0-DTE premium harvesting. 2) Crypto: stagnation is the edge My base case for crypto is not another explosive trend, but prolonged consolidation. That's exactly why IBIT, the iShares Bitcoin Trust ETF with liquid options, is so interesting. Implied volatility remains structurally rich, often well above realized volatility. I don't trade crypto directionally, but I sell premium strategically. Compared to the industry's obsession with upside narratives, this approach is far less exciting, but it creates a much more consistent income engine. 3) Rate cuts shift income opportunities If rate cuts continue, my famous "yield engineering" trades like SPX box spreads and risk-free butterflies become less attractive. At the same time, they open a different door. Lower rates support REITs (Realty Income - O - remains my personal favorite), utilities (XLU), healthcare (XLV, UNH), and dividend growth ETFs (SCHD). I consistently combine these with aggressive call writing, creating my Triple Income Strategy. This approach targets an additional 11-18% per annum, with extremely low volatility and zero vega risk!

What are you trading today?

Last trading day of 2025 what tickers are ya'll looking at Gextron for? the last one I checked was DIS for calls Jan 16 118

1-10 of 1,287

@charles-antonini-9531

trading for some time but mainly selling options for income

Active 4d ago

Joined Sep 23, 2024

Powered by