Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Ruben

A community for serious traders who want to learn how to be profitable trading stocks/options

Chat about javascript and javascript related projects. Yes, typescript counts.

Memberships

Free Skool Course

48.5k members • Free

Free Swing Trading Watchlist

120 members • Free

Cashflow Collective

1.8k members • Free

Starship Kevinprise

23 members • Free

Skoolers

191.5k members • Free

1707 contributions to Trading Growth Engine

Wanting to learn more

Hi, everyone. I'm new here. There's a lot of information, a lot of videos, a lot of material. I can't understand everything right away, there's a lot. Can anyone advise where and how to start? I am from Georgia and my english is not very well. Thank you

0 likes • 20h

hard to say where to start. But start with risk. this is where most traders can't figure out and it's why they don't make money by the end of the year. 1. Risk models - How much you can lose 2. Profit taking models - how you lock in gains 3. When to exit - how to stop a trade when you're wrong then you can move up to entries, and price target zones

Quarterly price targets matter

Stocks moves in 3-month cycles. That cycle ends on earnings day and starts again right after the report. As soon as earnings are over, it’s important to mark the quarterly price targets in Gextron. Why? Because the market is forward-looking. Prices move based on expectations for the next quarter, not the last one. Gextron makes this extremely easy. How to find the Quarterly Price Targets: 1. Go to the Price Targets tab 2. Look for the expiration nearest to the next earnings date 3. That gives you the quarterly top and bottom targets You can click the Top or Bottom number to copy it and paste it straight into your charting platform. that's it. You can find your favorite stock quarterly price targets here: https://gextron.com/

lotto fRIDAY

TRADE PLAN for Lotto Friday SPX massive sell off today. SPX dropped 130 points from the highs. Possible we see more downside tomorrow if SPX fails to reclaim 6870. SPX needs through that 7k level to trigger a run to 7400+. QQQ dropped from 616 premarket to 601 at the lows. QQQ under 600 can test 589 again. I'd wait for 607 to consider calls. Mag7 price action has also been very weak. AAPL is down 20 points since yesterday, AMZN is down 50 points the past 2 weeks, NFLX is a long downtrend, NVDA having a hard time holding above 190. There's still no reason to take any aggressive risk with calls until we see the price action change in the market. Be patient and be careful this month.

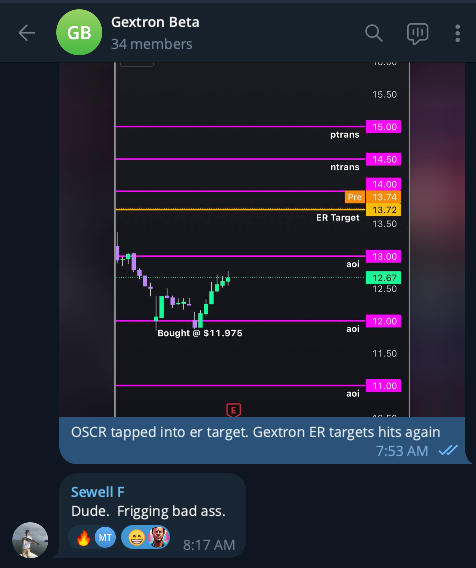

How to set ER price targets on ER day

earnings day is one my favorite days to make money. the moves can move +14% on stocks. about an hour ago, $OSCR had earnings and I got in shares. But I needed to find out what is the potential target range. So this was simple with Gextron: 1. Click on the price target tab 2. Found the expiration closest to the earnings date 3. Clicked on the top and bottom price targets that's it. 3 easy steps to identify high probability price targets without predicting or guessing. if you're looking for accurate price targets, seriously try Gextron: https://gextron.com/

1

0

1-10 of 1,707