Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

Trading Skool

1.6k members • Free

TGE

759 members • Free

397 contributions to TGE

RDW 18% on the day

S&P 500 is boring today. But $RDW is the real one. The current position is up 28%. Here's the catch. The monthly momentum is weakening on the sellside. This can truly be a great trade in the next 6-12 months.

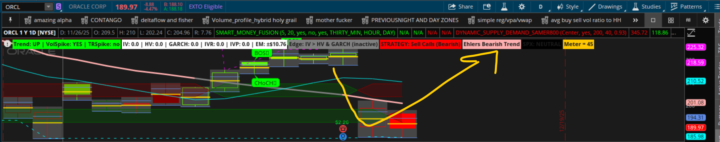

ORCL

Oracle has reinvented itself as the backbone of the AI boom, with its cloud infrastructure now powering giant superclusters and attracting enormous long-term contracts that have pushed its backlog to unprecedented levels. If it can keep building capacity fast enough to meet this “insatiable” demand, the company’s shift from slow-and-steady enterprise player to high-growth AI infrastructure provider could fundamentally change how the market values it. Expect ORCL to bounce after earnings.

1 like • 23d

ORCLE chart analysis: Oracle's exceptional cloud growth momentum (33% revenue growth, $523B RPO) and strong earnings guidance are significantly undermined by severe financial structure concerns including negative $13.2B free cash flow and 4.36x debt-to-equity ratio. While the AI and cloud transformation story remains compelling with 177% GPU revenue growth, the capital-intensive nature of this transition combined with bearish technicals and premium valuation create substantial near-term risk despite long-term potential.

1-10 of 397

@thillaivel-ranganathan-4336

Option trader mostly Double calendar

Active 1d ago

Joined Oct 2, 2024

Powered by