Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

What is this?

Less

More

Memberships

Digital Products Academy

2.9k members • Free

Crypto for Women

191 members • Free

Worldschoolers Community

81 members • Free

MEE 1st ~ Blooming Unique Soul

37 members • Free

3 contributions to Crypto for Women

ARE YOU HAVING TROUBLE GETTING MONEY OUT OF THE BANKS?!

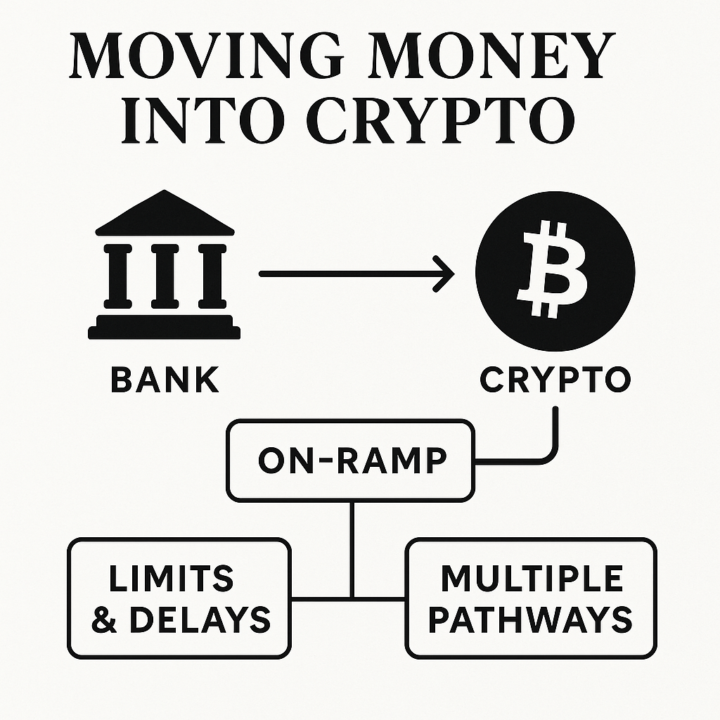

If you’ve ever tried to move money from your bank into crypto and thought, “Why is this so hard?” You’re not imagining it. 1. Banks and Governments Don’t Make This Easy Between the banks adding limits and delays, and the government tightening control wherever they can, it’s become very obvious that the traditional system doesn’t want everyday people moving their money freely. Not because it’s unsafe. But because they lose control the moment you step into decentralised assets they can’t freeze, lock, monitor or profit from. 2. You Don’t Owe Anyone Explanations When you move your money, you don’t need to justify yourself. If a bank asks questions, the calm, confident approach always works best. “I am comfortable with this transaction” is more powerful than you think. You don’t need to tell them exactly what you’re buying or who you learned from. Your financial decisions remain your private business. 3. Always Have More Than One Pathway This is why sovereign investors use more than one on-ramp. If one route blocks or slows down, you’re not stuck. You simply use a different option and keep moving. This is how you protect your freedom to act. 4. Let’s Open This Conversation Up Have you ever had a bank block you, question you or slow down your transfers? Share your experience in the comments so we can actually talk about what’s happening and build real confidence around on-ramping.

1 like • 10d

Had it once with a UK bank, they blocked a transfer to a crypto platform (it wasn't my first transfer there, not sure why this particular one got flagged). Called them and I was very clear it's my money, I can do with it whatever I want, and they are not the only bank - they removed some limitation at their back office end on that call and it never happened again. It felt like their approach was "people don't call and tell us off, so eventually will get fed up and stop making those transfers to crypto if we are persistent enough in blocking them" 🙈🤣

Crypto Platforms

Hi ladies, I hope you're having an amazing week! I'm curious to know for those of you who currently have crypto, what platform are you using? I have small amounts of a few different assets on Coinbase which is the only platform I use/have tried at the moment. Does anyone have any recommendations if you have tried a few? I'm interested to learn from other experiences 🙂

0 likes • 22d

@Emily Walker it's one you get with crypto.com app, you'd need to lock certain amount of CRO tokens to get the benefits of earning the rewards, and the more you lock the better the rewards (there are different tiers of the card available). It works like a prepaid card, you top up your account within the crypto.com app either with FIAT currency from your bank or by selling some of your crypto. Does that answer your question?

COMPOUNDING!!! MUST READ!

I've just been chatting with a woman inside of 30DTCC and reverse engineering buying bitcoin at $1000 a month for the next decade... you must read this!!!! If you were to put $1,000 a month into Bitcoin for the next 10 years, that’s a total contribution of $120,000. And when we look at two different historical-type return rates, the picture is honestly pretty wild. At a 30% annual return, which is still a conservative high-growth scenario for Bitcoin, your $120k would grow into around $1.6 million. But if Bitcoin repeated its historical 10-year average of around 49% annually, that same $120k turns into around $6.9 million. Let that land for a second. From one hundred and twenty thousand dollars contributed… to multiple millions simply because of consistency and compounding. Obviously, none of this is a guarantee. We can’t promise future returns. But this is what history has shown us. And honestly, this is why so many people who stay consistent for a decade completely change their financial trajectory. So no, you’re not “making a mistake” by compounding $1,000 a month into Bitcoin over 10 years. If history even rhymed with itself, let alone repeated, the upside is extraordinary. And it could go even higher. This is the power of time, consistency and exponential compounding. Ahhhh!!! And yes, how sexy is my BTC card?!!! he he! The joys of being wealthy!!! Jess x

1-3 of 3