Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

Real Estate Note Investors

536 members • Free

7 contributions to Real Estate Note Investors

Week in the Life of a Portfolio Manager (week #50 / 2025)

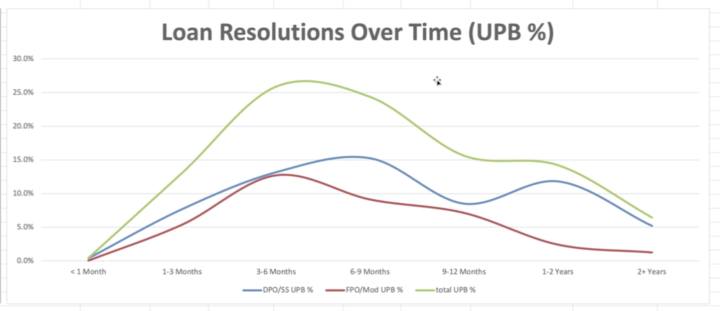

Happy Friday! Another week of full-time note investing work in the books! As you may know, we provide portfolio management & run loan sales for a handful of private clients. Our top client currently holds 2,716 mortgage notes, approximately 300 are cash-flowing and the vast majority are non-performing (NPL). FIXnotes' job is to get those NPLs back on track or sold. So to help the community run efficient operations of their own (or as a service for other investors), I'm going to start documenting our progress - giving you a peak inside a business that brings in $5MM+ per year in mortgage note revenue (2025 has been a banner year with over $8MM grossed). So what did we do this week? Year End Cash-Flowing Audit On a regular basis it's important to ensure that your performing loans are performing as expected. This month we did a heavy audit of all of our client's cash-flow and initiated a campaign to get any re-defaulted accounts reinstated. Essentially - that means we told the borrowers how much they needed to pay to get caught up, while extending an olive branch for a revised modification if necessary. Thanks @Bill McCafferty for heading up this initiative! Data-Mining for Current Vintage versus Historic Performance I spent many hours this week pouring over our latest portfolio performance (we call each portfolio a separate "vintage") and comparing this against past efforts gives us a good understanding of how the trade stacks up against our historic results. I prepared two reports (in Excel) including line graphs: "% of UPB Resolved" & "Cumulative Basis Recovered". Here's a little detail about each: % of UPB Resolved This report reveals the percentage of unpaid principal balance that was turned into successful loan modification or payoffs within distinct time periods measured from the data of acquisition. Month 0 has a handful of resolutions as the seller occasionally sends "interim payoffs" that clear after our contract cut-off date. Then we measure in 3 months chunks: Months 1-3, Months 3-6, Months 6-9 etc. We plot the results on a line graph to see how the portfolio performs over time against similar portfolios that were acquired in the past.

Poll

17 members have voted

📣 Introducing: The Pricing Game!

Our first round of The Pricing Game has concluded! Actual purchase price: $32,211 (~53% of UPB) 🎯 Closest guess (the winner!): @Roman Bassovski , who came within ~$1,200 of the actual sale price. Honorable mentions to: @Jeff Vincent: $30,000 @Smitty Smith: $30,200 (45–50% range) Join Round 2 here 👈 And here is the original post: This is how you train your pricing instincts without risking real money. Your job: guess the final sale price as closely as possible. Most new investors struggle with one thing: “What do notes actually trade for?” This game compresses years of deal exposure into minutes. You'll learn to: • Price notes realistically • Understand how equity actually gets discounted • Start thinking like a buyer How to Play (Simple): 1. Review the deal data below 2. Comment with your best guess for the final sale price 3. Optional: add 1–2 sentences explaining your logic 4. Closest guess wins the round 📂 Today’s Deal: a REAL Closed Transaction Asset Type: Charged-Off, Non-Performing 2nd Mortgage HELOC (Junior Lien, NPL) Sale Date: 12/26/2023 Property Type: Single Family Home Location: Fort Washington, MD 20744 - Prince George’s County Property Fair Market Value: $424,500 1st Mortgage Payoff (Current Senior Lien): $175,608.46 2nd Mortgage (Unpaid Principal Balance, "UPB"): $60,449.90 Status Notes: • Subject asset is a Non-Performing Junior Lien • Charged off by the bank on 11/02/2022 • Subject Junior lien is behind a Current Senior (1st mortgage) • Sold to a member of the Mastermind Accelerator on 12/26/2023 in a package of 3 assets What do you think this note actually sold for? Leave your guess down below!

Initiated Reinstatement Proposal

Kind of excited today. Just took the first steps towards getting my seriously delinquent loan back on track. Reached out to the servicer to get options for sending the borrower a re-instatement proposal and stated my willingness to accept payments from the BK case to cover the arrears and past due payments... I've never been through this process, so kinda feeling my way through it. It's my understanding they can take the arrearage amount and add it to the BK case and the trustee can make payments towards that amount until its paid off. This will allow the borrowower to focus on the BK payments and keeping the monthly payments current on the note. It will also increase the monthly income from the note as now I may be getting 2 payment streams from this note... if all goes well and I understand the moving pieces. My next steps are if this process fails, then I can file a motion for relief from stay and remove the BK protections and proceed with the demand letter and begin the foreclosure process. I'm hoping it doesn't come to that, but that's my understanding. If anyone has feedback or sees anyting I'm missing or misunderstanding please chime in and we can all learn together :D Cheers and have a great day!

4 likes • 27d

Update: Attorney recommends filing MFR because borrower's attorney hasn't responded to the inquiry of re-instatement. They can then decide to seek re-instatment through the BK plan or the court will extend MFR so we can send the demand letter and begin loss mitigation or foreclosure path. At least thats my understanding at this point.

Join the Thursday Community Chat!

Our bi-monthly community call goes live tomorrow @ 4pm EST. Be there to hear veteran asset managers Rob Hytha & Bill McCafferty break down the latest note investing strategies, market news, and industry shifts. Perfect for real estate investors looking to sharpen their edge, ask questions, & grow their portfolio. Get event details & add to your calendar here.

Performing to Non-Performing

The first note I ever puchased is on the verge of becoming seriously delinquent. I've never been through the process of getting a note re-performing. I'm curious, once the borrower crosses the 90 day threshold, what would be your first move to bring the borrower to the table? The borrower is in BK 13 currently and I have already advanced the taxes, FPI and attorney fees for the Proof of Claim. I know my next steps will be doing a post petition filing for the updated advances since the BK began and then Motion for Relief from Stay. At this point the borrower will need around 5k for reinstatement. My question is, would you tell the servicer not to accept partial payments and then proceed with demand letter next or is there a better way to bring the borrower to the table and help them to get back on track? I'm open to suggestions for next steps. (Note and collateral is in TX) Also, I'm not interested in selling the note; I'm looking to gain experience from the process of working out a non-performing loan.

1-7 of 7

@jeff-vincent-7572

Distressed Real Estate Investor for 10 yr. Note Investor for 2 Yr.

Active 2d ago

Joined Oct 17, 2025

Powered by